Terms and Definitions

Terms

Term | Definition | |

|---|---|---|

Transaction | A transaction consists of a number of linked messages. At its simplest a transaction will consist of a minimum of a request message and a response message. | |

Payment | A payment is the equivalent to a transaction in | |

Action | An action is an operation that changes the status of a payment when performed successfully. | |

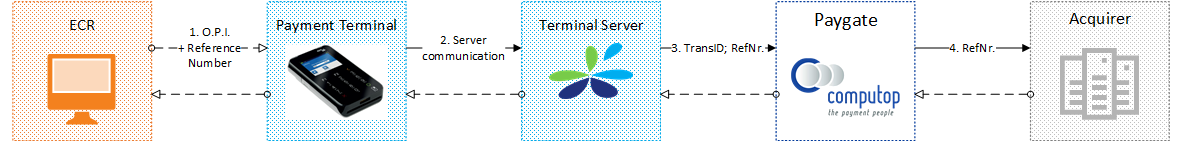

Schematic overview

The following block diagram provides a high level process overview.

|

Process narrative

(1) ECR submits estimated amount and a Reference Number via OPI message protocol to the POI device

(2) POI device performs cardholder authentication, encrypts the PIN block and the PAN with the encryption key and forwards the authorization request via SSL through a central proxy server to CCV acCEPT

(3) CCV acCEPT routes the transaction to via VPN connection

(4) submits authorization request to the acquirer

(5) Authorization result are transferred via notification request

Please note that authorization and notification are two distinct asynchronous processes.

Notification request

will submit a notification request via HTTP POST in order to transfer the authorization status and transaction details to the server URL as stored in the merchant configuration.

The request will be sent in real-time. If no response will retry the notification once after 2 seconds of the first submission. In case that the retry fails Merchant System may actively request the status of the transaction once the system is available again.

| ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Notice: The parameters baseAmount, baseCurrency, and dccRateValue will be only present when DCC was used. In this case the Amount and the Currency parameter correspond to the foreign values. For transaction that have been carried out without DCC the parameter Amount will refer to the amount in the merchant's local currency as given in the parameter Currency.

References

supports two external references, TransID and RefNr. For POS environments the parameter TransID holds a unique identifier from CCV acCEPT. Thus, the merchant may submit a unique reference via RefNr to

.

For reconciliation purposes, maps the parameter RefNr against suitable elements in the corresponding acquirer protocol in order to make sure that values are shown in the electronic merchant statements (e.g. EPA file). As RefNr is an optional element,

automatically reverts to the TransID if RefNr is not given in the request message.

|

Merchant may transfer his Reference Number in the OPI protocol to the acCEPT server. CCV will map this element against the parameter RefNr.

Please note that acquirers do have different size limits for references that can be submitted depending on the message protocol and host capabilities.

| ||||||||||||||||||||||||||||||||||||

Status inquiry

In order to inquire about the status of a payment via a Server-to-Server connection, please use the following URL:

|

|

Parameters for status inquiries via socket connections

| |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Notice: The parameter baseAmount, baseCurrency and dccRateValue will be only present when DCC was used. In this case AmountAuth, AmountCap and AmountCred are given in the cardholder's currency. For transaction that have been carried out without DCC all Amounts refer the merchant's local currency.

Code Listings

Brands

| ||||||||||||||||||||||||||||||||||||||||

Acquirer

| ||||||||||||||||||||||||||||||