Overview

A Silent Order Post or Direct Post is a transmission method where form data from a merchant website are getting directly posted to a third-party server. This is commonly achieved through the form action attribute that specifies the URL the data are sent to.

Sensitive data such as card details can be captured within a merchant’s website without being processed by the merchant server as the POST is submitted silently. The URL endpoint in Computop Paygate to receive Silent Order Post requests is referred to as PayNow.

<form action="../payNow.aspx" method="post">

This approach is very similar to Computop hosted payment forms and leaves the merchant in full control of the checkout experience as all website elements are delivered from the merchant’s server.

PCI-DSS Considerations

Merchants processing card transactions using the Silent Post model must submit the PCI DSS Self-Assessment Questionnaire (SAQ) A-EP. This SAQ is more comprehensive and thus might require more time and resources in comparison to SAQ A applicable to merchants that use hosted payment pages. However, merchants should always consult with their acquirer to evaluate the level of compliance required and refer to the PCI DSS guidelines. This does not affect the use of pseudo card numbers which is possible without submitting the SAQ questionaire.

Notice about Cookie-/Session Handling

Please note that some browsers might block necessary cookies when returning to Your shop. Here you will find additial information and different solution approaches.

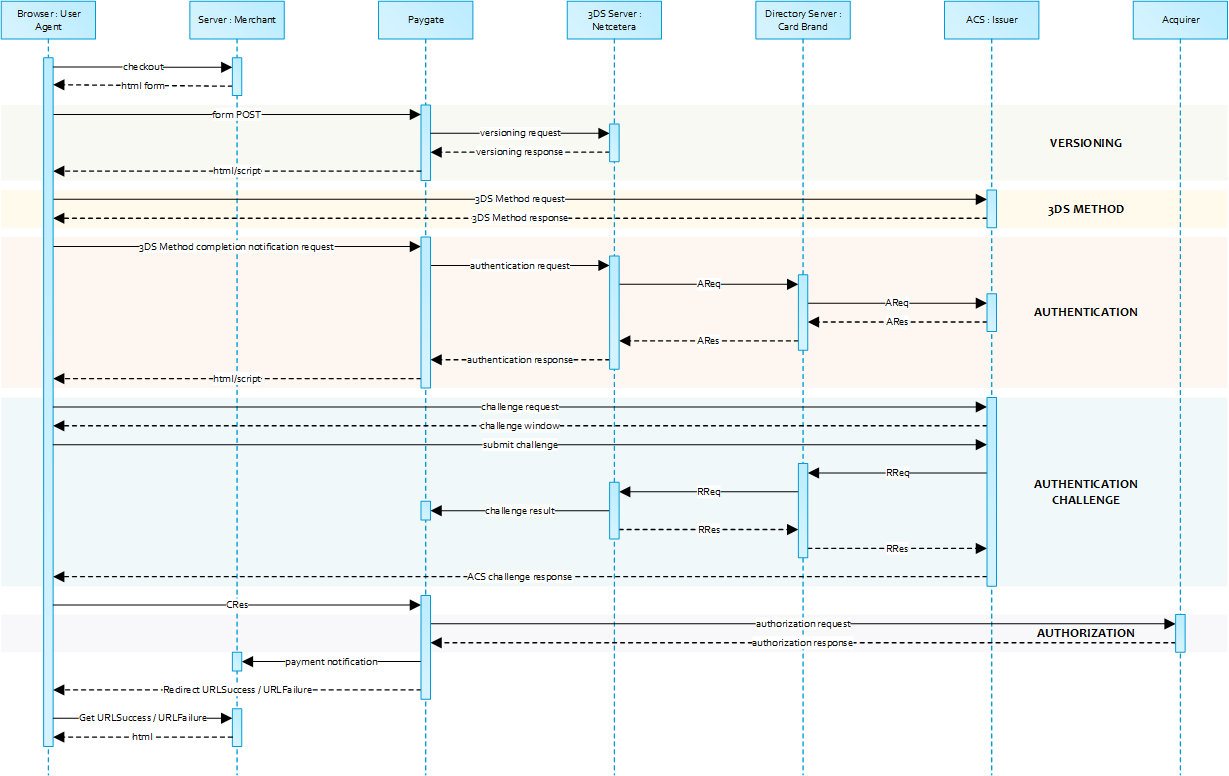

Sequence Diagram

Payment Request

Please POST the form data as outlined in table below to https://www.computop-paygate.com/payNow.aspx.

Form Elements

| Data Element | Legacy Element | Description | |

|---|---|---|---|

| 1 | MerchantID | -- | Merchant identifier assigned by Computop. |

| 2 | Len | -- | The length of the original encrypted with Blowfish. |

| 3 | Data | -- | Blowfish encrypted data. |

| 4 | number | CCNr | Card number. |

| 5 | securityCode | CCCVC | Card security value. |

| 6 | expiryDate | CCExpiry | Card expiry in format YYYYMM. |

| 7 | brand | CCBrand | Card network. |

| 8 | cardholder | CreditCardHolder | Name of the cardholder as printed on the card. |

(- Computop will continue to support the legacy form data fields that are currently in use. -)

Data

| Key | Format | Condition | Description | |

|---|---|---|---|---|

| 1 | MerchantID | ans..30 | M | Merchant identifier assigned by Computop. |

| 2 | MsgVer | ans..5 | M | Message version. Accepted values:

|

| 3 | TransID | ans..64 | M | Transaction identifier supplied by the merchant. Shall be unique for each payment. |

| 4 | RefNr | ans..30 | O | Merchant’s unique reference number, which serves as payout reference in the acquirer EPA file. Please note, without the own shop reference delivery you cannot read out the EPA transaction and regarding the additional Computop settlement file (CTSF) we cannot add the additional payment data. |

| 5 | Amount | n..10 | M | Transaction amount in it smallest unit of the submission currency. |

| 6 | Currency | a3 | M | ISO 4217 three-letter currency code. |

| 7 | Capture | ans..6 | O | Determines the type and time of payment completion (i.e. dual message systems). Values accepted:

|

| 8 | ans..22 | O | A descriptor to be printed on a cardholder’s statement. Please also refer to the additional comments made elswhere for more information about rules and regulations. | |

| 9 | OrderDesc | ans..768 | O | Order description. |

| 10 | a3 | O | Indicator to request an account verification (aka zero value authorization). If an account verification is requested the submitted amount will be optional and ignored for the actual payment transaction (e.g. authorization). Values accepted:

| |

| 11 | JSON | O | Object specifying authentication policies and excemption handling strategies. | |

| 12 | JSON | O | Prior Transaction Authentication Information contains optional information about a 3DS cardholder authentication that occurred prior to the current transaction. | |

| 13 | JSON | M | Accurate browser information are needed to deliver an optimized user experience. Required for 3DS 2.0 transactions. | |

| 14 | JSON | O | The account information contains optional information about the customer account with the merchant. | |

| 15 | JSON | C | The customer that is getting billed for the goods and / or services. Required unless market or regional mandate restricts sending this information. | |

| 16 | JSON | C | The customer that the goods and / or services are sent to. Required if different from billToCustomer. | |

| 17 | JSON | C | Billing address. Required (if available) unless market or regional mandate restricts sending this information. | |

| 18 | JSON | C | Shipping address. If different from billingAddress, required (if available) unless market or regional mandate restricts sending this information. | |

| 19 | JSON | C | Object specifying type and series of transactions using payment account credentials (e.g. account number or payment token) that is stored by a merchant to process future purchases for a customer. Required if applicable. | |

| 20 | JSON | O | The Merchant Risk Indicator contains optional information about the specific purchase by the customer. If no | |

| 21 | URLNotify | an..256 | M | A FQDN URL to submit the final payment result (HTTP POST). |

| 22 | URLSuccess | an..256 | M | A FQDN URL for redirection of the client in case the payment could not be processed succefully (HTTP POST). |

| 23 | URLFailure | an..256 | M | A FQDN URL for redirection of the client in case the payment could not be processed succefully (HTTP POST). |

| 24 | UserData | ans..1024 | O | If specified at request, Paygate forwards the parameter with the payment result to the shop |

| 25 | MAC | an64 | M | Hash Message Authentication Code (HMAC) with SHA-256 algorithm |

Sample HTML Form

<!DOCTYPE html> <html> <head> <title>Merchant Checkout</title> </head> <body> <form name="card form" action="https://www.computop-paygate.com/payNow.aspx" method="post"> <input type="hidden" name="MerchantID" value="MerchantID"> <input type="hidden" name="Len" value="Length of the Blowfish encrypted data"> <input type="hidden" name="Data" value="Blowfish encrypted data"> Cardholder: <input type="text" name="cardholder"><br> Card number: <input type="text" name="number"><br> Expiry date: <input type="text" name="expiryDate"><br> CVV2: <input type="text" name="securityCode"><br> Card brand: <input type="text" name="brand"><br> <input type="submit" value="Submit"> </form> </body> </html>

When the payment is completed Computop Paygate will send a notification to the merchant server (i.e. URLNotify) and redirect the browser to the URLSuccess resepctively to the URLFailure.

The blowfish encrypted data elements as listed in the following table are transferred via HTTP POST request method to the URLNotify and URLSuccess/URLFailure.

HTTP POST to URLSuccess / URLFailure / URLNotify

| Key | Format | Condition | Description | |

|---|---|---|---|---|

| 1 | MID | ans..30 | M | Merchant identifier assigned by Computop. |

| 2 | MsgVer | ans..5 | M | Message version. Accepted values:

|

| 3 | PayID | ans32 | M | Payment/transaction identifier assigned by Computop. |

| 4 | XID | ans64 | M | ID assigned by Paygate for the operation performed on the payment. |

| 5 | TransID | ans..64 | M | Transaction identifier supplied by the merchant. Shall be unique for each payment. |

| 6 | schemeReferenceID | ans..64 | C | Card scheme specific transaction ID required for subsequent credential-on-file payments, delayed authorizations and resubmssions. |

| 7 | Status | a..20 | M | Staus of the transaction. Values accepted:

In case of Authentication-only the Status will be either |

| 8 | Description | ans..1024 | M | Textual description of the code. |

| 9 | Code | n8 | M | Paygate response code. |

| 10 | JSON | M | Card response data. | |

| 11 | JSON | C | Object containing IP information. Presence depends on the configuration for the merchant. | |

| 12 | JSON | M | Authentication data. | |

| 13 | JSON | C | In case the authentication process included a cardholder challenge additional information about the challenge result will be provided. | |

| 14 | UserData | ans..1024 | C | If specified at request, Paygate forwards the parameter with the payment result to the shop |

| 15 | MAC | an64 | M | Hash Message Authentication Code (HMAC) with SHA-256 algorithm |