- Created by Admin, last modified by Peter Posse on 22. Feb 2023

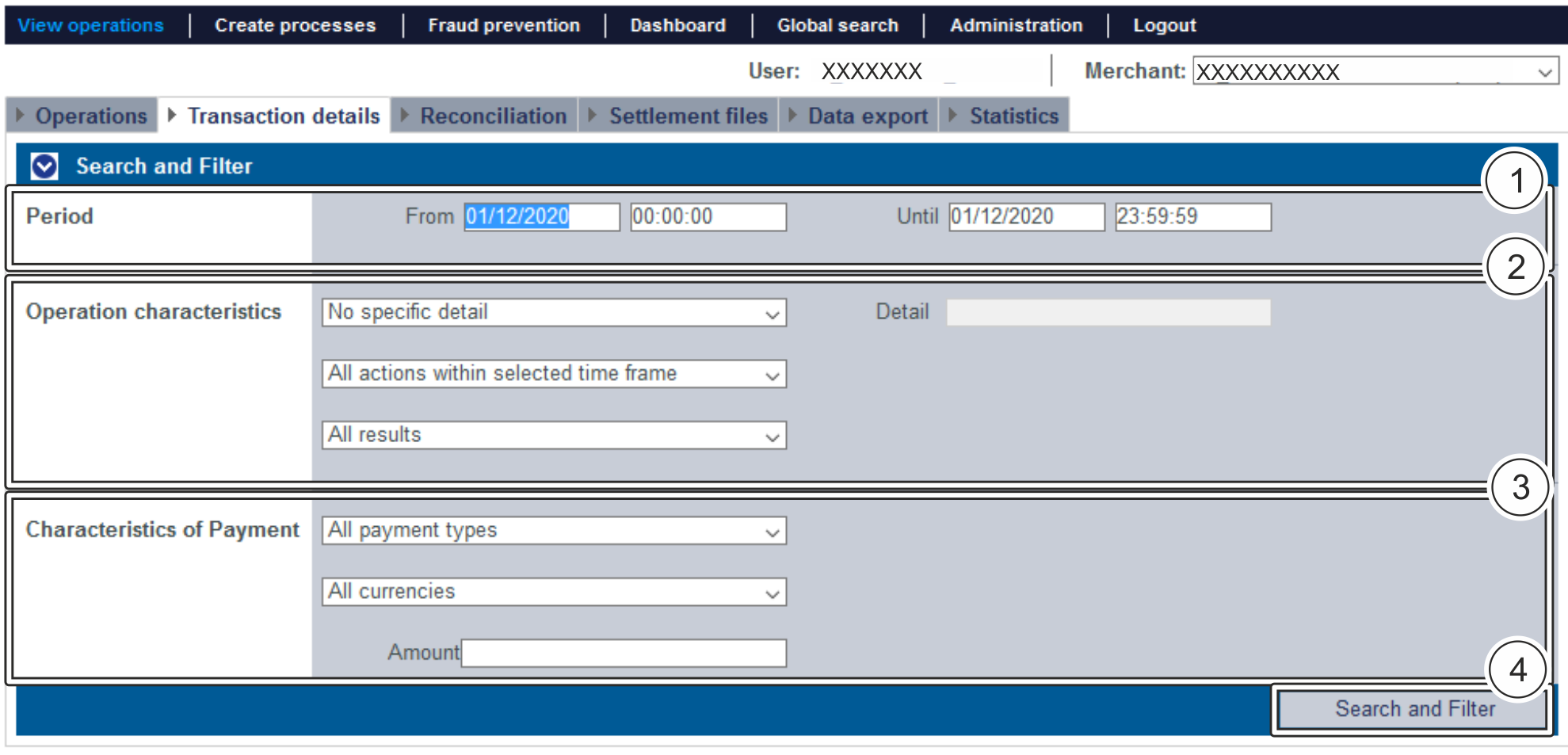

The "View operations → Transaction details" tab allows you to search for, filter, and have all payment transactions for an operation displayed. Payment transactions for an operation are for example, reservation, capture or credit. You can search for specific payment transactions in order to find all captures or credits within a given period. Moreover, you can open a detailed view of an operation, and add other actions to the operation. The search results can be exported as an Excel file.

Overview of the search criteria

- "Period" selection field

- "Operation characteristics" selection field

- "Characteristics of payment" selection field

- "Search and Filter" button

Activating the "Period" selection field

When you click in the input fields for the date, a calendar opens in which you can select a date. When you click in the input fields for the time, you can define a time for the search.

Activating the "Operation characteristics" selection field

Operation characteristics describe the type of operation, along with the status it has. You can set three different operation characteristics: specific details, payment transaction, and status.

Selecting specific details

Descriptions of the specific details can be found in the "Specific details" table below.

"Detail" input field

The "Detail" input field next to the "No specific detail" drop-down menu allows you to narrow the search to a character string (card number, error code, etc.). The character string that is entered depends on the specific detail selected in the "No specific detail" drop-down menu.

| Specific Detail | Description |

|---|---|

Operation number | The operation number (also "PayID") is an operation code automatically assigned by Computop Paygate |

Card number | The card number is the number on the bank card that allows a unique assignment |

Masked card number (partial search) | Selecting "Masked card number (partial search)" allows a search to be made for parts of the card number |

Pseudo card number | The pseudo card number (PCNr) is an adequate substitute for the card number. You can save and use the pseudo card number (PCNr) without a PCI certification in order to avoid having to enter the card data again in the shop. |

Pseudo card number (partial search) | Selecting "Pseudo card number (partial search)" allows a search to be made for parts of the PCNr |

Account number | The account number is a country-specific number and is used to identify a bank account |

IBAN | An IBAN is a standardised international bank account number and is used to identify a bank account. The IBAN is comprised of the country code (DE for Germany), the two-digit verification code, the bank code, the previous account number. |

Merchant reference number | The merchant reference number is a merchant code automatically assigned by Computop Paygate |

Merchant reference number (partial search) | Selecting "Merchant reference number (partial search)" allows a search to be made for parts of the merchant reference number |

Reference number | The reference number is a code automatically assigned to every payment transaction by Computop Paygate |

Reference number (partial search) | Selecting "Reference number (partial search)" allows a search to be made for parts of the reference number |

Error code | The error code is a number issued by Computop Paygate in order to isolate the Paygateerror. You can find an overview of the error codes here. An overview of the error codes can be found here. |

Error code (partial search) | Selecting "Error code (partial search)" allows a search to be made for parts of the error code |

Card holder information | The card holder information is the first name and surname of the account holder |

Selecting a payment transaction

An operation is comprised of several payment transactions for which you can carry out a specific search. Descriptions of the specific payment transactions can be found in the "Payment transactions" table below.

| Status | Beschreibung | Status | Beschreibung |

|---|---|---|---|

| ACCOUNT_VERIFICATION | Verify ACC function, credit card verification | CREDIT | Credit for a transaction |

ACTIVATION | Activation of a transaction (Klarna/Billpay) | CREDIT INVOICE | Credit for debtor management |

ACTIVATION PARTLY | Partial activation of a transaction (Klarna/Billpay) | CREDIT PARTLY | Partial credit for a transaction |

AUTHENTICATE | Authentication of a 3-D Secure transaction | CURRENCY_CONVERSION | DCC transaction |

AUTHORISE | Authorisation of a transaction | FRAUD | Scoring engine |

CALCULATION | Calculation status (Ratepay/Unzer [paymorrow]) | IDENT | Identifier for a transaction |

CANCEL ACTIVATION | Activation of a transaction cancelled (Billpay only) | INCREMENT | Increase in amount blocked on credit card |

CANCEL ACTIVATION PARTLY | Activation of a transaction partly cancelled (Billpay only) | INITIALIZE | Initialise payment (Ratepay/Billpay) |

CANCEL RESERVATION | Amounts blocked for a transaction cancelled (Billpay only) | INVOICE | Create debtor management invoice |

CANCEL RESERVATION PARTLY | Amounts blocked for a transaction partly cancelled (Billpay only) | LOGIN | Special feature of Amazon Pay |

CAPTURE | Capture of a transaction | ORDER | Creation of a transaction |

CHANGE | Change to a transaction (Amazon/Ratepay) | ORDER REVERSE | Undo the creation of a transaction |

CHANGE RESERVATION | Change to an amount blocked (Amazon/Ratepay) | PAIRING | Merging of a transaction (Klarna only) |

CHARGEBACK | Chargeback of the information | RESERVATION | Amount reserved (Klarna/Billpay) |

CHECKOUT | Special feature of Amazon Pay | REVERSE AUTHORISE | Cancellation of an authorisation for a transaction |

CHECKOUT_PAIRING | Special feature of Amazon Pay | REVERSE CAPTURE | Cancellation of the capture of a transaction |

CLOSE | Special feature of Amazon Pay | REVERSE CREDIT | Cancellation of a credit transaction |

CONFIGURATION | Transaction set up | REVERSE SALE | Cancellation of a sales transaction |

CONFIRM | Special feature of Amazon Pay | RISK CHECK | Consumer check/risk (BIG. Afterpay) |

SALE | Purchase transaction (authorisation and capture in one step) | ||

TRANSLATE | Special status (Tamara) | ||

UPDATE | Transaction update (Klarna only) |

Selecting the status

Descriptions of the statuses can be found in the "Status" table below.

| Status | Description |

|---|---|

| OK | Status of the payment transaction is "OK". The operation has been completed. |

OPEN | Status of the payment transaction is "OPEN". The operation has not been completed yet. |

NOT OK | Status of the payment transaction is "NOT OK". The operation has not been completed. |

Activating the "Characteristics of payment" selection field

Characteristics of payment describe the paymethod used for an operation, along with the associated currency and total. You can set three different characteristics of payment: Paymethod, currency and amount.

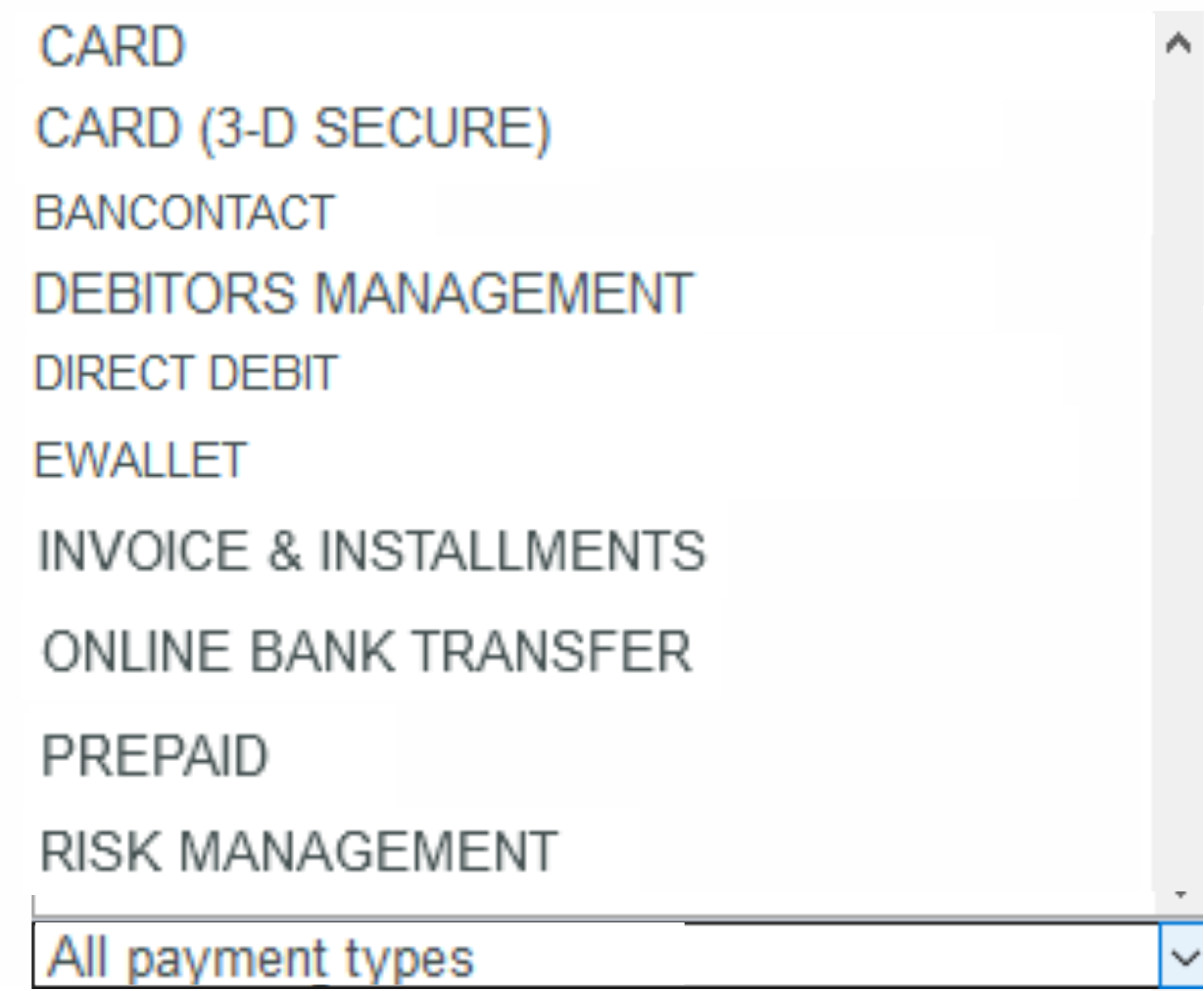

Selecting the paymethod or payment method provider

You can either search for all credit cards, or select a payment method provider. The "All payment types" drop-down menu shows you all paymethods that have been enabled for you in Computop Paygate. Individual payment method providers appear under the respective main categories in the list. A description of the main categories can be found in the "All paymethods" table below.

| Status | Description |

|---|---|

CARD | All payment method providers that support credit cards |

CARD (3-D SECURE) | All payment method providers that support credit cards with 3-D Secure authentication |

BANCONTACT | All payment method providers that support Bancontact |

DEBTOR MANAGEMENT | All payment method providers that support debtor management |

DIRECT DEBIT | All payment method providers that support direct debit |

EWALLET | All payment method providers that support online wallets |

INVOICE & INSTALMENTS | All payment method providers that support payments by invoice and in instalments |

ONLINE BANK TRANSFER | All payment method providers that support online bank transfers |

PREPAID | All payment method providers that support prepaid |

RISK MANAGEMENT | All service providers that support risk management |

Information about the individual paymethods

Selecting currency and amount

When you open the "All currencies" drop-down menu, you will see all currencies that can be selected. You can narrow the search to a specific amount of money in the "Amount" input field.

“Amount” input field

The amount entered depends on the currency selected beforehand from the "Currency" drop-down menu. You must enter the amount in the largest currency unit using the decimal notation applicable for the currency (e.g. €10,50). Whether decimals are allowed does, however, depend on the respective currency.

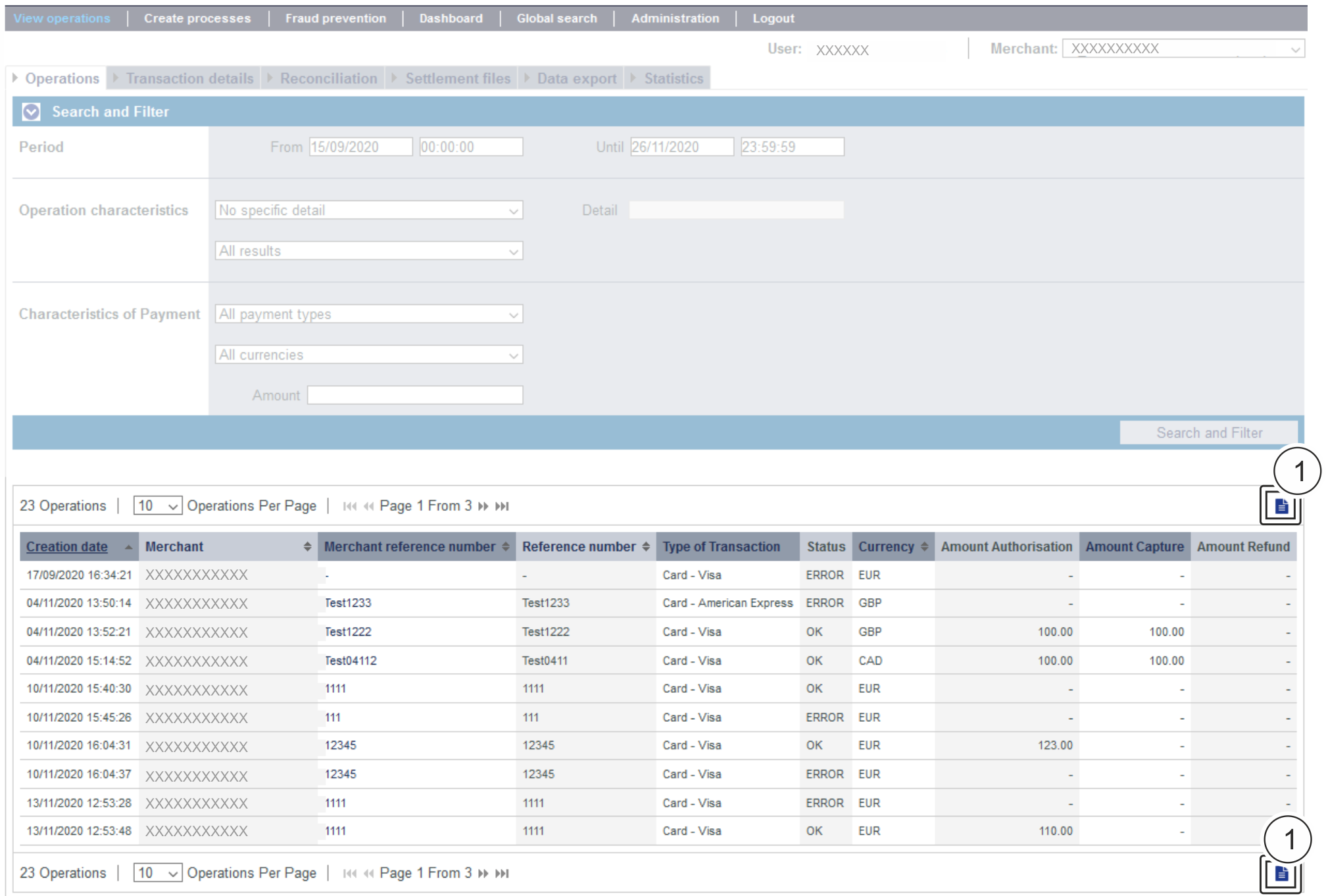

You can export the search results as an Excel file for further processing. Proceed as follows to export the search results: → The application verifies the values entered. If the values are invalid, a message showing the reason why will appear in red. If the values are valid, the search results will be shown. 3. Click on the "Export → The search results are issued as a CSV file ready to download.Exporting search results

![]() " button

" button![]() " button.

" button.

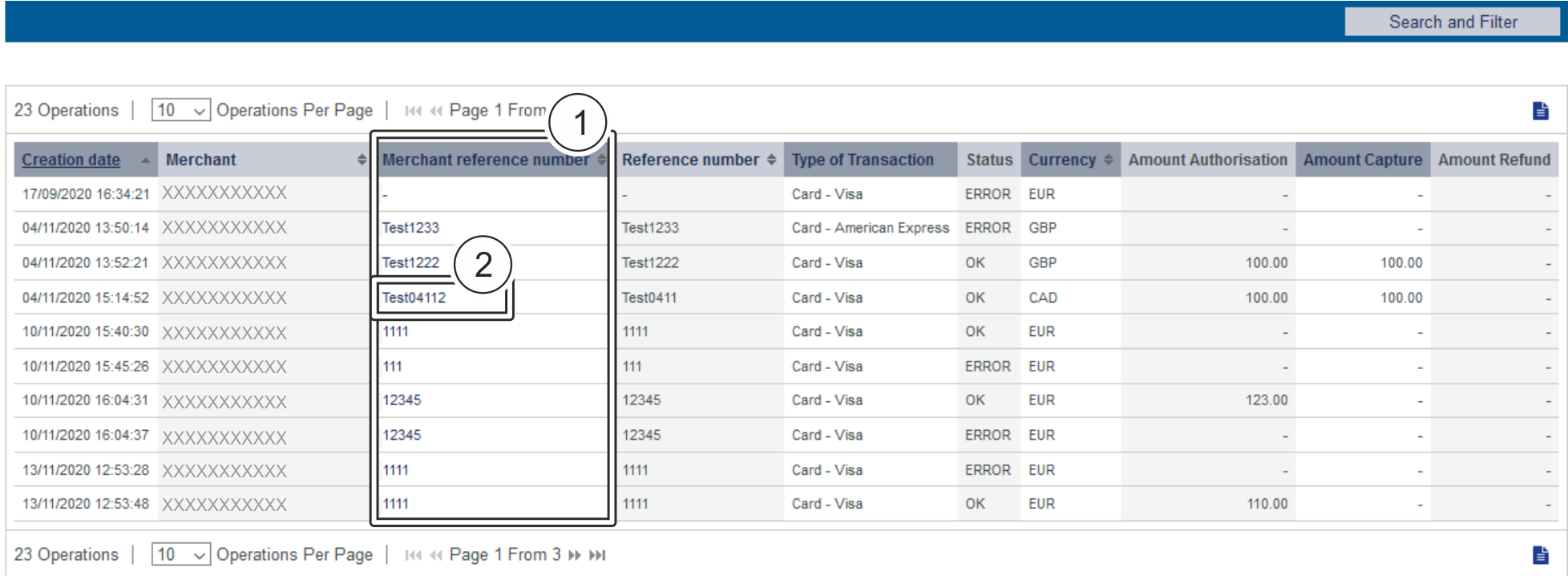

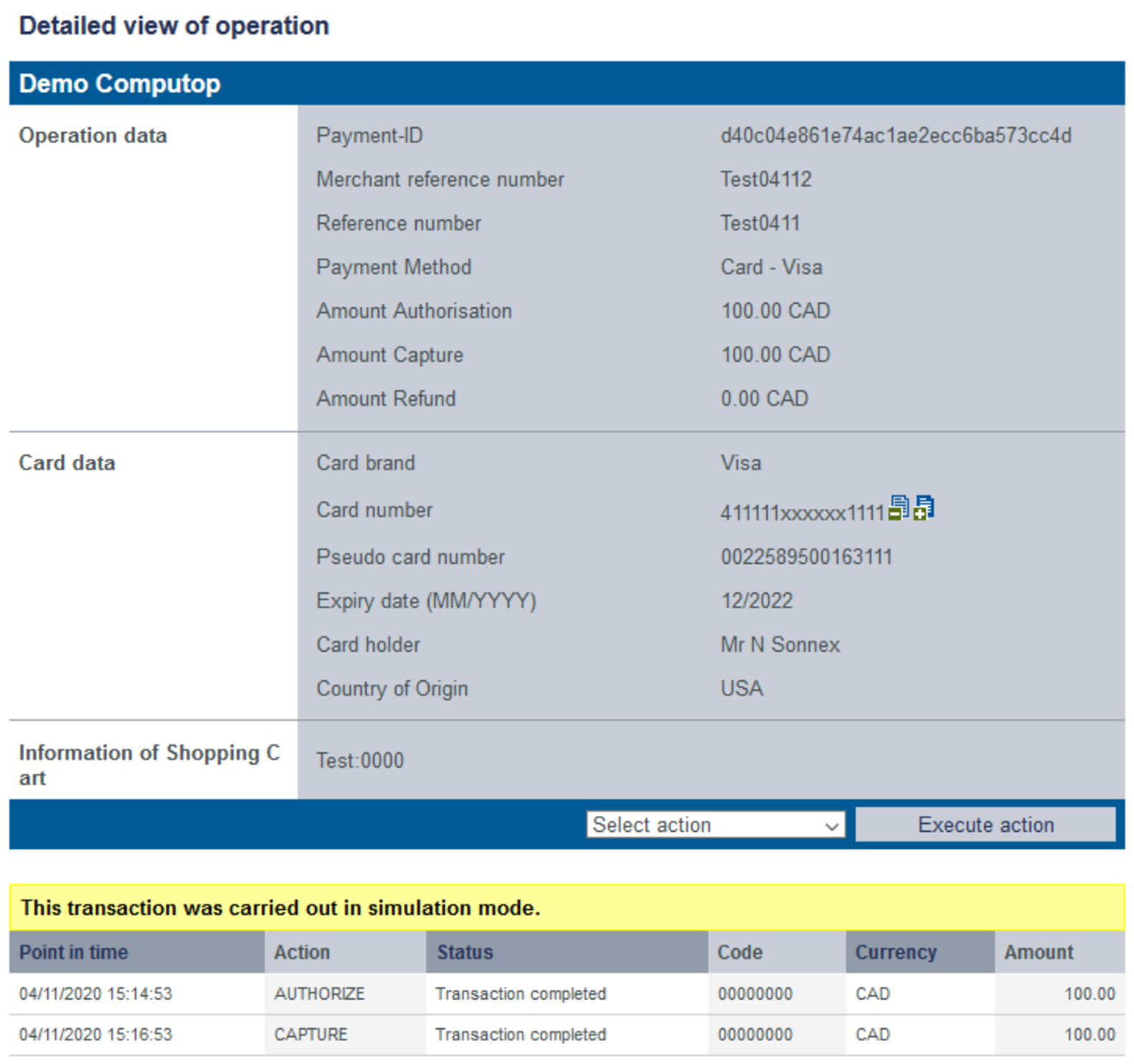

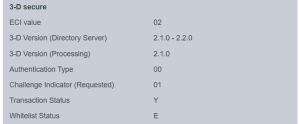

You can open a detailed view for every operation in the search results. More information about the customer and operation data are shown to you in the detailed view. Moreover, you can add other actions to the operation in the detailed view, such as postings or credits. If an operation was processed using card, account or device data, you can disable these in the detailed view. If you wish to enable the card, account or device data again, you must remove the credit card from the negative list. Proceed as follows to open the detailed view of an operation: → The application verifies the values entered. If the values are invalid, a message showing the reason why will appear in red. If the values are valid, the search results will be shown. 3. Click on the merchant reference number for the required operation in the "Merchant reference number" column. → The detailed view of the operation opens. The detailed view of the operation is divided into fields with the customer and operation data, along with data about postings. If you check the country of origin of the card for purposes of fraud prevention, you will also find the country of origin of the credit card here. Moreover, you can add other actions to the operation in the detailed view. Each payment process (operation) can include one or more actions. Each action has a status, e.g. indicating success / failure of this status. The actions may vary on your implementation and the paymethod involved. Pls. find a list of most common combinations and their meaning here: Credit card PayPal Action "order" indicates that a payment has been initiated, but not yet authorized. Transaction completed Other The "Order" failed, e.g.: Account-Verification is used with credit cards to check whether this credit card is existing. Technically an authorization with "amount=0" is done, so no money is reserved on the card holders account. The credit card could not be verified, e.g.: Authenticate happens with 3-D Secure and means that the card holder has to identify (authenticate) himself. After successful authentication an authorization may be initiated to reserve the money on the card holders account. Authentication completed The "Authentication" failed, e.g.: Credit card PayPal Direct Debit Paydirekt The authorization checks the card holders account and reserves the money for a given period of time. Transaction completed The "Authorization" has been declined, e.g.: The authorization should be reversed and the money should not be reserved on the card holders account any more. The "Reverse-Authorization" failed, e.g.: Credit card PayPal Direct Debit Paydirekt "Capture" means that money should be transferred from the customer/card holder to the acquirer (and finally to the merchant). Depending on the paymethod and connection a capture can be done one time only or multiple times. Request The "capture" (i.e. transfer) of the money has been initiated and is waiting for its processing → "capture" is pending. This can be either processed online (i.e. in realtime) or offline (file based - and then normally within 24 hours) - depending on the paymethod and downstream processing. Transaction completed The "Capture" failed, e.g.: Credit card PayPal Direct Debit Paydirekt Sofort "Credit" means the money should be refunded to the customer. Depending on the paymethod and connection a refund can be done one time only or multiple times. Request The "credit" (i.e. refund) of the money has been initiated and is waiting for its processing. This can be either processed online (i.e. in realtime) or offline (file based - and then normally within 24 hours) - depending on the paymethod and downstream processing. Transaction completed The "Credit" failed, e.g.: Credit card PayPal Paydirekt Sofort "Sale" is a combination of "authorization" and "capture". Transaction completed The "Sale" has been rejected, e.g.: For payments which are authenticated with 3-D Secure you may see details like this: The values shown above depend on 3-D Secure version used for authentication and the card scheme. Here are some details: The ECI value stands for "Electronic Commerce Indicator" and detailed overview can be found here: ECI Codes. The Directory Server is managed by the card scheme (Mastercard, VISA, American Express, ...) where each credit card issuer isregistered and can be identified by the BIN (Bank Identication Number). The Directory Server "talks" to the Access Control Server which finally refers to the credit card issuer system. For 3-D Secure processing all parties (scheme, issuer and PSP Computop) have to agree on the same 3-D Secure version. This is the 3-D Secure version which has been agreed by all parties finally for 3-D Secure authentication. It may happen that a specific issuer is not supporting 3-D Secure (Version 2.1.0, 2.2.0) by now and then automatically a fallback to Version 1.0 will happen. Current supported values for "authentication type" are: Static password is used for card holder authentication. Also used for 3DS1 non frictionless OOB stands for "Out Of Band": Users verify transactions in their issuer’s authentication service which can be issuers website or issuers app. Current supported values for "authentication method" are: Authentication has been completed successfully, i.e. ready for authorisation. It still may happen that the authorisation fails, e.g. due to low account balance.Opening the detailed view of an operation

Details on Action and Status

Action Paymethod (samples) Description ORDER Status Description The "order" was initiated successfully Request The "order" has been initiated, but not completed ACCOUNT_VERIFICATION Credit card Status Description Transaction completed The transaction has been completed successfully. Other AUTHENTICATE Credit card Status Description REQUEST Authentication process has been initiated, but not yet completed. The card holder proofed his/her identity towards the issuer. Other AUTHORIZE Status Description The authorization was successful, the amount is reserved on the card holders account and can finally be captured (i.e. transferred). Other REVERSEAUTHORIZE Status Description Transaction completed The authorized amount has been released successfully. Other CAPTURE Status Description The "capture" has been processed, i.e.: transmitted to the acquirer and further to the issuer. Other CREDIT Status Description The "credit" has been processed, i.e.: transmitted to the acquirer and further to the issuer. Other SALE Status Description The "sale" has been processed, i.e.: transmitted to the acquirer. Other Details on 3-D Secure transactions

ECI value

3-D Version (Directory Server)

3-D Version (Processing)

Authentication Type

Value Meaning Description 00 Frictionless Issuer did not challenge for card holder authentication. 01 Static 02 Dynamic Dynamic password (e.g. token or app) is used for card holder authentication. 03 OOB 04 Decoupled Will be supported with 3-D Secure 2.2, intended to support card holder authentication for merchant initiated transactions (MIT). Authentication Method

Value Meaning Description 01 Static Passcode Static password is used for card holder authentication. Also used for 3DS1 non frictionless 02 SMS OTP Dynamic password (OTP = One Time Password) provided by SMS is used for card holder authentication. 03 Key fob or EMV card reader OTP Dynamic password (OTP = One Time Password) provided by Key Fob or EMV card reader is used for card holder authentication. 04 App OTP Dynamic password (OTP = One Time Password) provided by Application is used for card holder authentication. 05 OTP Other Dynamic password (OTP = One Time Password) provided by "other" is used for card holder authentication. 06 KBA Knowledge Based Authentication 07 OOB Biometrics Users verify transactions in their issuer’s authentication service based on Biometrics. 08 OOB Login Users verify transactions in their issuer’s authentication service based on Login. 09 OOB Other Users verify transactions in their issuer’s authentication service based on other methods. 10 Other 11 Push Confirmation Authenticates by pushing a push notification to a secure application on the user's device. 12 Decoupled Authentication without being the cardholder in session 13 WebAuthn WebAuthn / FIDO 14 SPC Secure Payment Confirmation, Authentication is handled using a platform authenticator, e.g. Touch ID on a macOS device, Hello on a Windows device 15 Behavioural biometrics Authenticates users based on patterns in their behavior, e.g. how people type or move. Challenge Indicator (Requested)

Value Meaning Description 01 No preference No specific challenge indicator requested, default value. 02 No challenge requested Merchant prefers that no challenge should be performed 03 Challenge requested: 3DS Requestor Preference Merchant prefers that a challenge should be performed 04 Challenge requested:Mandate There are local or regional mandates that mean that a challenge must be performed 05 No challenge requested Transactional risk analysis is already performed 06 No challenge requested Data share only 07 No challenge requested Strong consumer authentication is already performed 08 No challenge requested Utilise whitelist exemption if no challenge required 09 Challenge requested Whitelist prompt requested if challenge required Transaction Status

Value Meaning Description Y Authentication Verification Successful N Not Authenticated /Account Not Verified Transaction denied U Authentication/ Account Verification Could Not Be Performed Technical or other problem, as indicated in ARes or RReq A Attempts Processing Performed Not Authenticated/Verified, but a proof of attempted authentication/verification is provided. C Challenge Required Additional authentication is required using the CReq/CRes. D Challenge Required Decoupled Authentication confirmed. R Authentication/ Account Verification Rejected Issuer is rejecting authentication/verification and request that authorisation not be attempted. I Informational Only 3DS Requestor (merchant) challenge preference acknowledged. Whitelist Status

Value Meaning Y 3DS Requestor (merchant) is whitelisted by cardholder N 3DS Requestor (merchant) is not whitelisted by cardholder E Not eligible as determined by issuer P Pending confirmation by cardholder R Cardholder rejected U Whitelist status unknown, unavailable, or does not apply

Application Button

The button at the bottom allows you to jump to the corresponding page within the application. You must be logged in to jump to the corresponding page within the application.

On this page

In this section

-

Page:

-

Page:

-

Page:

-

Page:

-

Page:

-

Page:

-

Page:

-

Page: