Specific parameters for CB2A: AXEPTA BNP Crossborder and French Domestic

For credit card connection CB2A: AXEPTA BNP besides the general parameters described above CB2A requires the following additional parameters. An authorisation with 3-D Secure is possible.

Notice: For security reasons, Computop Paygate rejects all payment requests with formatting errors. Therefore, please use the correct data type for each parameter. The following table describes the additional encrypted payment request parameters described below for "interface via form" and "interface via Server-to-Server" :

Key | REST | Format | CND | Description |

|---|---|---|---|---|

RefNr | "referenceNumber": "..." | an12 | C | Merchant’s unique reference number, which serves as payout reference in the acquirer EPA file. Please note, without the own shop reference delivery you cannot read out the EPA transaction and regarding the additional Computop settlement file (CTSF) we cannot add the additional payment data. Notes:

|

| AccVerify | "payment": {"card": { "<accountVerification": "..." }} | a3 | O | If AccVerify=Yes the card will be checked at the acquirer according to the acquirer’s interface description. The merchant has to submit only this parameter, the parameter "Amount" is optional. If "Amount" is used we replace the amount according to acquirer’s interface description. At payment always Amount=0 is stored. Allowed value: yes |

RTF | not used | a1 | O | for repeat payments (subscriptions): I = Initial payment of a new subscription |

| ContractID | n..8 | O | Further reference in order to retrieve to combination TerminalID / Contract partner number | |

| Contact data/Address verification (AVS) | ||||

| AddrStreet | "billing": {"addressInfo": { "addressLine1": { "street": "..." }}} | ans..20 | O | Street name, e.g. Bergstraße Note: AddrStreet, AddrStreetNr and AddrCity are concated and truncated at 40 characters. Special characters (diacritics) will be converted (e.g. "ü" → "ue", "é" → "e") |

| AddrStreetNr | "billing": {"addressInfo": { "addressLine1": { "streetNumber": "..." }}} | ans..30 | O | Street number of the customer (for AVS) |

| AddrCity | "billing": {"addressInfo": { "city": "..." }} | ans..20 | O | Town/city of the customer (for AVS) |

| AddrZip | "billing": {"addressInfo": { "postalCode": "..." }} | n..9 | O | Postcode (for AVS) |

Additional parameters for credit card payments

The following table describes the result parameters with which the Computop Paygate responds to your system. these result parameters are additional to the standard parameters for "interface via form" and "interface via Server-to-Server" described below

pls. be prepared to receive additional parameters at any time and do not check the order of parameters

the key (e.g. MerchantId, RefNr) should not be checked case-sentive

Key | REST | Format | CND | Description |

|---|---|---|---|---|

RefNr | an12 | M | Merchant’s unique reference number, which serves as payout reference in the acquirer EPA file. Please note, without the own shop reference delivery you cannot read out the EPA transaction and regarding the additional Computop settlement file (CTSF) we cannot add the additional payment data. | |

| CodeExt | an2 | O | Error code of acquirer, if agreed with Computop Helpdesk | |

| Approvalcode | an..6 | O | Approval code / authorization code of acquirer, if agreed with Computop Helpdesk | |

| TerminalID | n..7 | O | TerminalId used for processing, if agreed with Computop Helpdesk | |

| VUNr | n..7 | O | Acquirer contract number of acquirer, if agreed with Computop Helpdesk | |

Match | a1 | O | Total result of an address verification, if agreed with Computop Helpdesk. For possible values see A3 AVS match parameters | |

PAR | an..32 | O | Scheme Payment Account Reference (PAR) in response. PAR-value is not provided by all schemes already. To enable pls. contact Computop Helpdesk. |

Additional response parameters for credit card payments

Payment Request

To retrieve a Computop card form please submit the following data elements via HTTP POST request method to https://www.computop-paygate.com/payssl.aspx.

Notice: For security reasons, Computop Paygate rejects all payment requests with formatting errors. Therefore, please use the correct data type for each parameter.

The following table describes the encrypted payment request parameters:

Key | REST | Format | CND | Description | ||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| BasicAuth.Username | ans..30 | M | MerchantID, assigned by Computop. Additionally this parameter has to be passed in plain language too. | |||||||||

| msgver | not used | ans..5 | M | Computop Paygate Message version. Valid values:

| ||||||||

| ReqId | "requestId": "..." | ans..32 | O | To avoid double payments or actions (e.g. by ETM), enter an alphanumeric value which identifies your transaction and may be assigned only once. If the transaction or action is submitted again with the same ReqID, Computop Paygate will not carry out the payment or new action, but will just return the status of the original transaction or action. Please note that the Computop Paygate must have a finalized transaction status for the first initial action (authentication/authorisation). This does not apply to 3-D Secure authentications that are terminated by a timeout. The 3-D Secure Timeout status does not count as a completed status in which the ReqID functionality on Paygate does not take effect. Submissions with identical ReqID for an open status will be processed regularly. Notice: Please note that a ReqID is only valid for 12 month, then it gets deleted at the Paygate. | ||||||||

| TransID | "transactionId": "..." | ans..64 | M | TransactionID provided by you which should be unique for each payment | ||||||||

| RefNr | "referenceNumber": "..." | O | Merchant’s unique reference number, which serves as payout reference in the acquirer EPA file. Please note, without the own shop reference delivery you cannot read out the EPA transaction and regarding the additional Computop settlement file (CTSF) we cannot add the additional payment data.

Only ASCII characters allowed, special characters ("Umlaute", diacritics) are not allowed and must be replaced by their ASCII-representation (e.g. ü → ue, é → e, ...). | |||||||||

| not used | an64 | M | Hash Message Authentication Code (HMAC) with SHA-256 algorithm. Details can be found here: | |||||||||

| Amount | "amount": { "value": ...} | n..10 | M | Amount in the smallest currency unit (e.g. EUR Cent). Please contact the Computop Helpdesk, if you want to capture amounts <100 (smallest currency unit). | ||||||||

| Currency | "amount": { "currency": "..."} | a3 | M | Currency, three digits DIN / ISO 4217, e.g. EUR, USD, GBP. Please find an overview here: A1 Currency table | ||||||||

| Capture | an..6 | OM | Determines the type and time of capture.

| |||||||||

| PayTypes | "payment": {"cardForm": { "payTypes": "..." }} | ans..256 | O | With this parameter you can override the accepted schemes, i.e. you can decide within this parameter separated by pipe which of the available credit card schemes are displayed. The template must support this function like for example the "Cards_v1". Example: PayTypes=VISA|MasterCard | ||||||||

| "billing": {"addressInfo": { "descriptor": "..." }} | ans..22 | O | A descriptor to be printed on a card holder’s statement. Please also refer to the additional comments made elsewhere for more information about rules and regulations. | |||||||||

OrderDesc | "order": {"description": "..."} | ans..768 | O | Order description | ||||||||

| "payment": {"card": { "accountVerification": "..." }} | a3 | O | Indicator to request an account verification (aka zero value authorization). If an account verification is requested the submitted amount will be optional and ignored for the actual payment transaction (e.g. authorization). Values accepted

| |||||||||

| "payment": {"card": { "threeDsPolicy": JSON }} | JSON | O | Object specifying authentication policies and exemption handling strategies | |||||||||

| "payment": {"card": { "priorAuthenticationInfo": JSON }} | JSON | O | Prior Transaction Authentication Information contains optional information about a 3DS cardholder authentication that occurred prior to the current transaction | |||||||||

| "accountInfo": JSON | JSON | O | The account information contains optional information about the customer account with the merchant | |||||||||

| "billing": JSON | JSON | C | The customer that is getting billed for the goods and / or services. Required for EMV 3DS unless market or regional mandate restricts sending this information. | |||||||||

| "shipping": JSON | JSON | C | The customer that the goods and / or services are sent to. Required if different from billToCustomer. | |||||||||

| "billing": {"addressInfo": JSON} | JSON | C | Billing address. Required for EMV 3DS (if available) unless market or regional mandate restricts sending this information. | |||||||||

| "shipping": {"addressInfo": JSON} | JSON | C | Shipping address. If different from billingAddress, required for EMV 3DS (if available) unless market or regional mandate restricts sending this information. | |||||||||

| "credentialOnFile": JSON | JSON | C | Object specifying type and series of transactions using payment account credentials (e.g. account number or payment token) that is stored by a merchant to process future purchases for a customer. Required if applicable. | |||||||||

| "riskIndicator": JSON | JSON | O | The Merchant Risk Indicator contains optional information about the specific purchase by the customer. If no | |||||||||

| subMerchantPF | "subMerchantPaymentFacilitator": JSON | JSON | O | Object specifying SubMerchant (Payment Facilitator) details.

| ||||||||

| URLSuccess | "urls": {"success": "..."} | ans..256 | M | Complete URL which calls up Paygate if payment has been successful. The URL may be called up only via port 443. This URL may not contain parameters: In order to exchange values between Paygate and shop, please use the parameter UserData.

| ||||||||

| URLFailure | "urls": {"failure": "..."} | ans..256 | M | Complete URL which calls up Paygate if payment has been unsuccessful. The URL may be called up only via port 443. This URL may not contain parameters: In order to exchange values between Paygate and shop, please use the parameter UserData.

| ||||||||

| URLBack | "urls": {"cancel": "..."} | ans..256 | O | Complete URL which Paygate calls in case that Cancel is clicked by the customer. The parameter "URLBack" can be sent

In order to exchange values between Paygate and shop you may use something like this:

When user cancels payment this URL is called exactly like this and you may use URL Decode to extract parameter and values. | ||||||||

| Response | not used | a7 | O | Status response sent by Paygate to URLSuccess and URLFailure, should be encrypted. For this purpose, transmit Response=encrypt parameter. | ||||||||

| URLNotify | "urls": {"notify": "..."} | ans..256 | M | Complete URL which Paygate calls up in order to notify the shop about the payment result. The URL may be called up only via port 443. It may not contain parameters: Use the UserData parameter instead.

| ||||||||

| UserData | ans..1024 | O | If specified at request, Paygate forwards the parameter with the payment result to the shop. | |||||||||

| Custom | "metadata": "..." | ans..1024 | O | "Custom"-parameter is added to the request data before encryption and is part of encrypted "Data" in Computop Paygate request. By this they are protected against manipulation by a consumer. The Custom-value is added to the Computop Paygate response in plain text and the "|" is replaced by a "&". By this you can put a single value into Custom-parameter and get multiple key-value-pairs back in response for your own purpose. Please find a samples here: Custom | ||||||||

| Plain | "metadata[plain]": "..." | ans..50 | O | A single value to be set by the merchant to return some information unencrypted in response/notify, e.g. the MID. "Plain"-parameter is part of encrypted "Data" in Computop Paygate and therefore protected against manipulation. | ||||||||

| expirationTime | "expirationTime": "..." | ans..19 | O | timestamp for the end time of the transaction processing, specified in UTC. Format: YYYY-MM-ddTHH:mm:ss |

Computop Paygate will return an HTML document in the response body representing the requested card form. The form may be included in the merchant checkout page or used as a standalone page to redirect the card holder to.

Card holder authentication and payment authorization will take place once the the cardholder entered all required card details and submitted the form data to Computop Paygate.

Note: In case you are using your own templates (Corporate Payment Page), please make sure you include Cardholder name on your custom template. Cardholder name is mapped to Paygate API parameter "CreditCardHolder". Cardholder name field must not contain any special characters and must have minimal length of 2 characters and maximum length of 45 characters.

When the payment is completed Computop Paygate will send a notification to the merchant server (i.e. URLNotify) and redirect the browser to the URLSuccess respectively to the URLFailure.

The blowfish encrypted data elements as listed in the following table are transferred via HTTP POST request method to the URLNotify and URLSuccess/URLFailure.

The credit card form can be highly customized by using your own template.

Details are available here: Corporate PayPage and templates

HTTP POST to URLSuccess / URLFailure / URLNotify

In case of using REST API

In case of using REST API you will always receive a link where the merchant has to redirect the consumer to complete the payment.

| REST | Format | CND | Description |

|---|---|---|---|

"paymentId": "..." | an32 | M | May be "00000000000000000000000000000000" if not yet set by Computop Paygate |

| "_Links.self.type": "..." | an..20 | M | "application/json" |

| "_Links.redirect.href": "..." | an..1024 | M | Merchant needs to redirect consumer to this URL to complete payment |

| "_Links.redirect.type": "..." | an..20 | M | "text/html" |

Merchant can use inquire.aspx

In case of using Key-Value-Pair API

The following table gives the result parameters which Computop Paygate transmits to URLSuccess or URLFailure and URLNotify. If you have specified the Response=encrypt parameter, the following parameters are sent Blowfish encrypted to your system:

pls. be prepared to receive additional parameters at any time and do not check the order of parameters

the key (e.g. MerchantId, RefNr) should not be checked case-sentive

Key | Format | CND | Description | ||||

|---|---|---|---|---|---|---|---|

ans..30 | M | MerchantID, assigned by Computop | |||||

| msgver | ans..5 | M | Computop Paygate Message version. Valid values:

| ||||

| PayID | an32 | M | ID assigned by Paygate for the payment, e.g. for referencing in batch files as well as for capture or credit request. | ||||

| XID | an32 | M | ID for all single transactions (authorisation, capture, credit note) for one payment assigned by Paygate | ||||

| TransID | ans..64 | M | TransactionID provided by you which should be unique for each payment | ||||

| schemeReferenceID | ans..64 | C | Card scheme specific transaction ID required for subsequent credential-on-file payments, delayed authorizations and resubmissions. Mandatory: CredentialOnFile – initial false – unscheduled MIT / recurring schemeReferenceID is returned for 3DS2-payments. In case of fallback to 3DS1 you will also need to check for TransactionId. The schemeReferenceID is a unique identifier generated by the card brands and as a rule Computop merchants can continue to use the SchemeReferenceIDs for subscription plans that were created while using another PSP environment / Paygate MerchantID / Acquirer ContractID / Acquirer. | ||||

| refnr | O | Reference number taken from request | |||||

| Status | a..20 | M | Status of the transaction. Values accepted:

In case of Authentication-only the Status will be either | ||||

| Description | ans..1024 | M | Further details in the event that payment is rejected. Please do not use the Description but the Code parameter for the transaction status analysis! | ||||

| Code | n8 | M | Error code according to Paygate Response Codes (A4 Error codes) | ||||

JSON | M | Card data | |||||

JSON | O | Object containing IP information | |||||

JSON | M | Authentication data | |||||

JSON | C | In case the authentication process included a cardholder challenge additional information about the challenge result will be provided. | |||||

| externalPaymentData | JSON | O | Optional additional data from acquirer/issuer/3rd party for authorization. | ||||

| TimeStamp | Date/Time | O | Timestamp of this action if activated by Computop Helpdesk, e.g. 30.05.2023 08:47:57 or 30.05.2023 10:03:01.633 | ||||

| CardHolder | ans..50 | O | Card holder name if activated by Computop Helpdesk, e.g. John Doe | ||||

| bin | n..6 | O | BIN of credit card if activated by Computop Helpdesk, e.g. 40001 | ||||

| maskedpan | an..19 | O | Masked number of credit card if activated by Computop Helpdesk, e.g. 400001XXXXXX8323 | ||||

| cardinfo | JSON | O | JSON containing data of credit card type and issuer if activated by Computop Helpdesk, e.g. {"BIN":"400001","Brand":"VISA","Product":"","Source":"CREDIT","Type":"","Country":{"A3":"USA","N3":"840"},"Issuer":""} | ||||

| CCBrand | an..20 | O | Brand / card scheme of credit card, e.g. VISA | ||||

| PCNr | n16 | O | Pseudo Card Number: Random number generated by Computop Paygate which represents a genuine credit card number. The pseudo card number (PCN) starts with 0 and the last 3 digits correspond to those of the real card number. The PCN can be used like a genuine card number for authorisation, capture and credits. PCNr is a response value from Computop Paygate and is sent as CCNr in Request or part of card-JSON | ||||

| CCExpiry | n6 | OC | Optional in combination with PCNr: Expiry date of the credit card in the format YYYYMM (202207). | ||||

| Plain | ans..50 | O | A single value to be set by the merchant to return some information unencrypted in response/notify, e.g. the MID. "Plain"-parameter is part of encrypted "Data" in Computop Paygate and therefore protected against manipulation. | ||||

| Custom | ans..1024 | O | "Custom"-parameter is added to the request data before encryption and is part of encrypted "Data" in Computop Paygate request. By this they are protected against manipulation by a consumer. The Custom-value is added to the Computop Paygate response in plain text and the "|" is replaced by a "&". By this you can put a single value into Custom-parameter and get multiple key-value-pairs back in response for your own purpose. Please find a samples here: Custom | ||||

| UserData | ans..1024 | O | If specified at request, Paygate forwards the parameter with the payment result to the shop. | ||||

an64 | M | Hash Message Authentication Code (HMAC) with SHA-256 algorithm. Details can be found here: |

Credit card payments with separate authorisation

For credit card payments the ORDER can be separated from the subsequent authorisation and the following steps. Therefore initially the SSL credit card payment is initiated via Paygate form or via Server-to-Server-connection like in the chapters above with an additional parameter. Later it is authorised using the interface authorize.aspx via server-to-server connection. For initialising visit the following URL:

https://www.computop-paygate.com/payssl.aspx |

For Server-to-Server-connection it is the following URL:

https://www.computop-paygate.com/direct.aspx |

The following table describes the encrypted payment request parameters:

Key | REST | Format | CND | Description |

|---|---|---|---|---|

TxType | ans..20 | M | Submit “Order” to initialize a payment which later will be authorised via interface authorize.aspx. Please note that in combination with the used 3-D Secure method a separate setting is necessary. Please contact directly Computop Helpdesk. |

Additional parameters for credit card payments with separate authorisation

In order to authorise a previously with TxType=Order initiated SSL credit card payment, please visit the following URL:

https://www.computop-paygate.com/authorize.aspx |

Notice: Please note, that for an initial order KPN/CVC/CVV-check is not possible. For the subsequent reservation request this ID also cannot be passed on.

Notice: For security reasons, Computop Paygate rejects all payment requests with formatting errors. Therefore, please use the correct data type for each parameter.

The following table describes the encrypted payment request parameters:

Key | REST | Format | CND | Description | ||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| BasicAuth.Username | ans..30 | M | MerchantID, assigned by Computop. Additionally this parameter has to be passed in plain language too. | |||||||||

| PayID | "paymentId": "..." | an32 | M | ID assigned by Paygate for the payment, e.g. for referencing in batch files as well as for capture or credit request. | ||||||||

| TransID | "transactionId": "..." | ans..64 | M | TransactionID provided by you which should be unique for each payment | ||||||||

| Amount | "amount": { "value": ...} | n..10 | M | Amount in the smallest currency unit (e.g. EUR Cent). Please contact the Computop Helpdesk, if you want to capture amounts <100 (smallest currency unit). | ||||||||

| Currency | "amount": { "currency": "..."} | a3 | M | Currency, three digits DIN / ISO 4217, e.g. EUR, USD, GBP. Please find an overview here: A1 Currency table | ||||||||

OrderDesc | "order": {"description": "..."} | ans..768 | O | Description of purchased goods, unit prices etc. | ||||||||

| not used | an64 | M | Hash Message Authentication Code (HMAC) with SHA-256 algorithm. Details can be found here: | |||||||||

| Capture | an..6 | OM | Determines the type and time of capture.

|

Parameters for credit card payments via authorize.aspx

The following table describes the result parameters with which the Computop Paygate responds to your system

pls. be prepared to receive additional parameters at any time and do not check the order of parameters

the key (e.g. MerchantId, RefNr) should not be checked case-sentive

Key | REST | Format | CND | Description |

|---|---|---|---|---|

| "merchantId": "..." | ans..30 | M | MerchantID, assigned by Computop | |

| PayID | "paymentId": "..." | an32 | M | ID assigned by Paygate for the payment, e.g. for referencing in batch files as well as for capture or credit request. |

| XID | "xId": "..." | an32 | M | ID for all single transactions (authorisation, capture, credit note) for one payment assigned by Paygate |

| Code | "code": ... | n8 | M | Error code according to Paygate Response Codes (A4 Error codes) |

| Description | "description": "..." | ans..1024 | M | Further details in the event that payment is rejected. Please do not use the Description but the Code parameter for the transaction status analysis! |

| TransID | "transactionId": "..." | ans..64 | M | TransactionID provided by you which should be unique for each payment |

Status | a..50 | M | AUTHORIZED or FAILED | |

| RefNr | "referenceNumber": "..." | O | Merchant’s unique reference number, which serves as payout reference in the acquirer EPA file. Please note, without the own shop reference delivery you cannot read out the EPA transaction and regarding the additional Computop settlement file (CTSF) we cannot add the additional payment data.

Only ASCII characters allowed, special characters ("Umlaute", diacritics) are not allowed and must be replaced by their ASCII-representation (e.g. ü → ue, é → e, ...). |

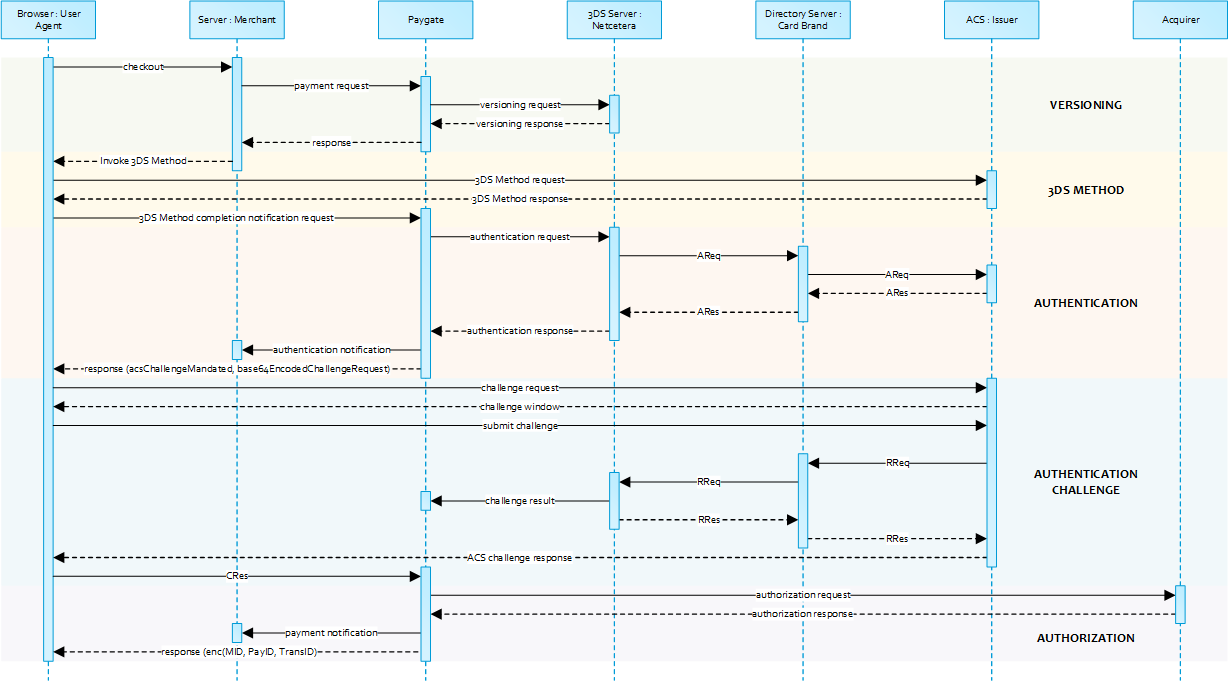

Extended Sequence Diagram

Payment Initiation

The initial request to Computop Paygate will be the same regardless of the underlying 3-D Secure Protocol.

In order to start a server-to-server 3-D Secure card payment sequence please post the following key-value-pairs to https://www.computop-paygate.com/ direct.aspx.

Call of interface: general parameters

Notice: For credit card payments with 3-D Secure, please note the different cases as explained separately in the chapter at the start of the handbook. If the credit card is registered for Verified or SecureCode or SafeKey, the next phase is divided into two steps of authentication and payment. However it always begins in the same way via the direct.aspx interface. The first response however is the receipt of Javascript code or other parameters in order to carry out a second call up of the direct3d.aspx interface. Only after that, do you receive the listed parameter as a response.

To carry out a credit card payment via a Server-to-Server connection, please use the following URL:

https://www.computop-paygate.com/direct.aspx |

Request Elements

Notice: For security reasons, Computop Paygate rejects all payment requests with formatting errors. Therefore, please use the correct data type for each parameter.

The following table describes the encrypted payment request parameters:

Notice: In case of a merchant initiated recurring transaction the JSON objects (besides credentialOnFile and card), the URLNotify and TermURL are not mandatory parameters, because no 3-D Secure and no risk evaluation is done by the card issuing bank and the payment result is directly returned within the response.

Key | REST | Format | CND | Description | ||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| BasicAuth.Username | ans..30 | M | MerchantID, assigned by Computop. Additionally this parameter has to be passed in plain language too. | |||||||||||

| msgver | not used | ans..5 | M | Computop Paygate Message version. Valid values:

| ||||||||||

| TransID | "transactionId": "..." | ans..64 | M | TransactionID provided by you which should be unique for each payment | ||||||||||

| ReqId | "requestId": "..." | ans..32 | O | To avoid double payments or actions (e.g. by ETM), enter an alphanumeric value which identifies your transaction and may be assigned only once. If the transaction or action is submitted again with the same ReqID, Computop Paygate will not carry out the payment or new action, but will just return the status of the original transaction or action. Please note that the Computop Paygate must have a finalized transaction status for the first initial action (authentication/authorisation). This does not apply to 3-D Secure authentications that are terminated by a timeout. The 3-D Secure Timeout status does not count as a completed status in which the ReqID functionality on Paygate does not take effect. Submissions with identical ReqID for an open status will be processed regularly. Notice: Please note that a ReqID is only valid for 12 month, then it gets deleted at the Paygate. | ||||||||||

| RefNr | "referenceNumber": "..." | O | Merchant’s unique reference number, which serves as payout reference in the acquirer EPA file. Please note, without the own shop reference delivery you cannot read out the EPA transaction and regarding the additional Computop settlement file (CTSF) we cannot add the additional payment data.

Only ASCII characters allowed, special characters ("Umlaute", diacritics) are not allowed and must be replaced by their ASCII-representation (e.g. ü → ue, é → e, ...). | |||||||||||

| schemeReferenceID | "payment": {"card": { "schemeReferenceId": "..." }} | ans..64 | C | Card scheme specific transaction ID required for subsequent credential-on-file payments, delayed authorizations and resubmissions. Mandatory: CredentialOnFile – initial false – unscheduled MIT / recurring schemeReferenceID is returned for 3DS2-payments. In case of fallback to 3DS1 you will also need to check for TransactionId. The schemeReferenceID is a unique identifier generated by the card brands and as a rule Computop merchants can continue to use the SchemeReferenceIDs for subscription plans that were created while using another PSP environment / Paygate MerchantID / Acquirer ContractID / Acquirer. | ||||||||||

| industrySpecificTxType | "payment": {"card": { "industrySpecificTransactionType": "..." }} | ans..20 | C | This parameter is required whenever an industry specific transaction is processed according to the card brands MIT (Merchant Initiated Transactions) Framework, i.e.: specific use cases like described below.

Values accepted:

Note: It is always submitted in conjunction with the "schemeReferenceID" parameter. Please contact Computop Helpdesk for the supported Acquirer and card brands. | ||||||||||

| Amount | "amount": { "value": ...} | n..10 | M | Amount in the smallest currency unit (e.g. EUR Cent). Please contact the Computop Helpdesk, if you want to capture amounts <100 (smallest currency unit). | ||||||||||

| Currency | "amount": { "currency": "..."} | a3 | M | Currency, three digits DIN / ISO 4217, e.g. EUR, USD, GBP. Please find an overview here: A1 Currency table | ||||||||||

| card | "payment": {"card": JSON} | JSON | M | Card data | ||||||||||

| Capture | an..6 | OM | Determines the type and time of capture.

| |||||||||||

| billingDescriptor | "billing": {"addressInfo": { "descriptor": "..." }} | ans..22 | O | A descriptor to be printed on a card holder’s statement. Please also refer to the additional comments made elsewhere for more information about rules and regulations. | ||||||||||

| OrderDesc | "order": {"description": "..."} | ans..768 | O | Order description | ||||||||||

| AccVerify | "payment": {"card": { "accountVerification": "..." }} | a3 | O | Indicator to request an account verification (aka zero value authorization). If an account verification is requested the submitted amount will be optional and ignored for the actual payment transaction (e.g. authorization). Values accepted:

| ||||||||||

| "payment": {"card": { "threeDsPolicy": JSON }} | JSON | O | Object specifying authentication policies and exemption handling strategies | |||||||||||

| "payment": {"card": { "threeDSData": JSON }} | JSON | C | Object detailing authentication data in case authentication was performed through a third party or by the merchant | |||||||||||

| "payment": {"card": { "priorAuthenticationInfo": JSON }} | JSON | O | Prior Transaction Authentication Information contains optional information about a 3-D Secure cardholder authentication that occurred prior to the current transaction | |||||||||||

| "browserInfo": JSON | JSON | C | Accurate browser information are needed to deliver an optimized user experience. Required for 3-D Secure 2.0 transactions. | |||||||||||

| "accountInfo": JSON | JSON | O | The account information contains optional information about the customer account with the merchant. Optional for 3-D Secure 2.0 transactions. | |||||||||||

| "billing": JSON | JSON | C | The customer that is getting billed for the goods and / or services. Required unless market or regional mandate restricts sending this information. | |||||||||||

| "shipping": JSON | JSON | C | The customer that the goods and / or services are sent to. Required (if available and different from billToCustomer) unless market or regional mandate restricts sending this information. | |||||||||||

| "billing": {"addressInfo": JSON} | JSON | C | Billing address. Required for 3-D Secure 2.0 (if available) unless market or regional mandate restricts sending this information. | |||||||||||

| "shipping": {"addressInfo": JSON} | JSON | C | Shipping address. If different from billingAddress, required for 3-D Secure 2.0 (if available) unless market or regional mandate restricts sending this information. | |||||||||||

| "credentialOnFile": JSON | JSON | C | Object specifying type and series of transactions using payment account credentials (e.g. account number or payment token) that is stored by a merchant to process future purchases for a customer. Required if applicable. | |||||||||||

| "riskIndicator": JSON | JSON | O | The Merchant Risk Indicator contains optional information about the specific purchase by the customer | |||||||||||

| subMerchantPF | "subMerchantPaymentFacilitator": JSON | JSON | O | Object specifying SubMerchant (Payment Facilitator) details

| ||||||||||

| TermURL | "payment": {"threeDSLegay": { "termUrl": "..." }} | ans..256 | C | Only for 3-D Secure: URL of the shop which has been selected by the Access Control Server (ACS) of the bank to transmit the result of the authentication. The bank transmits the parameters PayID, TransID and MerchantID via GET and the PAResponse parameter via POST to the TermURL. In case of a merchant initiated recurring transaction the JSON objects (besides credentialOnFile and card), the URLNotify and TermURL are not mandatory parameters, because no 3-D Secure and no risk evaluation is done by the card issuing bank and the payment result is directly returned within the response. | ||||||||||

| URLNotify | "urls": {"notify": "..."} | ans..256 | C | Complete URL which Paygate calls up in order to notify the shop about the payment result. The URL may be called up only via port 443. It may not contain parameters: Use the UserData parameter instead. In case of a merchant initiated recurring transaction the JSON objects (besides credentialOnFile and card), the URLNotify and TermURL are not mandatory parameters, because no 3-D Secure and no risk evaluation is done by the card issuing bank and the payment result is directly returned within the response.

| ||||||||||

| UserData | ans..1024 | O | If specified at request, Paygate forwards the parameter with the payment result to the shop. | |||||||||||

| not used | an64 | M | Hash Message Authentication Code (HMAC) with SHA-256 algorithm. Details can be found here: |

General parameters for credit card payments via socket connection

Please note the additional parameter for a specific credit card integration in the section "Specific parameters"

Response Elements (authentication)

In case of using REST API

In case of using REST API you will always receive a link where the merchant has to redirect the consumer to complete the payment.

| REST | Format | CND | Description |

|---|---|---|---|

"paymentId": "..." | an32 | M | May be "00000000000000000000000000000000" if not yet set by Computop Paygate |

| "_Links.self.type": "..." | an..20 | M | "application/json" |

| "_Links.redirect.href": "..." | an..1024 | M | Merchant needs to redirect consumer to this URL to complete payment |

| "_Links.redirect.type": "..." | an..20 | M | "text/html" |

Merchant can use inquire.aspx

The following table describes the result parameters with which the Computop Paygate responds to your system

pls. be prepared to receive additional parameters at any time and do not check the order of parameters

the key (e.g. MerchantId, RefNr) should not be checked case-sentive

Key | REST | Format | CND | Description |

|---|---|---|---|---|

| "merchantId": "..." | ans..30 | M | MerchantID, assigned by Computop | |

| PayID | "paymentId": "..." | an32 | M | ID assigned by Paygate for the payment, e.g. for referencing in batch files as well as for capture or credit request. |

| XID | "xId": "..." | an32 | M | ID for all single transactions (authorisation, capture, credit note) for one payment assigned by Paygate |

| TransID | "transactionId": "..." | ans..64 | M | TransactionID provided by you which should be unique for each payment |

| refnr | "referenceNumber": "..." | O | Reference number taken from request | |

| Status | a..20 | M | Status of the transaction. Values accepted:

In case of Authentication-only the Status will be either | |

| Description | "description": "..." | ans..1024 | M | Further details in the event that payment is rejected. Please do not use the Description but the Code parameter for the transaction status analysis! |

| Code | "code": ... | n8 | M | Error code according to Paygate Response Codes (A4 Error codes) |

| "payment": {"card": JSON} | JSON | M | Card data | |

| versioningdata | "payment": {"versioningdata": JSON} | JSON | M | The Card Range Data data element contains information that indicates the most recent EMV 3-D Secure version supported by the ACS that hosts that card range. It also may optionally contain the ACS URL for the 3-D Secure Method if supported by the ACS and the DS Start and End Protocol Versions which support the card range. |

| threeDSLegacy | "payment": {"threeDSLegacy": JSON} | JSON | C | Object containing the data elements required to construct the Payer Authentication request in case of a fallback to 3-D Secure 1.0. |

versioningData

The

versioningData

object will indicate the EMV 3-D Secure protocol versions (i.e. 2.1.0 or higher) that are supported by Access Control Server of the issuer.

If the corresponding protocol version fields are NULL it means that the BIN range of card issuer is not registered for 3-D Secure 2.0 and a fallback to 3-D Secure 1.0 is required for transactions that are within the scope of PSD2 SCA.

When parsing versioningData please also refer to the subelement errorDetails which will specify the reason if some fields are not pupoluated (e.g. Invalid cardholder account number passed, not available card range data, failure in encoding/serialization of the 3-D Secure Method data etc).

BASEURL= https://www.computop-paygate.com/

{

"threeDSServerTransID": "14dd844c-b0fc-4dfe-8635-366fbf43468c",

"acsStartProtocolVersion": "2.1.0",

"acsEndProtocolVersion": "2.1.0",

"dsStartProtocolVersion": "2.1.0",

"dsEndProtocolVersion": "2.1.0",

"threeDSMethodURL": "http://www.acs.com/script",

"threeDSMethodDataForm": "eyJ0aHJlZURTTWV0aG9kTm90aWZpY2F0aW9uVVJMIjoiaHR0cHM6Ly93d3cuY29tcHV0b3AtcGF5Z2F0ZS5jb20vY2JUaHJlZURTLmFzcHg_YWN0aW9uPW10aGROdGZuIiwidGhyZWVEU1NlcnZlclRyYW5zSUQiOiIxNGRkODQ0Yy1iMGZjLTRkZmUtODYzNS0zNjZmYmY0MzQ2OGMifQ==",

"threeDSMethodData": {

"threeDSMethodNotificationURL": "BASEURL/cbThreeDS.aspx?action=mthdNtfn",

"threeDSServerTransID": "14dd844c-b0fc-4dfe-8635-366fbf43468c"

}

}

3-D Secure Method

The 3-D Secure Method allows for additional browser information to be gathered by an ACS prior to receipt of the authentication request message (AReq) to help facilitate the transaction risk assessment. Support of 3-D Secure Method is optional and at the discretion of the issuer.

The versioningData object contains a value for

threeDSMethodURL

. The merchant is supposed to invoke the 3-D Secure Method via a hidden HTML iframe in the cardholder browser and send a form with a field named threeDSMethodData via HTTP POST to the ACS 3-D Secure Method URL.

3-D Secure Method: threeDSMethodURL

Please note that the threeDSMethodURL will be populated by Computop Paygate if the issuer does not support the 3-D Secure Method. The 3-D Secure Method Form Post as outlined below must be performed independently from whether it is supported by the issuer. This is necessary to facilitate direct communication between the browser and Computop Paygate in case of a mandated challenge or a frictionless flow.

3-D Secure Method: No issuer threeDSMethodURL

3-D Secure Method Form Post

<form name="frm" method="POST" action="Rendering URL">

<input type="hidden" name="threeDSMethodData" value="eyJ0aHJlZURTU2VydmVyVHJhbnNJRCI6IjNhYzdjYWE3LWFhNDItMjY2My03OTFiLTJhYzA1YTU0MmM0YSIsInRocmVlRFNNZXRob2ROb3RpZmljYXRpb25VUkwiOiJ0aHJlZURTTWV0aG9kTm90aWZpY2F0aW9uVVJMIn0">

</form>

Netcetera 3DS Web SDK

You may use the operations init3DSMethod or createIframeAndInit3DSMethod at your discreation from the nca3DSWebSDK in order to iniatiate the 3-D Secure Method. Please refer to the Integration Manual at https://mpi.netcetera.com/3dsserver/doc/current/integration.html#Web_Service_API.

Once the 3-D Secure Method is concluded the ACS will instruct the cardholder browser through the iFrame response document to submit threeDSMethodData as a hidden form field to the 3-D Secure Method Notification URL.

ACS Response Document

<!DOCTYPE html>

<html lang="en">

<head>

<meta charset="UTF-8"/>

<title>Identifying...</title>

</head>

<body>

<script>

var tdsMethodNotificationValue = 'eyJ0aHJlZURTU2VydmVyVHJhbnNJRCI6ImUxYzFlYmViLTc0ZTgtNDNiMi1iMzg1LTJlNjdkMWFhY2ZhMiJ9';

var form = document.createElement("form");

form.setAttribute("method", "post");

form.setAttribute("action", "notification URL");

addParameter(form, "threeDSMethodData", tdsMethodNotificationValue);

document.body.appendChild(form);

form.submit();

function addParameter(form, key, value) {

var hiddenField = document.createElement("input");

hiddenField.setAttribute("type", "hidden");

hiddenField.setAttribute("name", key);

hiddenField.setAttribute("value", value);

form.appendChild(hiddenField);

}

</script>

</body>

</html>

3-D Secure Method Notification Form

<form name="frm" method="POST" action="3DS Method Notification URL">

<input type="hidden" name="threeDSMethodData" value="eyJ0aHJlZURTU2VydmVyVHJhbnNJRCI6ImUxYzFlYmViLTc0ZTgtNDNiMi1iMzg1LTJlNjdkMWFhY2ZhMiJ9">

</form>

Please note that the threeDSMethodNotificationURL as embedded in the Base64 encoded threeDSMethodData value points to Computop Paygate and must not be modified. The merchant notification is delivered to the URLNotify as provided in the original request or as configured for the MerchantID in Computop Paygate .

Authentication

If 3-D Secure Method is supported by the issuer ACS and was invoked by the merchant Computop Paygate will automatically continue with the authentication request once the 3-D Secure Method has completed (i.e. 3-D Secure Method Notification).

The authentication result will be transferred via HTTP POST to the URLNotify . It may indicate that the Cardholder has been authenticated, or that further cardholder interaction (i.e. challenge) is required to complete the authentication.

In case a cardholder challenge is deemed necessary Computop Paygate will transfer a JSON object within the body of HTTP browser response with the elements acsChallengeMandated , challengeRequest , base64EncodedChallengeRequest and acsURL . Otherwise, in a frictionless flow, Computop Paygate will automatically continue and respond to the cardholder browser once the authorization completed.

Cardholder Challenge: Browser Response

Browser Challenge Response

Data Elements

Schema: Browser Challenge Response

{

"$schema": "http://json-schema.org/draft-07/schema#",

"type": "object",

"properties": {

"acsChallengeMandated": {"type": "boolean"},

"challengeRequest": {"type": "object"},

"base64EncodedChallengeRequest": {"type": "string"},

"acsURL": {"type": "string"}

},

"required": ["acsChallengeMandated", "challengeRequest", "base64EncodedChallengeRequest", "acsURL"],

"additionalProperties": false

}

Sample: Browser Challenge Response

{

"acsChallengeMandated": false,

"challengeRequest": {

"threeDSServerTransID": "8a880dc0-d2d2-4067-bcb1-b08d1690b26e",

"acsTransID": "d7c1ee99-9478-44a6-b1f2-391e29c6b340",

"messageType": "CReq",

"messageVersion": "2.1.0",

"challengeWindowSize": "01",

"messageExtension": [

{

"name": "emvcomsgextInChallenge",

"id": "tc8Qtm465Ln1FX0nZprA",

"criticalityIndicator": false,

"data": "messageExtensionDataInChallenge"

}

]

},

"base64EncodedChallengeRequest": "base64-encoded-challenge-request",

"acsURL": "acsURL-to-post-challenge-request"

}

Authentication Notification

The data elements of the authentication notification are listed in the table below.

Browser Challenge

If a challenge is deemed necessary (see challengeRequest) the browser challenge will occur within the cardholder browser. To create a challenge it is required to post the value base64EncodedChallengeRequest via an HTML iframe to the ACS URL.

Challenge Request

<form name="challengeRequestForm" method="post" action="acsChallengeURL"> <input type="hidden" name="creq" value="ewogICAgInRocmVlRFNTZXJ2ZXJUcmFuc0lEIjogIjhhODgwZGMwLWQyZDItNDA2Ny1iY2IxLWIwOGQxNjkwYjI2ZSIsCiAgICAiYWNzVHJhbnNJRCI6ICJkN2MxZWU5OS05NDc4LTQ0YTYtYjFmMi0zOTFlMjljNmIzNDAiLAogICAgIm1lc3NhZ2VUeXBlIjogIkNSZXEiLAogICAgIm1lc3NhZ2VWZXJzaW9uIjogIjIuMS4wIiwKICAgICJjaGFsbGVuZ2VXaW5kb3dTaXplIjogIjAxIiwKICAgICJtZXNzYWdlRXh0ZW5zaW9uIjogWwoJCXsKCQkJIm5hbWUiOiAiZW12Y29tc2dleHRJbkNoYWxsZW5nZSIsCgkJCSJpZCI6ICJ0YzhRdG00NjVMbjFGWDBuWnByQSIsCgkJCSJjcml0aWNhbGl0eUluZGljYXRvciI6IGZhbHNlLAoJCQkiZGF0YSI6ICJtZXNzYWdlRXh0ZW5zaW9uRGF0YUluQ2hhbGxlbmdlIgoJCX0KICAgIF0KfQ=="> </form>

init3DSChallengeRequest or createIFrameAndInit3DSChallengeRequest from the nca3DSWebSDK in order submit the challenge message through the cardholder browser.Init 3-D Secure Challenge Request - Example

<!DOCTYPE html>

<html lang="en">

<head>

<meta charset="UTF-8">

<script src="nca-3ds-web-sdk.js" type="text/javascript"></script>

<title>Init 3-D Secure Challenge Request - Example</title>

</head>

<body>

<!-- This example will show how to initiate Challenge Reqeuests for different window sizes. -->

<div id="frameContainer01"></div>

<div id="frameContainer02"></div>

<div id="frameContainer03"></div>

<div id="frameContainer04"></div>

<div id="frameContainer05"></div>

<iframe id="iframeContainerFull" name="iframeContainerFull" width="100%" height="100%"></iframe>

<script type="text/javascript">

// Load all containers

iFrameContainerFull = document.getElementById('iframeContainerFull');

container01 = document.getElementById('frameContainer01');

container02 = document.getElementById('frameContainer02');

container03 = document.getElementById('frameContainer03');

container04 = document.getElementById('frameContainer04');

container05 = document.getElementById('frameContainer05');

// nca3DSWebSDK.init3DSChallengeRequest(acsUrl, creqData, container);

nca3DSWebSDK.init3DSChallengeRequest('http://example.com', 'base64-encoded-challenge-request', iFrameContainerFull);

// nca3DSWebSDK.createIFrameAndInit3DSChallengeRequest(acsUrl, creqData, challengeWindowSize, frameName, rootContainer, callbackWhenLoaded);

nca3DSWebSDK.createIFrameAndInit3DSChallengeRequest('http://example.com', 'base64-encoded-challenge-request', '01', 'threeDSCReq01', container01);

nca3DSWebSDK.createIFrameAndInit3DSChallengeRequest('http://example.com', 'base64-encoded-challenge-request', '02', 'threeDSCReq02', container02);

nca3DSWebSDK.createIFrameAndInit3DSChallengeRequest('http://example.com', 'base64-encoded-challenge-request', '03', 'threeDSCReq03', container03);

nca3DSWebSDK.createIFrameAndInit3DSChallengeRequest('http://example.com', 'base64-encoded-challenge-request', '04', 'threeDSCReq04', container04);

nca3DSWebSDK.createIFrameAndInit3DSChallengeRequest('http://example.com', 'base64-encoded-challenge-request', '05', 'threeDSCReq05', container05, () => {

console.log('Iframe loaded, form created and submitted');

});

</script>

</body>

</html>

Please note that the notification URL submited in the challenge request points to Computop Paygate and must not be changed.

Authorization

After successful cardholder authentication or proof of attempted authentication/verification is provided Computop Paygate will automatically continue with the payment authorization.

In case the cardholder authentication was not successful or proof proof of attempted authentication/verification can not be provided Computop Paygate will not continue with an authorization request.

In both cases Paygate will deliver a notification with the authentication result to the merchant specified

URLNotify

with the data elements as listed in the table below.

Payment Notification

In case of using REST API

In case of using REST API you will always receive a link where the merchant has to redirect the consumer to complete the payment.

| REST | Format | CND | Description |

|---|---|---|---|

"paymentId": "..." | an32 | M | May be "00000000000000000000000000000000" if not yet set by Computop Paygate |

| "_Links.self.type": "..." | an..20 | M | "application/json" |

| "_Links.redirect.href": "..." | an..1024 | M | Merchant needs to redirect consumer to this URL to complete payment |

| "_Links.redirect.type": "..." | an..20 | M | "text/html" |

Merchant can use inquire.aspx

In case of using Key-Value-Pair API

The following table gives the result parameters which Computop Paygate transmits to URLSuccess or URLFailure and URLNotify. If you have specified the Response=encrypt parameter, the following parameters are sent Blowfish encrypted to your system:

pls. be prepared to receive additional parameters at any time and do not check the order of parameters

the key (e.g. MerchantId, RefNr) should not be checked case-sentive

Browser Payment Response

Additionally the JSON formatted data elements as listed below are transferred in the HTTP response body to the cardholder browser. Please note that the data elements (i.e. MID , Len , Data ) are base64 encoded.

Data Elements

Schema

{

"$schema": "http://json-schema.org/draft-07/schema#",

"type": "object",

"properties": {

"MID": {

"type": "string"

},

"Len": {

"type": "integer"

},

"Data": {

"type": "string"

}

},

"required": ["MID", "Len", "Data"],

"additionalProperties": false

}

Decrypted Data

Sample decrypted Data

MID=YourMID&PayID=PayIDassignedbyPlatform&TransID=YourTransID

Capture / Credit / Reversal

Capture

Captures are possible via a Server-to-Server connection. To perform a capture via a Server-to-Server connection, please use the following URL:

https://www.computop-paygate.com/capture.aspx |

Notice: Please observe the reservation / authorisation deadlines of your acquirer (see General Terms and Conditions) so that you, as the merchant, ensure that the debits are submitted to our Paygate within the correct period.

Notice: For security reasons, Computop Paygate rejects all payment requests with formatting errors. Therefore, please use the correct data type for each parameter.

The following table describes the encrypted payment request parameters:

Key | REST | Format | CND | Description |

|---|---|---|---|---|

| BasicAuth.Username | ans..30 | M | MerchantID, assigned by Computop. Additionally this parameter has to be passed in plain language too. | |

| Amount | "amount": { "value": ...} | n..10 | M | Amount in the smallest currency unit (e.g. EUR Cent). Please contact the Computop Helpdesk, if you want to capture amounts <100 (smallest currency unit). |

| Currency | "amount": { "currency": "..."} | a3 | M | Currency, three digits DIN / ISO 4217, e.g. EUR, USD, GBP. Please find an overview here: A1 Currency table |

| not used | an64 | M | Hash Message Authentication Code (HMAC) with SHA-256 algorithm. Details can be found here: | |

| PayID | part of URL (e.g. /payments/{paymentId}/captures) | an32 | M | ID assigned by Paygate for the payment, e.g. for referencing in batch files as well as for capture or credit request. |

TransID | "transactionId": "..." | ans..64 | M | TransactionID which should be unique for each payment Please note for some connections the different formats that are given within the specific parameters. |

| RefNr | "referenceNumber": "..." | ns..30 | C | Merchant’s unique reference number, which serves as payout reference in the acquirer EPA file. Please note, without the own shop reference delivery you cannot read out the EPA transaction and regarding the additional Computop settlement file (CTSF) we cannot add the additional payment data. (not with EVO Payments, for CardComplete in the format an..25, for Cofidis in the format n..15, for Omnipay in the format ns..15, for RBI in the format ns..20) Only ASCII characters allowed, special characters ("Umlaute", diacritics) are not allowed and must be replaced by their ASCII-representation (e.g. ü → ue, é → e, ...). |

| ReqId | "requestId": "..." | ans..32 | O | To avoid double payments or actions (e.g. by ETM), enter an alphanumeric value which identifies your transaction and may be assigned only once. If the transaction or action is submitted again with the same ReqID, Computop Paygate will not carry out the payment or new action, but will just return the status of the original transaction or action. Please note that the Computop Paygate must have a finalized transaction status for the first initial action (authentication/authorisation). This does not apply to 3-D Secure authentications that are terminated by a timeout. The 3-D Secure Timeout status does not count as a completed status in which the ReqID functionality on Paygate does not take effect. Submissions with identical ReqID for an open status will be processed regularly. Notice: Please note that a ReqID is only valid for 12 month, then it gets deleted at the Paygate. |

FinishAuth | "finishAuth": "..." | a1 | C | Only with ETM: Transmit value <Y> in order to stop the renewal of guaranteed authorisations and rest amounts after partial captures. Please use this parameter only if you are using the additional function ETM (Extended Transactions Managament). (not with Clearhaus) |

Textfeld1 | "cardHolder": { "name": "..."} | ans..30 | O | Card holder information: Name (not with Clearhaus) |

Textfeld2 | "cardHolder": { "city": "..."} | ans..30 | O | Card holder information: City (not with Clearhaus) |

CHDesc | not used | ans..22 | OC | Only with Clearhaus: Text printed on the customer’s credit card bill. Only printable ASCII characters from 0x20 to 0x7E |

Parameters for captures of credit card payments

The following table describes the result parameters with which the Computop Paygate responds to your system

pls. be prepared to receive additional parameters at any time and do not check the order of parameters

the key (e.g. MerchantId, RefNr) should not be checked case-sentive

Key | REST | Format | CND | Description |

|---|---|---|---|---|

| "merchantId": "..." | ans..30 | M | MerchantID, assigned by Computop | |

| PayID | "paymentId": "..." | an32 | M | ID assigned by Paygate for the payment, e.g. for referencing in batch files as well as for capture or credit request. |

| XID | "xId": "..." | an32 | M | ID for all single transactions (authorisation, capture, credit note) for one payment assigned by Paygate |

| Code | "code": ... | n8 | M | Error code according to Paygate Response Codes (A4 Error codes) |

| Description | "description": "..." | ans..1024 | M | Further details in the event that payment is rejected. Please do not use the Description but the Code parameter for the transaction status analysis! |

TransID | "transactionId": "..." | ans..64 | M | Merchant’s transaction number. Please note for some connections the different formats that are given within the specific parameters. |

Status | a..50 | M | OK or FAILED | |

RefNr | "referenceNumber": "..." | ns..30 | C | Merchant’s unique reference number, which serves as payout reference in the acquirer EPA file. Please note, without the own shop reference delivery you cannot read out the EPA transaction and regarding the additional Computop settlement file (CTSF) we cannot add the additional payment data. (not with EVO Payments, for Card Complete in the format an..25, for Omnipay in the format ns..15, for RBI in the format ns..20) Only ASCII characters allowed, special characters ("Umlaute", diacritics) are not allowed and must be replaced by their ASCII-representation (e.g. ü → ue, é → e, ...). |

Aid | "authorizationId": "..." | n6 | OC | Only in the case of Card Complete: Authorisation ID returned by Card Complete |

Amount | "amountValue": "..." | n..10 | OC | Only with Clearhaus: Amount in the smallest currency unit (e.g. EUR Cent) If the actual amount differs from the requested amount this will be returned. Only with MasaPay: The amount has to be equal to the originally authorised amount. |

CodeExt | "externalErrorCode": "..." | n5 | OC | Only with Clearhaus: Only if configured: External error code (downstream system). Only with MasaPay: Format ans..10, error code from MasaPay. |

ErrorText | "errorText": "..." | ans.128 | OC | Only with Clearhaus: Detailed Clearhaus error message. Only with MasaPay: Format ans..128, detailed MasaPay error message. Is returned only if Status=FAILED. Use is possible only in agreement with Computop Helpdesk |

TransactionID | "clearhausTransactionId": "..." | ans36 | OC | Only with Clearhaus: Transaction number from Clearhaus |

GuWID | "wirecardTransactionId": "..." | ans..22 | O | Only with Wirecard: TransactionID of the Acquiring Bank |

| TID | "cofidisTransactionId": "..." | n..15 | M | Only with Cofidis: If RefNr was submitted, it's value will be returned. Otherwise the first 15 digits of TransactionID will be returned. |

Response parameters for captures of credit card payments

Credit with reference

Credits (refunds) are possible via a Server-to-Server connection. Paygate permits credits which relate to a capture previously activated by Paygate and allows merchants to carry out credits without a reference transaction. This section describes the processing of credits with reference transactions. If you refer to a capture for a Credit, the amount of the Credit is limited to the amount of the previous capture.

To carry out a credit with a reference transaction, please use the following URL:

https://www.computop-paygate.com/credit.aspx |

Notice: For security reasons, Computop Paygate rejects all payment requests with formatting errors. Therefore, please use the correct data type for each parameter.

The following table describes the encrypted payment request parameters:

Key | REST | Format | CND | Description |

|---|---|---|---|---|

| BasicAuth.Username | ans..30 | M | MerchantID, assigned by Computop. Additionally this parameter has to be passed in plain language too. | |

| Amount | "amount": { "value": ...} | n..10 | M | Amount in the smallest currency unit (e.g. EUR Cent). Please contact the Computop Helpdesk, if you want to capture amounts <100 (smallest currency unit). |

| Currency | "amount": { "currency": "..."} | a3 | M | Currency, three digits DIN / ISO 4217, e.g. EUR, USD, GBP. Please find an overview here: A1 Currency table |

| not used | an64 | M | Hash Message Authentication Code (HMAC) with SHA-256 algorithm. Details can be found here: | |

| PayID | part of URL (e.g. /payments/{paymentId}/refunds) | an32 | M | ID assigned by Paygate for the payment, e.g. for referencing in batch files as well as for capture or credit request. |

TransID | "transactionId": "..." | ans..64 | M | TransactionID which should be unique for each payment Please note for some connections the different formats that are given within the specific parameters. |

| RefNr | "referenceNumber": "..." | ns..30 | C | Merchant’s unique reference number, which serves as payout reference in the acquirer EPA file. Please note, without the own shop reference delivery you cannot read out the EPA transaction and regarding the additional Computop settlement file (CTSF) we cannot add the additional payment data. (not with EVO Payments, Only for CardComplete, for Clearhaus (ns..30, optional, only printable ASCII characters from 0x20 to 0x7E), for RBI (ns..20, optional), for MasaPay (ns..30, optional), for Cofidis (n..15, optional).) Only ASCII characters allowed, special characters ("Umlaute", diacritics) are not allowed and must be replaced by their ASCII-representation (e.g. ü → ue, é → e, ...). |

| OrderDesc | "orderDescription": "..." | ans..768 | O | Description of refunded goods, unit prices, merchant’s comment etc. (not with Clearhaus) |

| ReqId | "requestId": "..." | ans..32 | O | To avoid double payments or actions (e.g. by ETM), enter an alphanumeric value which identifies your transaction and may be assigned only once. If the transaction or action is submitted again with the same ReqID, Computop Paygate will not carry out the payment or new action, but will just return the status of the original transaction or action. Please note that the Computop Paygate must have a finalized transaction status for the first initial action (authentication/authorisation). This does not apply to 3-D Secure authentications that are terminated by a timeout. The 3-D Secure Timeout status does not count as a completed status in which the ReqID functionality on Paygate does not take effect. Submissions with identical ReqID for an open status will be processed regularly. Notice: Please note that a ReqID is only valid for 12 month, then it gets deleted at the Paygate. |

Textfeld1 | "cardHolder": { "name": "..."} | ans..30 | O | Card holder information: Name (not with Clearhaus) |

Textfeld2 | "cardHolder": { "city": "..."} | ans..30 | O | Card holder information: City (not with Clearhaus) |

CHDesc | not used | ans..22 | OC | Only with Clearhaus: Text printed on the customer’s credit card bill. Only printable ASCII characters from 0x20 to 0x7E |

| TID | "safeChargeTransactionId": "..." | ans..30 | OC | Only with SafeCharge: TransaktioncID of the capture to be credited, if the merchants wants to credit a specifc capture. If the parameter is nut submitted the last capture will be credited. |

| Additional parameters for Wirecard connection (for Visa Direct) | ||||

| refundType | "wirecardConnection": { "refundType": "p2p"} "wirecardConnection": { "refundType": "md"} "wirecardConnection": { "refundType": "acc2acc"} | enum | C | Type of refund. Possible values: “p2p”, “md”, “acc2acc”. “ccBill”, “fd” |

| receiverFirstName | "wirecardConnection": {"receiver": { "firstName": "..." }} | an..12 | C | First name of the receiver. Mandatory for cross-border transactions. |

| receiverLastName | "wirecardConnection": {"receiver": { "lastName": "..." }} | an..12 | C | Last name of the receiver. Mandatory for cross-border transactions. |

| senderAccountNumber | "wirecardConnection": {"sender": { "accountNumber": "..." }} | n..12 | C | Account number of the sender. Mastercard: Mandatory. Visa: Mandatory, if RefNr is empty. |

| senderFirstName | "wirecardConnection": {"sender": { "firstName": "..." }} | an..12 | C | First name of the sender. Mastercard: Mandatory. Visa: Mandatory for US domestic transactions and cross-border money transfers. |

| senderLastName | "wirecardConnection": {"sender": { "lastName": "..." }} | an..12 | C | Last name of the sender. Mastercard: Mandatory. Visa: Optional. |

| senderAddrStreet | "wirecardConnection": {"sender": { "street": "..." }} | an..25 | C | Street name of the sender. Mastercard: Optional. Visa: Mandatory for US domestic transactions and cross-border money transfers. |

| senderAddrStreetNr | "wirecardConnection": {"sender": { "streetNumber": "..." }} | an..25 | C | Street number of the sender. Mastercard: Optional. Visa: Mandatory for US domestic transactions and cross-border money transfers. |

| senderAddrCity | "wirecardConnection": {"sender": { "city": "..." }} | an..32 | C | Town/city of the sender. Mastercard: Optional. Visa: Mandatory for US domestic transactions and cross-border money transfers. |

| senderAddrState | "wirecardConnection": {"sender": { "stateCode": "..." }} | a2 | C | State of the sender. Mastercard: Mandatory, if senderAddrCountry=US or Canada. Visa: Mandatory for US domestic transactions and cross-border money transfers. |

| senderAddrCountry | "wirecardConnection": {"sender": { "countryCode": "..." }} | a2 | C | Country of the sender. Mastercard: Optional. Visa: Mandatory if country is US and for cross-border money transfers. |

Parameters for credits of credit card payments

The following table describes the result parameters with which the Computop Paygate responds to your system

pls. be prepared to receive additional parameters at any time and do not check the order of parameters

the key (e.g. MerchantId, RefNr) should not be checked case-sentive

Key | REST | Format | CND | Description |

|---|---|---|---|---|

| "merchantId": "..." | ans..30 | M | MerchantID, assigned by Computop | |

| PayID | "paymentId": "..." | an32 | M | ID assigned by Paygate for the payment, e.g. for referencing in batch files as well as for capture or credit request. |

| XID | "xId": "..." | an32 | M | ID for all single transactions (authorisation, capture, credit note) for one payment assigned by Paygate |

| Code | "code": ... | n8 | M | Error code according to Paygate Response Codes (A4 Error codes) |

| Description | "description": "..." | ans..1024 | M | Further details in the event that payment is rejected. Please do not use the Description but the Code parameter for the transaction status analysis! |

TransID | "transactionId": "..." | ans..64 | M | Merchant’s transaction number. Please note for some connections the different formats that are given within the specific parameters. |

Status | a..50 | M | OK or FAILED | |

Aid | "authorizationId": "..." | n6 | OC | Only in the case of Card Complete: Authorisation ID returned by Card Complete |

RefNr | "referenceNumber": "..." | an..25 | OC | Merchant’s unique reference number, which serves as payout reference in the acquirer EPA file. Please note, without the own shop reference delivery you cannot read out the EPA transaction and regarding the additional Computop settlement file (CTSF) we cannot add the additional payment data. Only for Card Complete, for Clearhaus (ans..30, optional, only printable ASCII characters from 0x20 to 0x7E), for RBI (ns..20, optional), for MasaPay (ns..30, optional), for Cofidis (n..15, optional). Only ASCII characters allowed, special characters ("Umlaute", diacritics) are not allowed and must be replaced by their ASCII-representation (e.g. ü → ue, é → e, ...). |

Amount | "amountValue": "..." | n..10 | OC | Only with Clearhaus: Amount in the smallest currency unit (e.g. EUR Cent) If the actual amount differs from the requested amount this will be returned. Only with MasaPay: The amount has to be equal to the originally authorised amount. |

CodeExt | "externalErrorCode": "..." | n5 | OC | Only with Clearhaus: Only if configured: External error code (downstream system). Only with MasaPay: Format ans..10, error code from MasaPay. |

ErrorText | "errorText": "..." | ans.128 | OC | Only with Clearhaus: Detailed Clearhaus error message. Only with MasaPay: Format ans..128, detailed MasaPay error message. Is returned only if Status=FAILED. Use is possible only in agreement with Computop Helpdesk |

TransactionID | "clearhausTransactionId": "..." | ans36 | OC | Only with Clearhaus: Transaction number from Clearhaus |

Response parameters for credits of credit card payments

Credit without reference

Paygate can carry out Credits which do not relate to a previous capture. In this case the credit must be transferred to Paygate as a completely new payment transaction. Please contact the Computop Helpdesk for help in using the described additional functions.

Notice: Please note that credits without reference to a previous capture generate higher costs with your Acquiring Bank. If you are frequently unable to make reference to the capture you should agree this with your Acquiring Bank.

To carry out a Credit without a reference transaction via a Server-to-Server connection, please use the following URL:

https://www.computop-paygate.com/creditex.aspx |

Notice: For security reasons, Computop Paygate rejects all payment requests with formatting errors. Therefore, please use the correct data type for each parameter.

The following table describes the encrypted payment request parameters:

Parameters for credits of credit card payments without reference

The following table describes the result parameters with which the Computop Paygate responds to your system

pls. be prepared to receive additional parameters at any time and do not check the order of parameters

the key (e.g. MerchantId, RefNr) should not be checked case-sentive

Response parameters for credits of credit card payments without reference

Reversal

A credit card authorisation lowers the customer's credit line. Paygate can reverse an authorisation so that it no longer block the limit any more. Use the following URL:

https://www.computop-paygate.com/reverse.aspx |

Notice: Reverse.aspx does not only reverse authorisations, but any LAST TRANSACTION STAGE!! If the last transaction was a capture, Reverse.aspx initiates the reverse, e.g. a credit. Therefore, the utmost caution is urged. Use is at your own risk. We recommend checking the transaction status with Inquire.aspx before using Reverse.aspx.

Notice: For security reasons, Computop Paygate rejects all payment requests with formatting errors. Therefore, please use the correct data type for each parameter.

The following table describes the encrypted payment request parameters:

Key | REST | Format | CND | Description |

|---|---|---|---|---|

| BasicAuth.Username | ans..30 | M | MerchantID, assigned by Computop. Additionally this parameter has to be passed in plain language too. | |

| Amount | "amount": { "value": ...} | n..10 | M | Amount in the smallest currency unit (e.g. EUR Cent). Please contact the Computop Helpdesk, if you want to capture amounts <100 (smallest currency unit). |

| Currency | "amount": { "currency": "..."} | a3 | M | Currency, three digits DIN / ISO 4217, e.g. EUR, USD, GBP. Please find an overview here: A1 Currency table |

| not used | an64 | M | Hash Message Authentication Code (HMAC) with SHA-256 algorithm. Details can be found here: | |

| PayID | part of URL (e.g. /payments/{paymentId}/reversals) | an32 | M | ID assigned by Paygate for the payment, e.g. for referencing in batch files as well as for capture or credit request. |

TransID | "transactionId": "..." | ans..64 | M | Merchant ID for the identification of the payment process to be reversed. Please note for some connections the different formats that are given within the specific parameters. |

RefNr | "referenceNumber": "..." | ans..30 | OC | Merchant’s unique reference number, which serves as payout reference in the acquirer EPA file. Please note, without the own shop reference delivery you cannot read out the EPA transaction and regarding the additional Computop settlement file (CTSF) we cannot add the additional payment data. Only for Clearhaus (only printable ASCII characters from 0x20 to 0x7E), for MasaPay. Only ASCII characters allowed, special characters ("Umlaute", diacritics) are not allowed and must be replaced by their ASCII-representation (e.g. ü → ue, é → e, ...). |

| ReqId | "requestId": "..." | ans..32 | O | To avoid double payments or actions (e.g. by ETM), enter an alphanumeric value which identifies your transaction and may be assigned only once. If the transaction or action is submitted again with the same ReqID, Computop Paygate will not carry out the payment or new action, but will just return the status of the original transaction or action. Please note that the Computop Paygate must have a finalized transaction status for the first initial action (authentication/authorisation). This does not apply to 3-D Secure authentications that are terminated by a timeout. The 3-D Secure Timeout status does not count as a completed status in which the ReqID functionality on Paygate does not take effect. Submissions with identical ReqID for an open status will be processed regularly. Notice: Please note that a ReqID is only valid for 12 month, then it gets deleted at the Paygate. |

Parameters for reversals of credit card payments

The following table describes the result parameters with which the Computop Paygate responds to your system

pls. be prepared to receive additional parameters at any time and do not check the order of parameters

the key (e.g. MerchantId, RefNr) should not be checked case-sentive

Key | REST | Format | CND | Description |

|---|---|---|---|---|

| "merchantId": "..." | ans..30 | M | MerchantID, assigned by Computop | |

| PayID | "paymentId": "..." | an32 | M | ID assigned by Paygate for the payment, e.g. for referencing in batch files as well as for capture or credit request. |

| XID | "xId": "..." | an32 | M | ID for all single transactions (authorisation, capture, credit note) for one payment assigned by Paygate |

| Code | "code": ... | n8 | M | Error code according to Paygate Response Codes (A4 Error codes) |

| Description | "description": "..." | ans..1024 | M | Further details in the event that payment is rejected. Please do not use the Description but the Code parameter for the transaction status analysis! |

TransID | "transactionId": "..." | ans..64 | M | Merchant’s transaction number. Please note for some connections the different formats that are given within the specific parameters. |

Status | a..50 | M | OK or FAILED | |

RefNr | "referenceNumber": "..." | an..25 | OC | Merchant’s unique reference number, which serves as payout reference in the acquirer EPA file. Please note, without the own shop reference delivery you cannot read out the EPA transaction and regarding the additional Computop settlement file (CTSF) we cannot add the additional payment data. Only for Card Complete, for Clearhaus (ans..30, only printable ASCII characters from 0x20 to 0x7E), for MasaPay (ns..30). Only ASCII characters allowed, special characters ("Umlaute", diacritics) are not allowed and must be replaced by their ASCII-representation (e.g. ü → ue, é → e, ...). |

AID | "authorizationId": "..." | n6 | OC | Only in the case of Card Complete: Authorisation ID returned by Card Complete |

CodeExt | "externalErrorCode": "..." | n5 | OC | Only with Clearhaus: Only if configured: External error code (downstream system) Only with MasaPay: Format ans..10, error code from MasaPay |

ErrorText | "errorText": "..." | ans.128 | OC | Only with Clearhaus: Detailed Clearhaus error message. Only with MasaPay: Format ans..128, detailed MasaPay error message. Is returned only if Status=FAILED. Use is possible only in agreement with Computop Helpdesk |

TransactionID | "clearhausTransactionId": "..." | ans36 | OC | Only with Clearhaus: Transaction number from Clearhaus |

Response parameters for reversals of credit card payments

Reversal of an authorisation extension

A credit card authorisation is valid for only 7 to 30 days. In order to maintain your payment claim in the case of longer delivery times, Paygate enables the automatic renewal of the authorisation. Renewal of the authorisation is also important for instalments or partial deliveries because the outstanding amount is invalid in the case of partial captures.

If you use authorisation renewal, Paygate renews your authorisations until the payment has been captured fully. Amongst other things the customer's card limit is reduced by the authorised amount. In order to restore the card limit again, for example because the order cannot be fully delivered, you need to specifically cancel the authorisation renewal with the following URL:

https://www.computop-paygate.com/cancelAuth.aspx |

Notice: CancelAuth cancels only the recurrence of the authorisation. If you wish to unblock the customer's card limit, please reverse the authorisation in accordance with the section above.

Notice: For security reasons, Computop Paygate rejects all payment requests with formatting errors. Therefore, please use the correct data type for each parameter.

The following table describes the encrypted payment request parameters:

Parameters for reversal of an authorisation extension

The following table describes the result parameters with which the Computop Paygate responds to your system

pls. be prepared to receive additional parameters at any time and do not check the order of parameters

the key (e.g. MerchantId, RefNr) should not be checked case-sentive

Result parameters for reversals of an authorisation extension

Credit card payment via POS terminals

To make a credit card payment via a POS terminal (POS: Point of Sale), send the payment request to the following URL:

https://www.computop-paygate.com/stationary.aspx |

Notice: For security reasons, Computop Paygate rejects all payment requests with formatting errors. Therefore, please use the correct data type for each parameter.

The following table describes the encrypted payment request parameters:

Parameters for credit card payments via POS terminals

The following table describes the result parameters with which the Computop Paygate responds to your system

pls. be prepared to receive additional parameters at any time and do not check the order of parameters

the key (e.g. MerchantId, RefNr) should not be checked case-sentive

Response parameters for credit card payments via POS terminals

Reversal of POS credit card payments

To reverse the capture of a credit card payment via a stationary terminal, please use the following URL:

https://www.computop-paygate.com/stationary_rev.aspx |

The following table describes the result parameters with which the Computop Paygate responds to your system

pls. be prepared to receive additional parameters at any time and do not check the order of parameters