- Created by user-faaa9, last modified by Admin on 18. Jun 2021

You are viewing an old version of this page. View the current version.

Compare with Current View Page History

« Previous Version 6 Next »

When requesting card payments via Computop hosted forms the complexity of 3-D Secure is completely removed from the merchant implementation.

From a merchant point of view the sequence itself does not differ between 3DS authenticated and non-authenticated payments though 3DS requires consideration of additional data elements in the request and response.

Notice about Cookie-/Session Handling

Please note that some browsers might block necessary cookies when returning to Your shop. Here you will find additial information and different solution approaches.

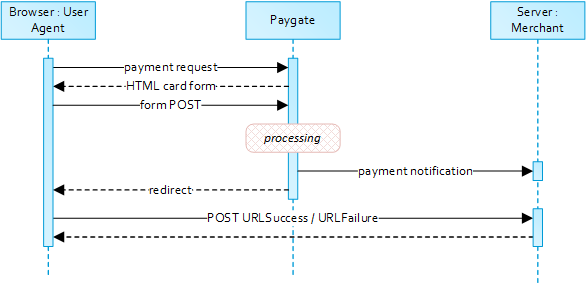

Simplified Sequence Diagram

Payment Request

To retrieve a Computop card form please submit the following data elements via HTTP POST request method to https://www.computop-paygate.com/payssl.aspx.

| Key | Format | Condition | Description | |

|---|---|---|---|---|

| 1 | MerchantID | ans..30 | M | Merchant identifier assigned by Computop. |

| 2 | MsgVer | ans..5 | M | Message version. Values accepted

|

| 3 | TransID | ans..64 | M | Transaction identifier supplied by the merchant. Shall be unique for each payment. |

| 4 | RefNr | ans..30 | O | Merchant’s unique reference number, which serves as payout reference in the acquirer EPA file. Please note, without the own shop reference delivery you cannot read out the EPA transaction and regarding the additional Computop settlement file (CTSF) we cannot add the additional payment data. |

| 5 | Amount | n..10 | M | Transaction amount in it smallest unit of the submission currency. |

| 6 | Currency | a3 | M | ISO 4217 three-letter currency code. |

| 7 | Capture | ans..6 | O | Determines the type and time of payment completion (i.e. dual message systems). Values accepted:

|

| 8 | ans..22 | O | A descriptor to be printed on a cardholder’s statement. Please also refer to the additional comments made elswhere for more information about rules and regulations. | |

| 9 | OrderDesc | ans..768 | O | Order description. |

| 10 | a3 | O | Indicator to request an account verification (aka zero value authorization). If an account verification is requested the submitted amount will be optional and ignored for the actual payment transaction (e.g. authorization). Values accepted

| |

| 11 | JSON | O | Object specifying authentication policies and excemption handling strategies. | |

| 12 | JSON | O | Prior Transaction Authentication Information contains optional information about a 3DS cardholder authentication that occurred prior to the current transaction. | |

| 13 | JSON | O | The account information contains optional information about the customer account with the merchant. | |

| 14 | JSON | C | The customer that is getting billed for the goods and / or services. Required for EMV 3DS unless market or regional mandate restricts sending this information. | |

| 15 | JSON | C | The customer that the goods and / or services are sent to. Required if different from billToCustomer. | |

| 16 | JSON | C | Billing address. Required for EMV 3DS (if available) unless market or regional mandate restricts sending this information. | |

| 17 | JSON | C | Shipping address. If different from billingAddress, required for EMV 3DS (if available) unless market or regional mandate restricts sending this information. | |

| 18 | JSON | C | Object specifying type and series of transactions using payment account credentials (e.g. account number or payment token) that is stored by a merchant to process future purchases for a customer. Required if applicable. | |

| 19 | JSON | O | The Merchant Risk Indicator contains optional information about the specific purchase by the customer. If no | |

| 20 | subMerchantPF | JSON | O | Object specifying SubMerchant (Payment Facilitator) details. |

| 21 | URLNotify | an..256 | M | A FQDN URL to submit the final payment result (HTTP POST). The URL may be called up only via port 443. This URL may not contain parameters: In order to exchange values between Paygate and shop, please use the parameter UserData. |

| 22 | URLSuccess | an..256 | M | A FQDN URL for redirection of the client in case the payment was processed succefully (HTTP POST). The URL may be called up only via port 443. This URL may not contain parameters: In order to exchange values between Paygate and shop, please use the parameter UserData. |

| 23 | URLFailure | an..256 | M | A FQDN URL for redirection of the client in case the payment could not be processed succefully (HTTP POST). The URL may be called up only via port 443. This URL may not contain parameters: In order to exchange values between Paygate and shop, please use the parameter UserData. |

| 24 | UserData | ans..1024 | O | If specified at request, Paygate forwards the parameter with the payment result to the shop |

| 25 | MAC | an64 | M | Hash Message Authentication Code (HMAC) with SHA-256 algorithm |

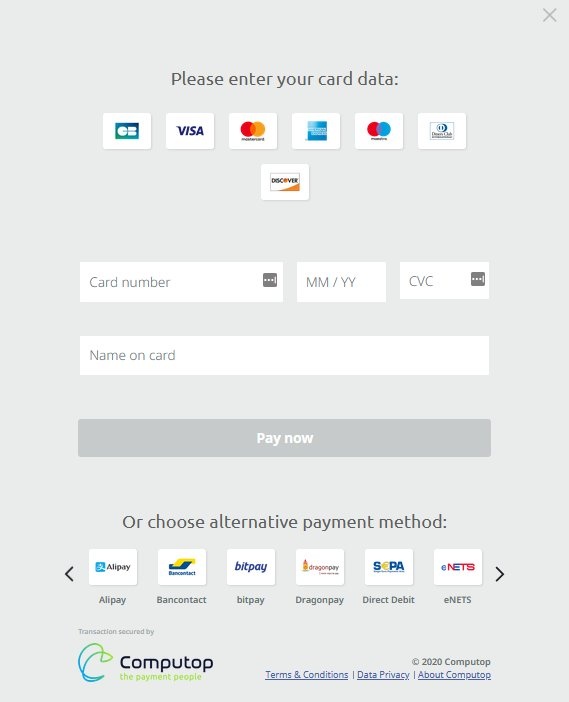

Computop Paygate will return an HTML document in the response body representing the requested card form. The form may be included in the merchant checkout page or used as a standalone page to redirect the cardholder to.

Cardholder authentication and payment authorization will take place once the the cardholder entered all required card details and submitted the form data to Computop Paygate.

Note: In case you are using your own templates (Corporate Payment Page), please make sure you include Cardholder name on your custom template. Cardholder name is mapped to Paygate API parameter "CreditCardHolder". Cardholder name field must not contain any special characters and must have minimal length of 2 characters and maximum length of 45 characters.

When the payment is completed Computop Paygate will send a notification to the merchant server (i.e. URLNotify) and redirect the browser to the URLSuccess resepctively to the URLFailure.

The blowfish encrypted data elements as listed in the following table are transferred via HTTP POST request method to the URLNotify and URLSuccess/URLFailure.

HTTP POST to URLSuccess / URLFailure / URLNotify

| Key | Format | Condition | Description |

|---|---|---|---|

MID | ans..30 | M | Merchant identifier assigned by Computop. |

MsgVer | ans..5 | M | Message version. Accepted values:

|

PayID | ans32 | M | Payment/transaction identifier assigned by Computop. |

XID | ans64 | M | ID assigned by Paygate for the operation performed on the payment. |

TransID | ans..64 | M | Transaction identifier supplied by the merchant. Shall be unique for each payment. |

schemeReferenceID | ans..64 | C | Card scheme specific transaction ID required for subsequent credential-on-file payments, delayed authorizations and resubmssions. |

| Status | a..20 | M | Staus of the transaction. Values accepted:

In case of Authentication-only the Status will be either |

| Description | ans..1024 | M | Textual description of the code. |

| Code | n8 | M | Paygate response code. |

| card | JSON | M | Card response data. |

| ipInfo | JSON | C | Object containing IP information. Presence depends on the configuration for the merchant. |

| threeDSData | JSON | M | Authentication data. |

| resultsResponse | JSON | C | In case the authentication process included a cardholder challenge additional information about the challenge result will be provided. |

| UserData | ans..1024 | C | If specified at request, Paygate forwards the parameter with the payment result to the shop |

| MAC | an64 | M | Hash Message Authentication Code (HMAC) with SHA-256 algorithm |

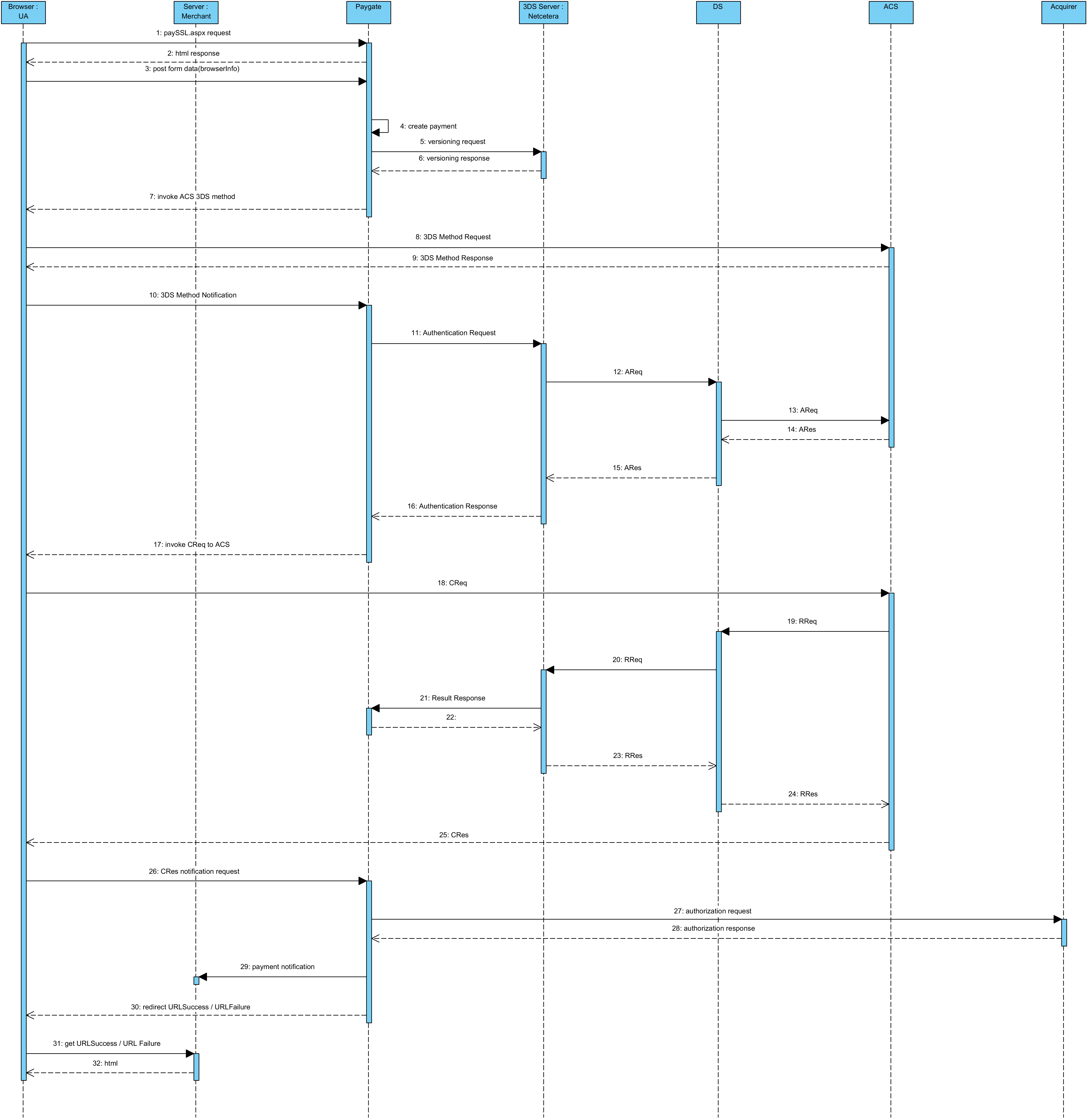

Extended Sequence Diagram

- No labels