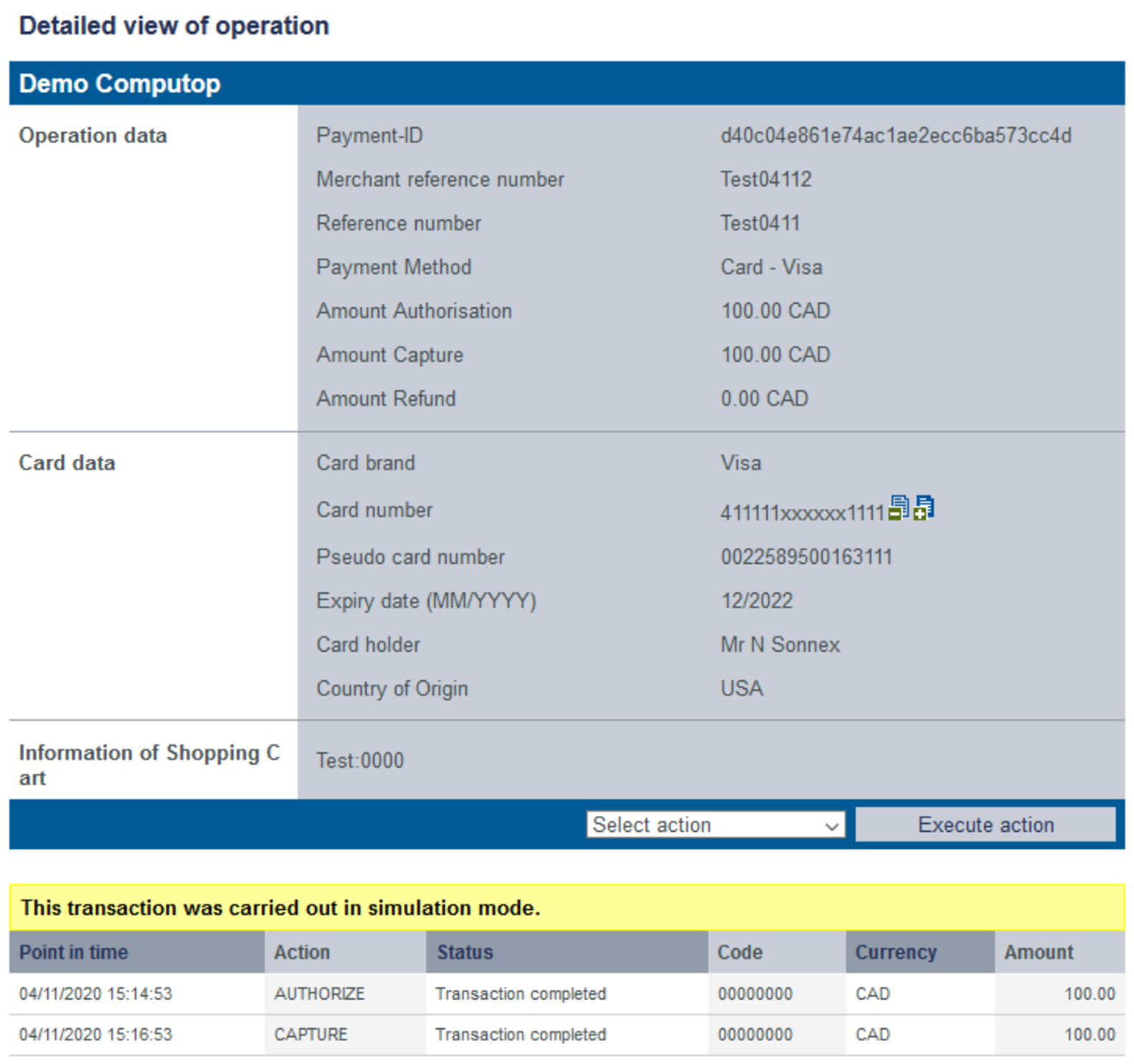

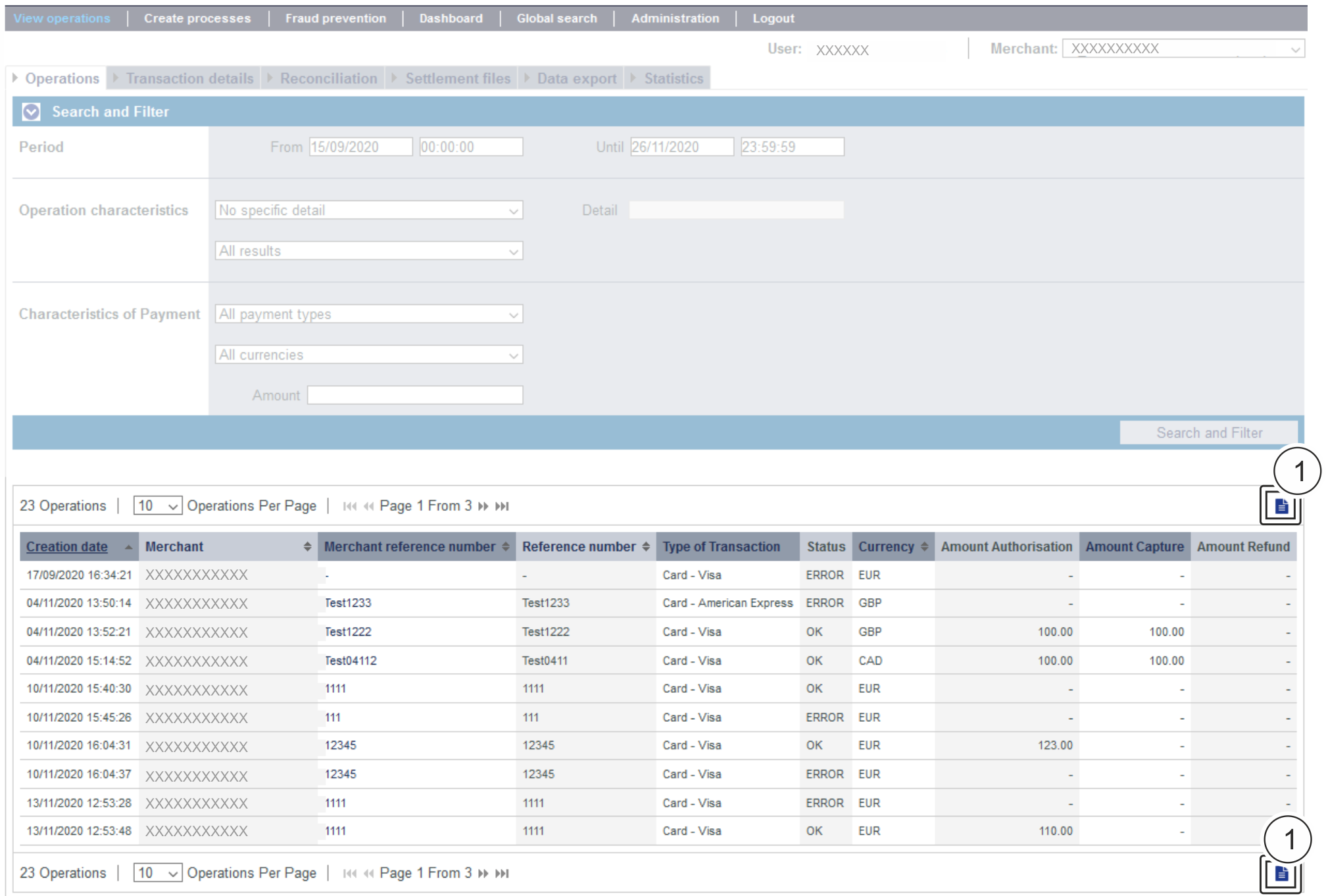

Opening the detailed view of an operationYou can open a detailed view for every operation in the search results. More information about the customer and operation data are shown to you in the detailed view. Moreover, you can add other actions to the operation in the detailed view, such as postings or credits. If an operation was processed using card, account or device data, you can disable these in the detailed view. If you wish to enable the card, account or device data again, you must remove the credit card from the negative list. Proceed as follows to open the detailed view of an operation: - Activate values in the selection fields.

- Click on the "Search and Filter" button.

→ The application verifies the values entered. If the values are invalid, a message showing the reason why will appear in red. If the values are valid, the search results will be shown.

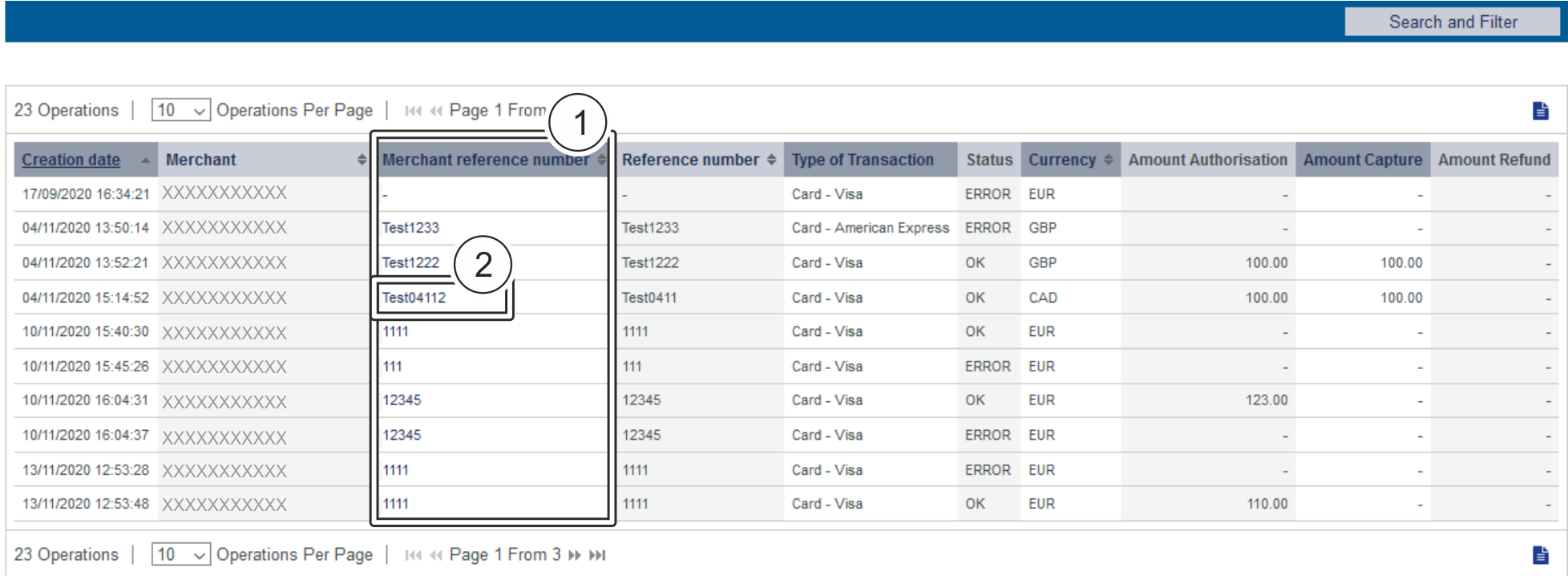

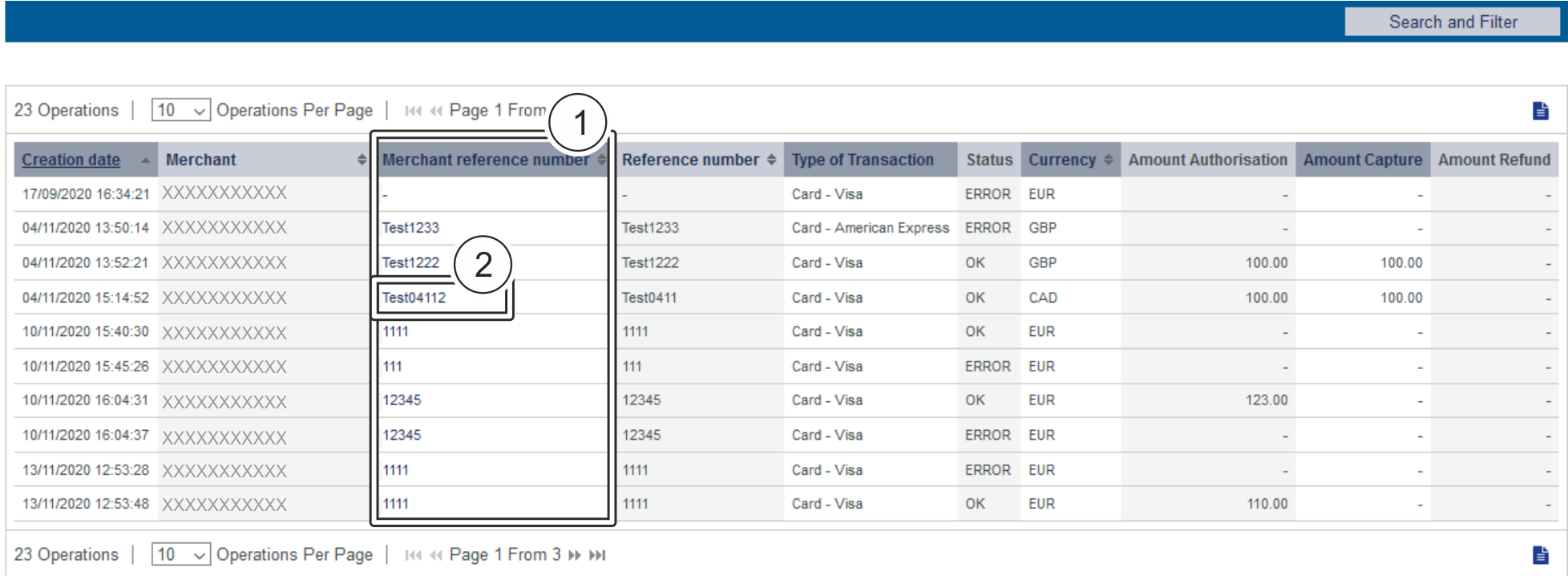

- "Merchant reference number" column

- "Merchant reference number" of an operation

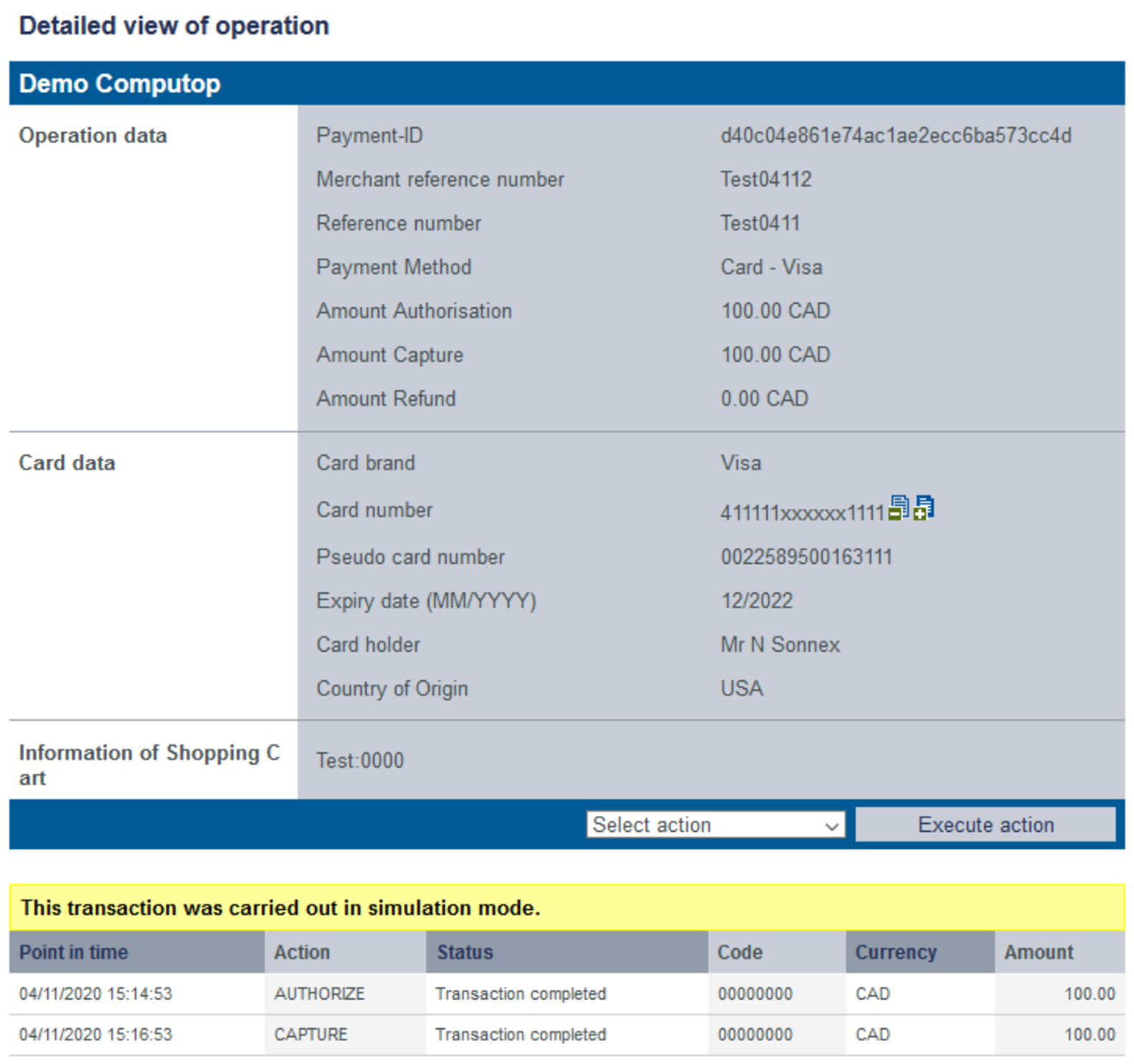

3. Click on the merchant reference number for the required operation in the "Merchant reference number" column. → The detailed view of the operation opens. The detailed view of the operation is divided into fields with the customer and operation data, along with data about postings. If you check the country of origin of the card for purposes of fraud prevention, you will also find the country of origin of the credit card here. Moreover, you can add other actions to the operation in the detailed view.

Details on Action and StatusEach payment process (operation) can include one or more actions. Each action has a status, e.g. indicating success / failure of this status. The actions may vary on your implementation and the paymethod involved. Pls. find a list of most common combinations and their meaning here: | Action | Paymethod (samples) | Description |

|---|

| ORDER | Credit card PayPal | Action "order" indicates that a payment has been initiated, but not yet authorized. | Status | Description |

|---|

Transaction completed | The "order" was initiated successfully | | Request | The "order" has been initiated, but not completed | Other | The "Order" failed, e.g.: - Transaction aborted by user → Transaction has been stopped by consumer.

- Transaction declined → The transaction has been declined by provider.

- Timeout → The consumer did not complete transaction.

|

| | ACCOUNT_VERIFICATION | Credit card | Account-Verification is used with credit cards to check whether this credit card is existing. Technically an authorization with "amount=0" is done, so no money is reserved on the card holders account. | Status | Description |

|---|

| Transaction completed | The transaction has been completed successfully. | | Other | The credit card could not be verified, e.g.: - Invalid card number → credit card number is not valid.

|

| | AUTHENTICATE | Credit card | Authenticate happens with 3-D Secure and means that the card holder has to identify (authenticate) himself. After successful authentication an authorization may be initiated to reserve the money on the card holders account. | Status | Description |

|---|

| REQUEST | Authentication process has been initiated, but not yet completed. | Authentication completed | The card holder proofed his/her identity towards the issuer. | | Other | The "Authentication" failed, e.g.: - Authentication failed → The card holder wasn't able to authenticate successfully, so the authentication failed.

- Connection timed out → The card holder did not complete the authentication.

- Cardholder not enrolled → Card holder is not enrolled to 3-D Secure system.

- RRes receive timeout → Technical time out receiving 3-D Secure response.

|

| | AUTHORIZE | Credit card PayPal Direct Debit Paydirekt | The authorization checks the card holders account and reserves the money for a given period of time. | Status | Description |

|---|

Transaction completed | The authorization was successful, the amount is reserved on the card holders account and can finally be captured (i.e. transferred). | | Other | The "Authorization" has been declined, e.g.: - Authorization declined → issuer/acquirer declined authorization.

- Invalid card number → card number is wrong.

- Shipping country and the card's country of origin do not match → risk setting prevents authorization.

|

| | REVERSEAUTHORIZE |

| The authorization should be reversed and the money should not be reserved on the card holders account any more. | Status | Description |

|---|

| Transaction completed | The authorized amount has been released successfully. | | Other | The "Reverse-Authorization" failed, e.g.: - Referenced transaction not found

|

| | CAPTURE | Credit card PayPal Direct Debit Paydirekt | "Capture" means that money should be transferred from the customer/card holder to the acquirer (and finally to the merchant). Depending on the paymethod and connection a capture can be done one time only or multiple times. | Status | Description |

|---|

Request | The "capture" (i.e. transfer) of the money has been initiated and is waiting for its processing → "capture" is pending. This can be either processed online (i.e. in realtime) or offline (file based - and then normally within 24 hours) - depending on the paymethod and downstream processing. | Transaction completed | The "capture" has been processed, i.e.: transmitted to the acquirer and further to the issuer. | | Other | The "Capture" failed, e.g.: - Declined by issuer → issuer/acquirer declined authorization.

|

| | CREDIT | Credit card PayPal Direct Debit Paydirekt Sofort | "Credit" means the money should be refunded to the customer. Depending on the paymethod and connection a refund can be done one time only or multiple times. | Status | Description |

|---|

Request | The "credit" (i.e. refund) of the money has been initiated and is waiting for its processing. This can be either processed online (i.e. in realtime) or offline (file based - and then normally within 24 hours) - depending on the paymethod and downstream processing. | Transaction completed | The "credit" has been processed, i.e.: transmitted to the acquirer and further to the issuer. | | Other | The "Credit" failed, e.g.: - Amount too high → total amount for "credit" is higher than the amount "captured" so far.

|

| | SALE | Credit card PayPal Paydirekt Sofort

| "Sale" is a combination of "authorization" and "capture". | Status | Description |

|---|

Transaction completed | The "sale" has been processed, i.e.: transmitted to the acquirer. | | Other | The "Sale" has been rejected, e.g.: - Timeout → The consumer did not complete the transaction.

- Declined by the issuer → The issuer declined transaction.

|

|

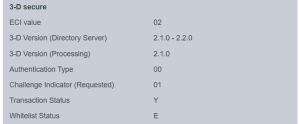

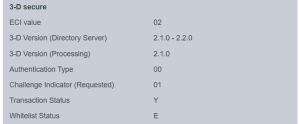

Details on 3-D Secure transactionsFor payments which are authenticated with 3-D Secure you may see details like this:

The values shown above depend on 3-D Secure version used for authentication and the card scheme. Here are some details: ECI valueThe ECI value stands for "Electronic Commerce Indicator" and detailed overview can be found here: ECI Codes. 3-D Version (Directory Server)The Directory Server is managed by the card scheme (Mastercard, VISA, American Express, ...) where each credit card issuer isregistered and can be identified by the BIN (Bank Identication Number). The Directory Server "talks" to the Access Control Server which finally refers to the credit card issuer system. For 3-D Secure processing all parties (scheme, issuer and PSP  ) have to agree on the same 3-D Secure version. ) have to agree on the same 3-D Secure version. 3-D Version (Processing)This is the 3-D Secure version which has been agreed by all parties finally for 3-D Secure authentication. It may happen that a specific issuer is not supporting 3-D Secure (Version 2.1.0, 2.2.0) by now and then automatically a fallback to Version 1.0 will happen. Authentication TypeCurrent supported values for "authentication type" are: | Value | Meaning | Description |

|---|

| 00 | Frictionless | Issuer did not challenge for card holder authentication. | | 01 | Static | Static password is used for card holder authentication. Also used for 3DS1 non frictionless | | 02 | Dynamic | Dynamic password (e.g. token or app) is used for card holder authentication. | | 03 | OOB | OOB stands for "Out Of Band": Users verify transactions in their issuer’s authentication service which can be issuers website or issuers app. | | 04 | Decoupled | Will be supported with 3-D Secure 2.2, intended to support card holder authentication for merchant initiated transactions (MIT). |

Authentication MethodCurrent supported values for "authentication method" are: | Value | Meaning | Description |

|---|

| 01 | Static Passcode | Static password is used for card holder authentication. Also used for 3DS1 non frictionless | | 02 | SMS OTP | Dynamic password (OTP = One Time Password) provided by SMS is used for card holder authentication. | | 03 | Key fob or EMV card reader OTP | Dynamic password (OTP = One Time Password) provided by Key Fob or EMV card reader is used for card holder authentication. | | 04 | App OTP | Dynamic password (OTP = One Time Password) provided by Application is used for card holder authentication. | | 05 | OTP Other | Dynamic password (OTP = One Time Password) provided by "other" is used for card holder authentication. | | 06 | KBA | Knowledge Based Authentication | | 07 | OOB Biometrics | Users verify transactions in their issuer’s authentication service based on Biometrics. | | 08 | OOB Login | Users verify transactions in their issuer’s authentication service based on Login. | | 09 | OOB Other | Users verify transactions in their issuer’s authentication service based on other methods. | | 10 | Other |

| | 11 | Push Confirmation | Authenticates by pushing a push notification to a secure application on the user's device. | | 12 | Decoupled | Authentication without being the cardholder in session | | 13 | WebAuthn | WebAuthn / FIDO | | 14 | SPC | Secure Payment Confirmation, Authentication is handled using a platform authenticator, e.g. Touch ID on a macOS device, Hello on a Windows device | | 15 | Behavioural biometrics | Authenticates users based on patterns in their behavior, e.g. how people type or move. |

Challenge Indicator (Requested)| Value | Meaning | Description |

|---|

| 01 | No preference | No specific challenge indicator requested, default value. | | 02 | No challenge requested | Merchant prefers that no challenge should be performed | | 03 | Challenge requested: 3DS Requestor Preference | Merchant prefers that a challenge should be performed | | 04 | Challenge requested:Mandate | There are local or regional mandates that mean that a challenge must be performed | | 05 | No challenge requested | Transactional risk analysis is already performed | | 06 | No challenge requested | Data share only | | 07 | No challenge requested | Strong consumer authentication is already performed | | 08 | No challenge requested | Utilise whitelist exemption if no challenge required | | 09 | Challenge requested | Whitelist prompt requested if challenge required |

Transaction Status| Value | Meaning | Description |

|---|

| Y | Authentication Verification Successful | Authentication has been completed successfully, i.e. ready for authorisation. It still may happen that the authorisation fails, e.g. due to low account balance. | | N | Not Authenticated /Account Not Verified | Transaction denied | | U | Authentication/ Account Verification Could Not Be Performed | Technical or other problem, as indicated in ARes or RReq | | A | Attempts Processing Performed | Not Authenticated/Verified, but a proof of attempted authentication/verification is provided. | | C | Challenge Required | Additional authentication is required using the CReq/CRes. | | D | Challenge Required | Decoupled Authentication confirmed. | | R | Authentication/ Account Verification Rejected | Issuer is rejecting authentication/verification and request that authorisation not be attempted. | | I | Informational Only | 3DS Requestor (merchant) challenge preference acknowledged. |

Whitelist Status| Value | Meaning |

|---|

| Y | 3DS Requestor (merchant) is whitelisted by cardholder | | N | 3DS Requestor (merchant) is not whitelisted by cardholder | | E | Not eligible as determined by issuer | | P | Pending confirmation by cardholder | | R | Cardholder rejected | | U | Whitelist status unknown, unavailable, or does not apply |

|