Setup with OpenBanking-provider Token.io

As | Multiexcerpt include |

|---|

| SpaceWithExcerpt | EN |

|---|

| MultiExcerptName | Partner-Name |

|---|

| PageWithExcerpt | Wording |

|---|

|

does not have access to your Token.io setup you need to send us the information required for setup in | Multiexcerpt include |

|---|

| SpaceWithExcerpt | EN |

|---|

| MultiExcerptName | Platform-Name |

|---|

| PageWithExcerpt | Wording |

|---|

|

.

You will have access to your Token.io-Dashboard after signing the contract.

Please login into your Token.io dashboard (https://dashboard.token.io/) and send the information to | Multiexcerpt include |

|---|

| SpaceWithExcerpt | EN |

|---|

| MultiExcerptName | Platform-Name |

|---|

| PageWithExcerpt | Wording |

|---|

|

– in clear text, not as a screenshot:

A sample mail to | Multiexcerpt include |

|---|

| SpaceWithExcerpt | EN |

|---|

| MultiExcerptName | Platform-Name |

|---|

| PageWithExcerpt | Wording |

|---|

|

could look like:

| Panel |

|---|

My Token.io setup| Table Filter |

|---|

| hideControls | false |

|---|

| inverse | false |

|---|

| totalrow | ,,,,, |

|---|

| hidelabels | false |

|---|

| sparkName | Sparkline |

|---|

| hidePane | true |

|---|

| disableSave | false |

|---|

| separator | Point (.) |

|---|

| sparkline | false |

|---|

| labels | Hide Columns |

|---|

| default | Kategorie&&Kommentar&&Wert |

|---|

| isFirstTimeEnter | false |

|---|

| cell-width | 150 |

|---|

| hideColumns | true |

|---|

| datepattern | dd M yy |

|---|

| disabled | false |

|---|

| enabledInEditor | false |

|---|

| globalFilter | false |

|---|

| id | 1685014852448_-228874398 |

|---|

| updateSelectOptions | false |

|---|

| worklog | 365|5|8|y w d h m|y w d h m |

|---|

| isOR | AND |

|---|

| order | 0 |

|---|

| | Multiexcerpt |

|---|

| MultiExcerptName | TokenSetup |

|---|

| | Category | Kategorie | Value | Wert | Comment | Kommentar |

|---|

| Account Setting | Kontoeinstellung |

|

|

|

|

|---|

| Company Name | Firmenname | John Doe Limited | Max Mustermann GmbH |

|

| | Member Information | Member Information |

|

|

|

|

|---|

| Member ID | Member ID | m:YCkxxxxxxxxxxxxxxxxxxxxxxxv:5zKtXEAq | m:YCkxxxxxxxxxxxxxxxxxxxxxxxv:5zKtXEAq |

|

| | Alias | Alias | {"type":"DOMAIN","value":"xxxxxxxxxxxxx"} | {"type":"DOMAIN","value":"xxxxxxxxxxxxx"} |

|

| | Public Token Key | Public Token Key | iYCC0wJXDO0Q-Bqqyi49mD_z-_IWqfmlP_jwGWWNKds | iYCC0wJXDO0Q-Bqqyi49mD_z-_IWqfmlP_jwGWWNKds | Should always be this value; Pls. let us know if it's a different one. | Es sollte immer dieser Wert sein; wenn nicht, teilen Sie uns diesen bitte mit. | | Authentication Keys | Authentifizierungsschlüssel |

|

|

|

|

|---|

| API Key | API Key | bS1xxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxzJm | bS1xxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxzJm |

|

| | Beneficiary Information | Informationen zum Begünstigten |

|

|

|

|

|---|

| Beneficiary | Begünstigter | | Account Name | Country | Currency | IBAN / Account Number | BIC / Sort Code |

|---|

| DE01 | Germany | EUR | Your IBAN used as standard | Your BIC used as standard | | DE02 | Germany | EUR | Optional: Another IBAN which could be selected via | Multiexcerpt include |

|---|

| SpaceWithExcerpt | EN |

|---|

| MultiExcerptName | Platform-Kurz |

|---|

| PageWithExcerpt | Wording |

|---|

|

-parameter "Account" | BIC for this IBAN | | UK01 | United Kingdom | GBP | Optional: Your Account Number for UK / FasterPayments | Your Sort Code for UK / FasterPayments |

| | Kontoname | Land | Währung | IBAN / Kontonummer | BIC / Bankleitzahl |

|---|

| DE01 | Deutschland | EUR | Die IBAN, welche standardmäßig verwendet werden soll | Die BIC, welche standardmäßig verwendet werden soll | | DE02 | Deutschland | EUR | Optional: Eine weitere IBAN, welche mit dem | Multiexcerpt include |

|---|

| SpaceWithExcerpt | EN |

|---|

| MultiExcerptName | Platform-Kurz |

|---|

| PageWithExcerpt | Wording |

|---|

|

-Parameter "Account" selektiert werden kann

| BIC für diese IBAN | | UK01 | Vereinigtes Königreich | GBP | Optional: Ihre Kontonummer für UK / FasterPayments | Ihr Sort Code für UK / FasterPayments |

|

|

|

|

|

|

Customization and Testing with OpenBanking-provider Token.io

How a payment looks like

| Multiexcerpt |

|---|

| MultiExcerptName | samplePayment |

|---|

|

| Table Filter |

|---|

| hideControls | false |

|---|

| inverse | false |

|---|

| totalrow | ,,, |

|---|

| hidelabels | false |

|---|

| sparkName | Sparkline |

|---|

| hidePane | true |

|---|

| disableSave | false |

|---|

| separator | Point (.) |

|---|

| sparkline | false |

|---|

| labels | Hide Columns |

|---|

| default | Beschreibung&&German |

|---|

| isFirstTimeEnter | false |

|---|

| cell-width | 150 |

|---|

| hideColumns | true |

|---|

| datepattern | dd M yy |

|---|

| disabled | false |

|---|

| enabledInEditor | false |

|---|

| globalFilter | false |

|---|

| id | 1685444730643_1438657823 |

|---|

| updateSelectOptions | false |

|---|

| worklog | 365|5|8|y w d h m|y w d h m |

|---|

| isOR | AND |

|---|

| order | 0 |

|---|

| | Multiexcerpt |

|---|

| MultiExcerptName | ParameterMapping |

|---|

| | English | Deutsch | Description | Beschreibung |

|---|

| | Static: - Logo is taken from Token.io-Dashboard → Configuration → CSS

- To is from Token.io-Dashboard → Configuration → Display name

Dynamic / from API request: - One-time payment of is taken from API-amount (e.g. amount=123)

- Transaction Ref No is taken from API-RefNr

- Description is taken from API-OrderDesc

Consumer: - selects From to choose consumer bank

- and enters IBAN

- then clicks Accept to login into consumer bank and confirm payment

| Statisch: - Das Logo stammt vom Token.io-Dashboard → Konfiguration → CSS

- Empfänger ist von Token.io-Dashboard → Konfiguration → Anzeigename

Dynamisch / von API-Anfrage: - Einmalzahlung wird vom API-Betrag übernommen (z.B. amount=123)

- Ende-zu-Ende Referenz wird von der API-RefNr genommen

- Verwendungszweck stammt aus API-OrderDesc

Verbraucher: - wählt mittels Von die Bank aus

- gibt die IBAN ein

- und klickt dann auf Zustimmen zur Anmeldung bei der Bank und Bestätigung der Zahlung

|

|

|

|

How to customize your payment / Token.io-account

After signing your contract with the Open Bank Operator (Token.io) you will get access to their dashboard.

There you can set up:

- your user details and company information (e.g. Company name, Billing details, ...)

Settings → Configuration

General

Here the "Display Name" can be changed. This is the recipient shown to the consumer ("To" / "Empfänger"):

| Multiexcerpt |

|---|

| MultiExcerptName | TokenGeneral |

|---|

|

|

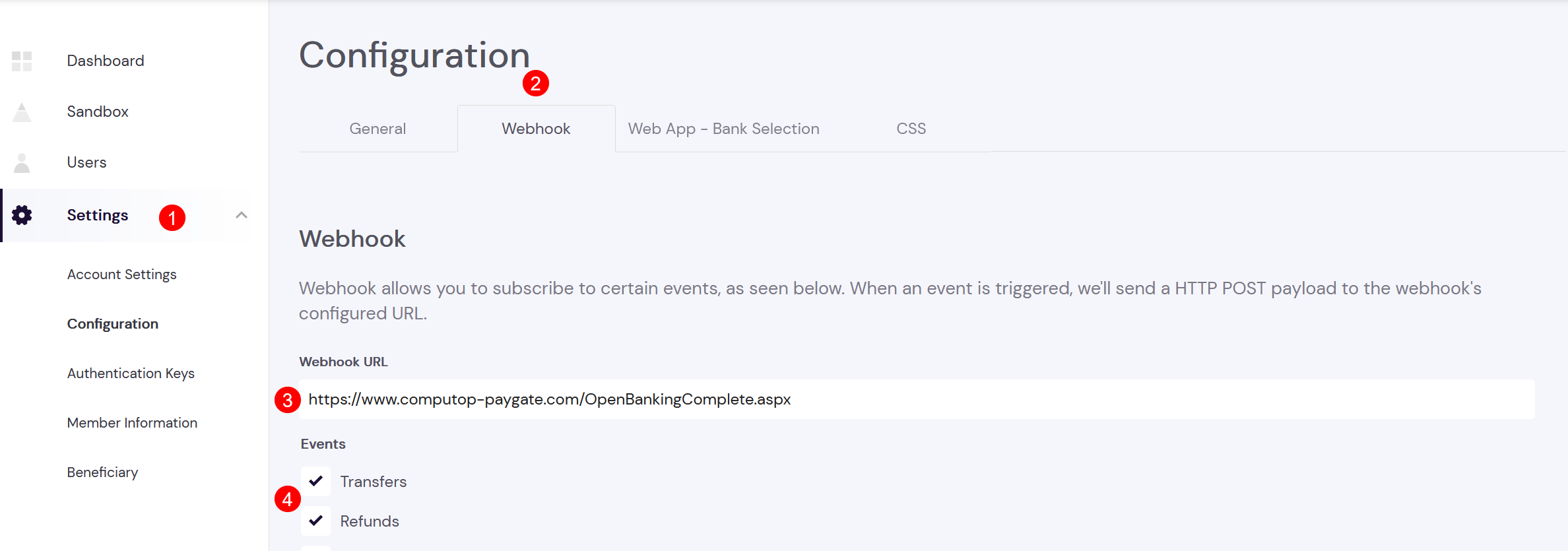

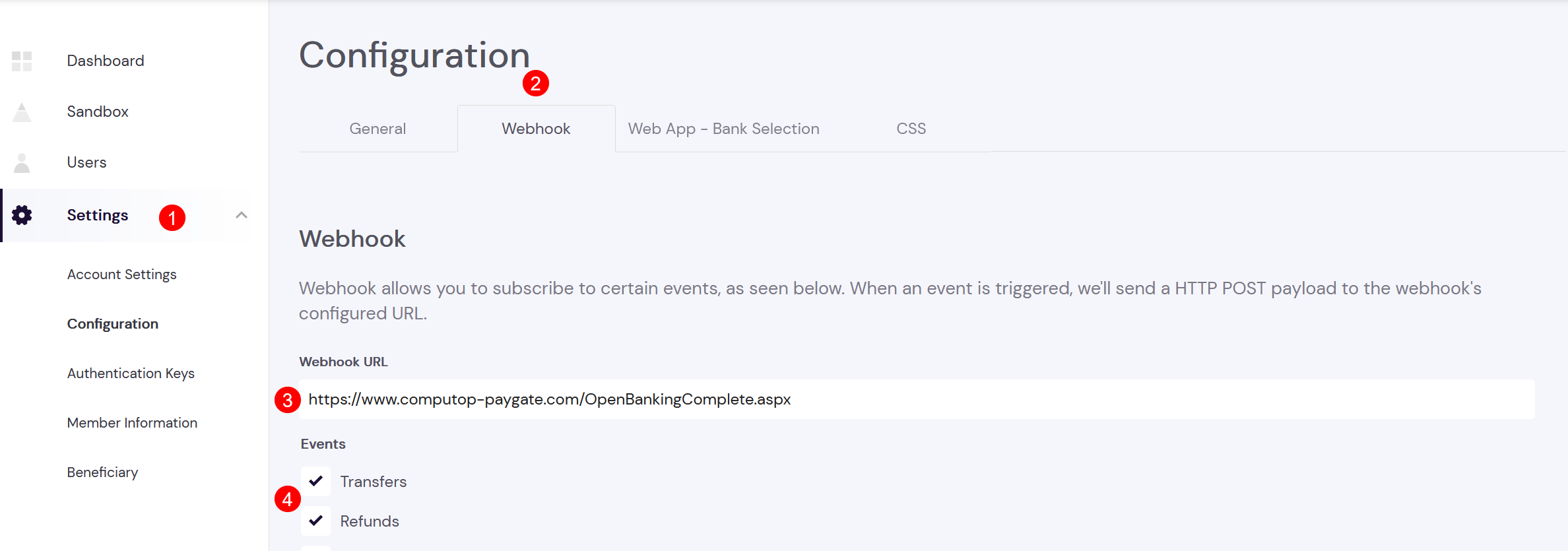

Webhook

Webhook must be set to technical | Multiexcerpt include |

|---|

| SpaceWithExcerpt | EN |

|---|

| MultiExcerptName | Platform-Name |

|---|

| PageWithExcerpt | Wording |

|---|

|

URL: | Multiexcerpt include |

|---|

| SpaceWithExcerpt | EN |

|---|

| MultiExcerptName | BaseURL |

|---|

| PageWithExcerpt | Wording |

|---|

|

/OpenBankingComplete.aspx

| Multiexcerpt |

|---|

| MultiExcerptName | TokenWebhook |

|---|

|

|

Web App Bank Selection

It's possible to limit bank selection for your consumers. It's recommended to allow "Enable all banks". The consumer can then select any supported bank.

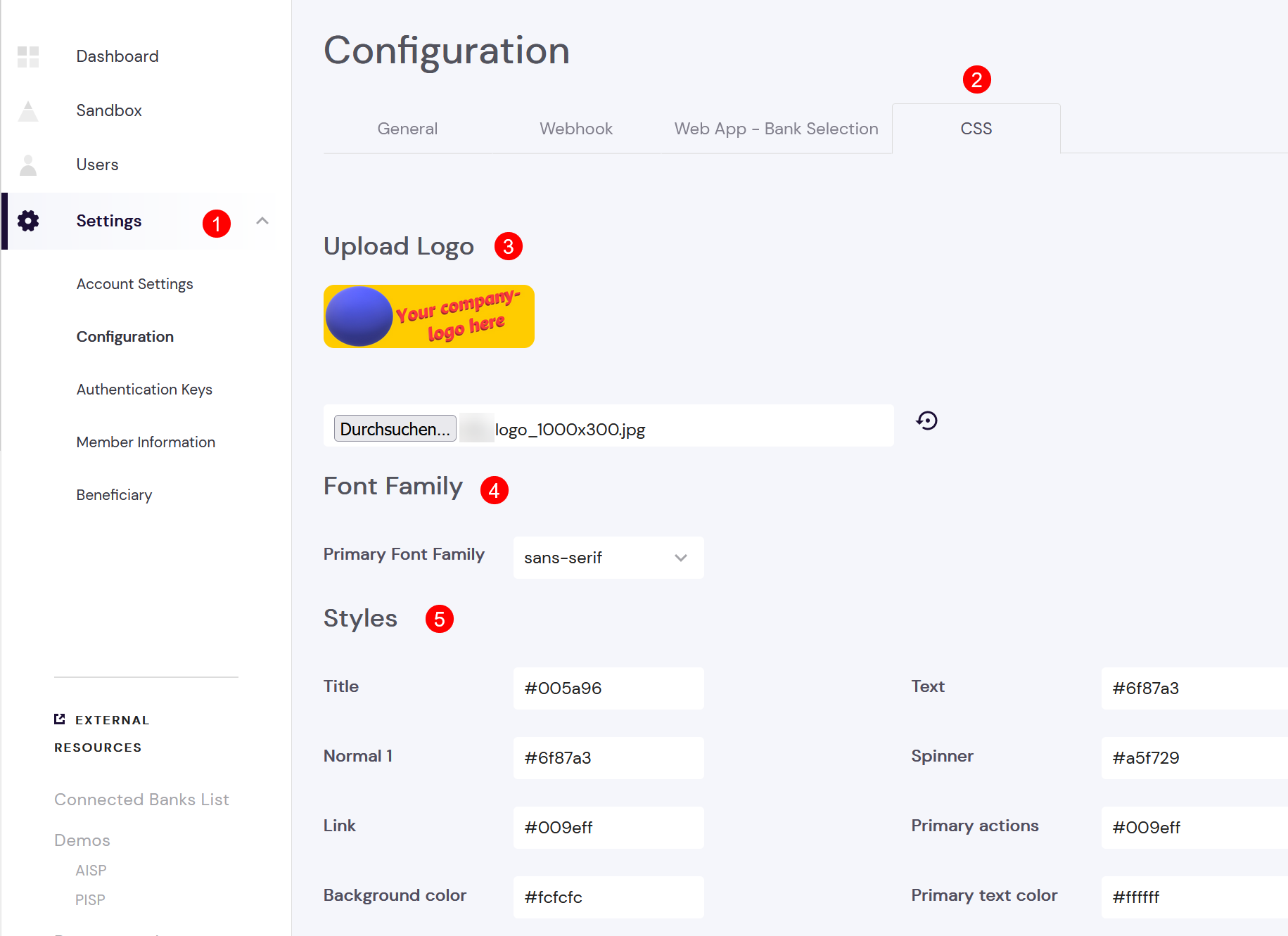

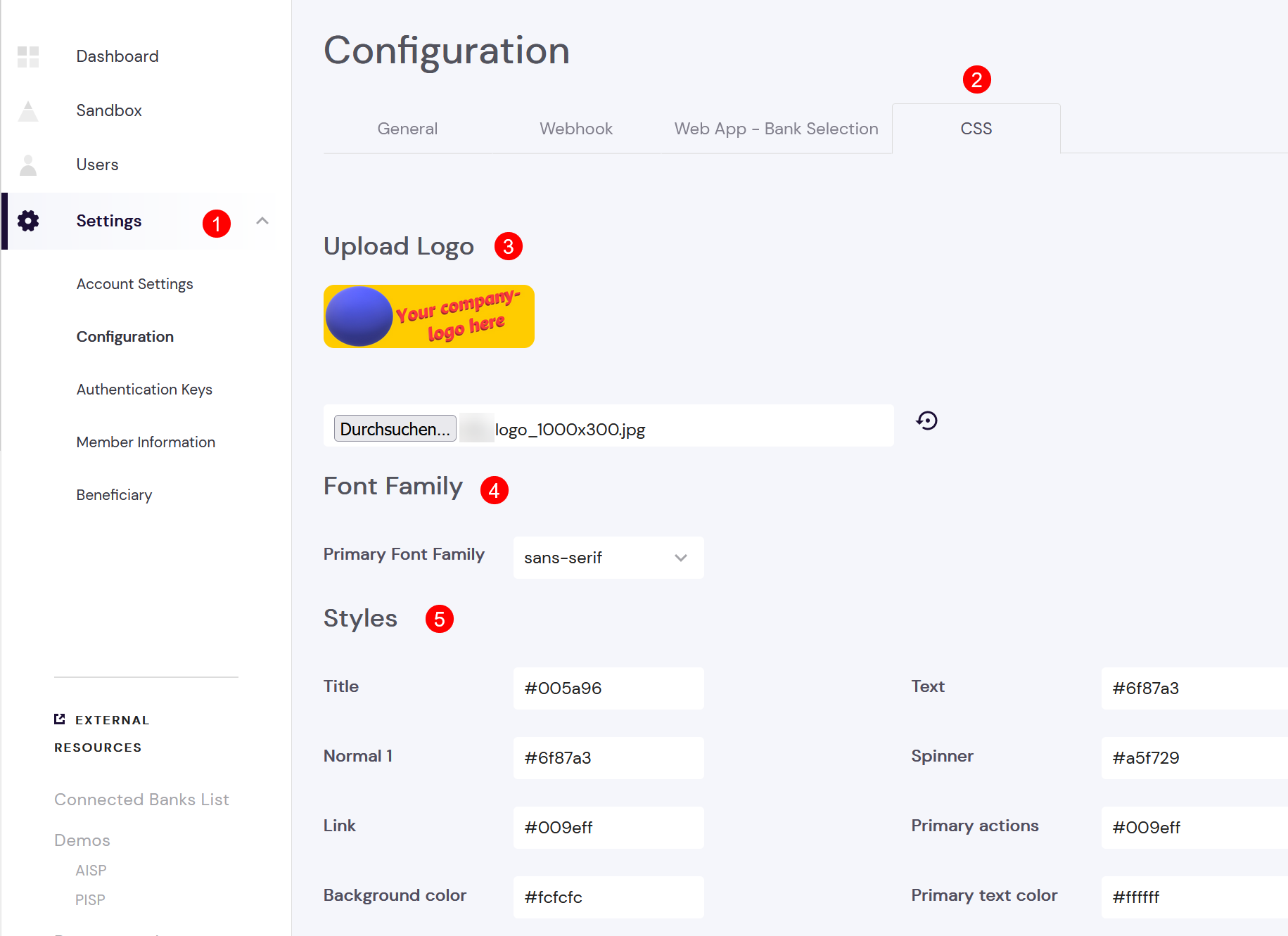

CSS (styling of Token.io Web App (shown to your customer)

It's possible to upload your own merchant logo and customize CSS styling of Web App (shown to consumer):

| Multiexcerpt |

|---|

|

|

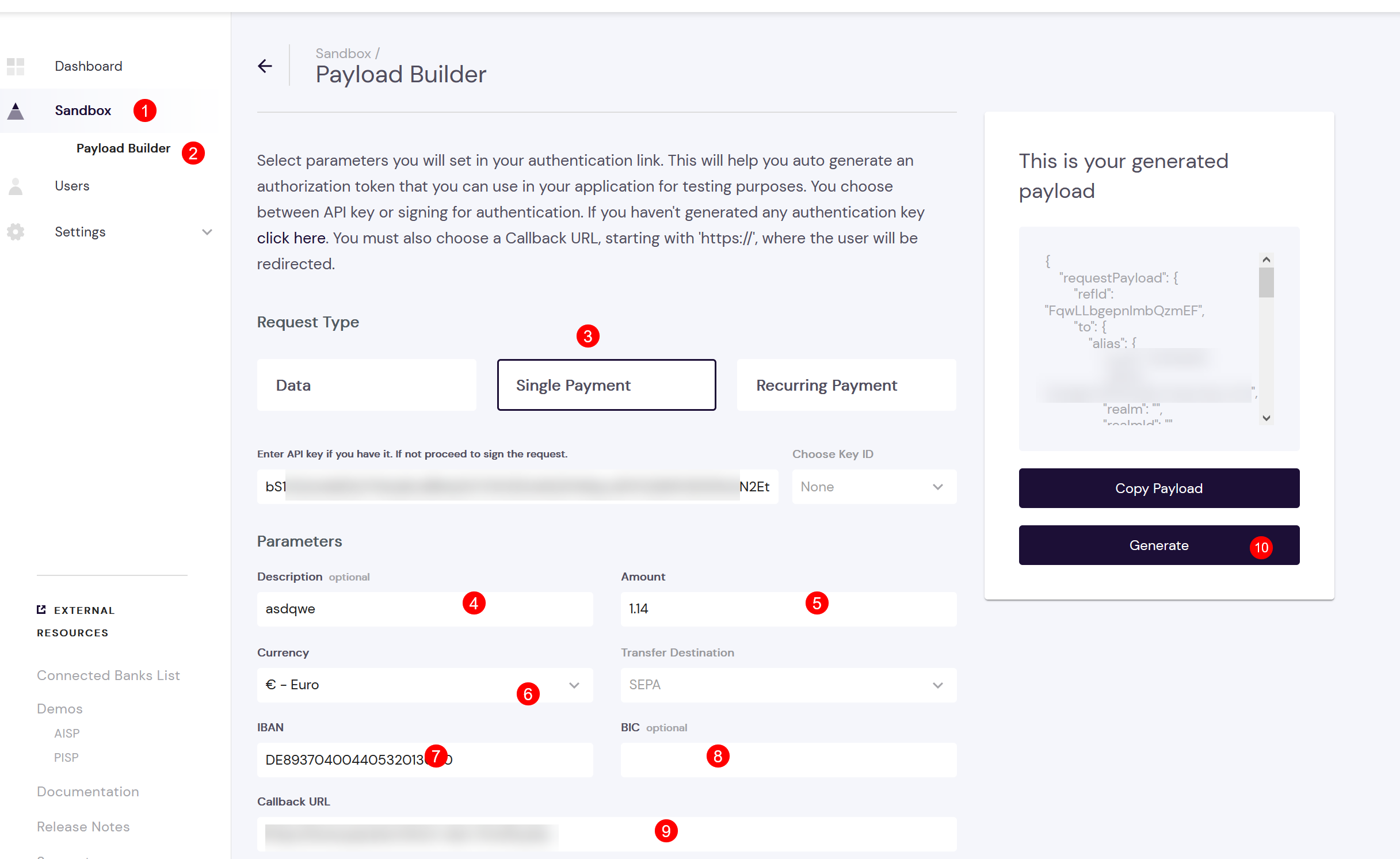

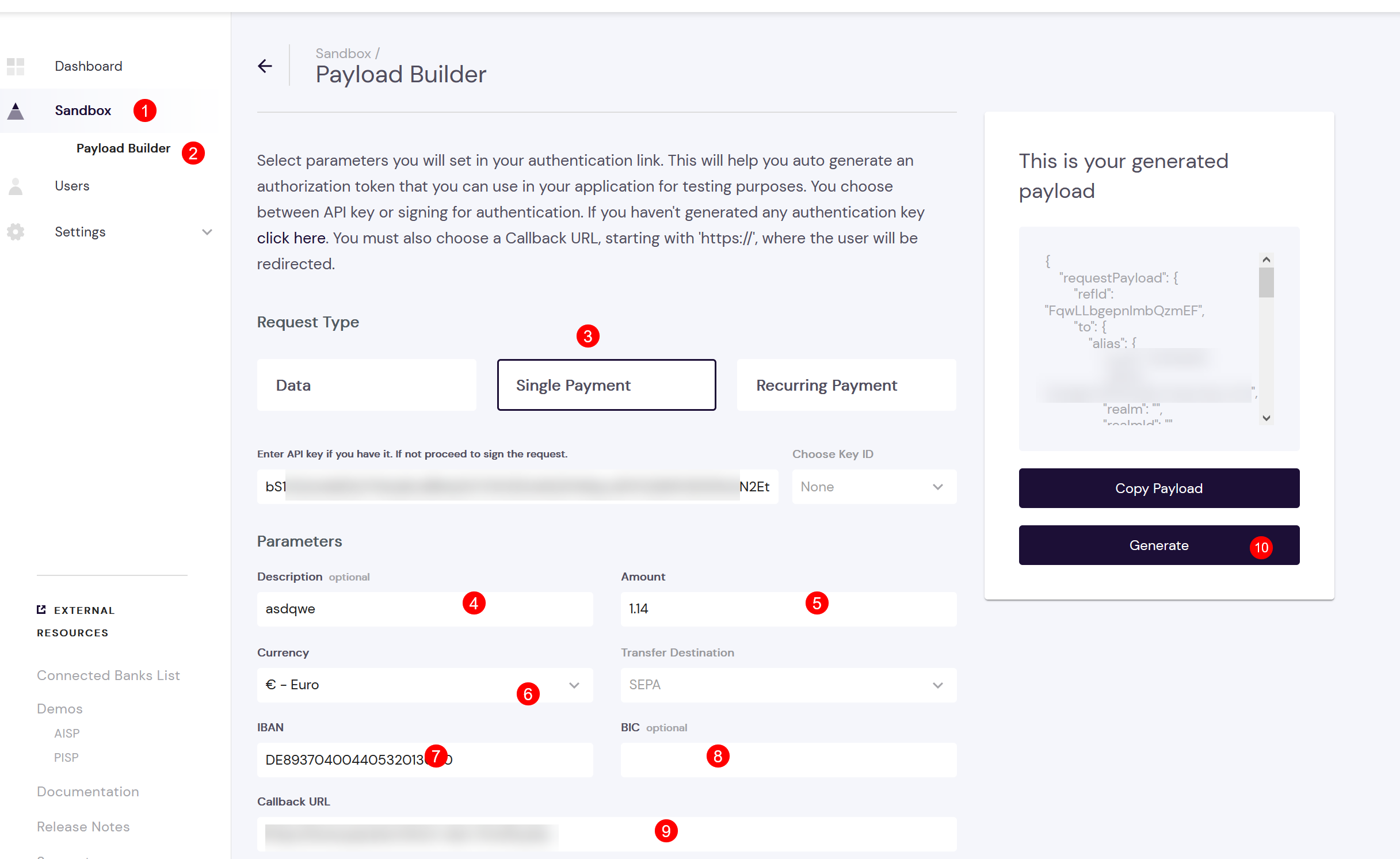

After you've uploaded your merchant logo and customized your CSS styles the new WebApp-layout can be tested via Payload Builder:

| Multiexcerpt |

|---|

| MultiExcerptName | PayloadBuilder |

|---|

|

|

After doing CSS modification a test payment can be initiated to check design:

- API Key and MemberID are automatically set by Payload Builder

- (4) Description must be unique for each payment

- (5) Amount must be used with decimal point

- (6) Currency must be EUR

- (7) IBAN is merchant's IBAN, i.e.: any of your benificiary IBAN

- (8) merchant's BIC is optional → leave empty

- (9) for testing use any Url, e.g. https://www.google.com

- (10) click on "Generate"

Then click on Test (1)

| Multiexcerpt |

|---|

|

|

A new tab/window will open with new design:

| Multiexcerpt |

|---|

| MultiExcerptName | PaymentConfirmation |

|---|

|

|

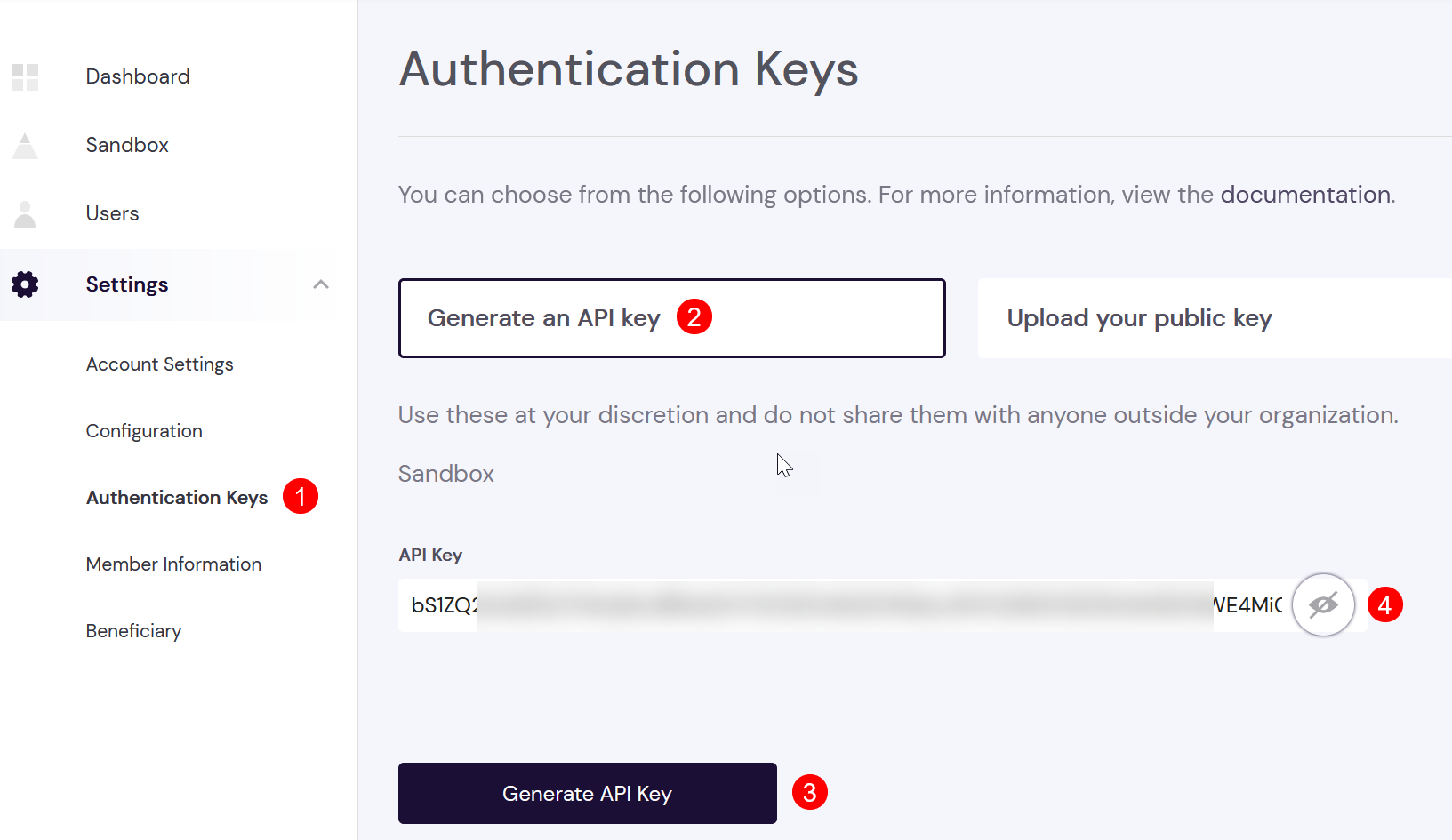

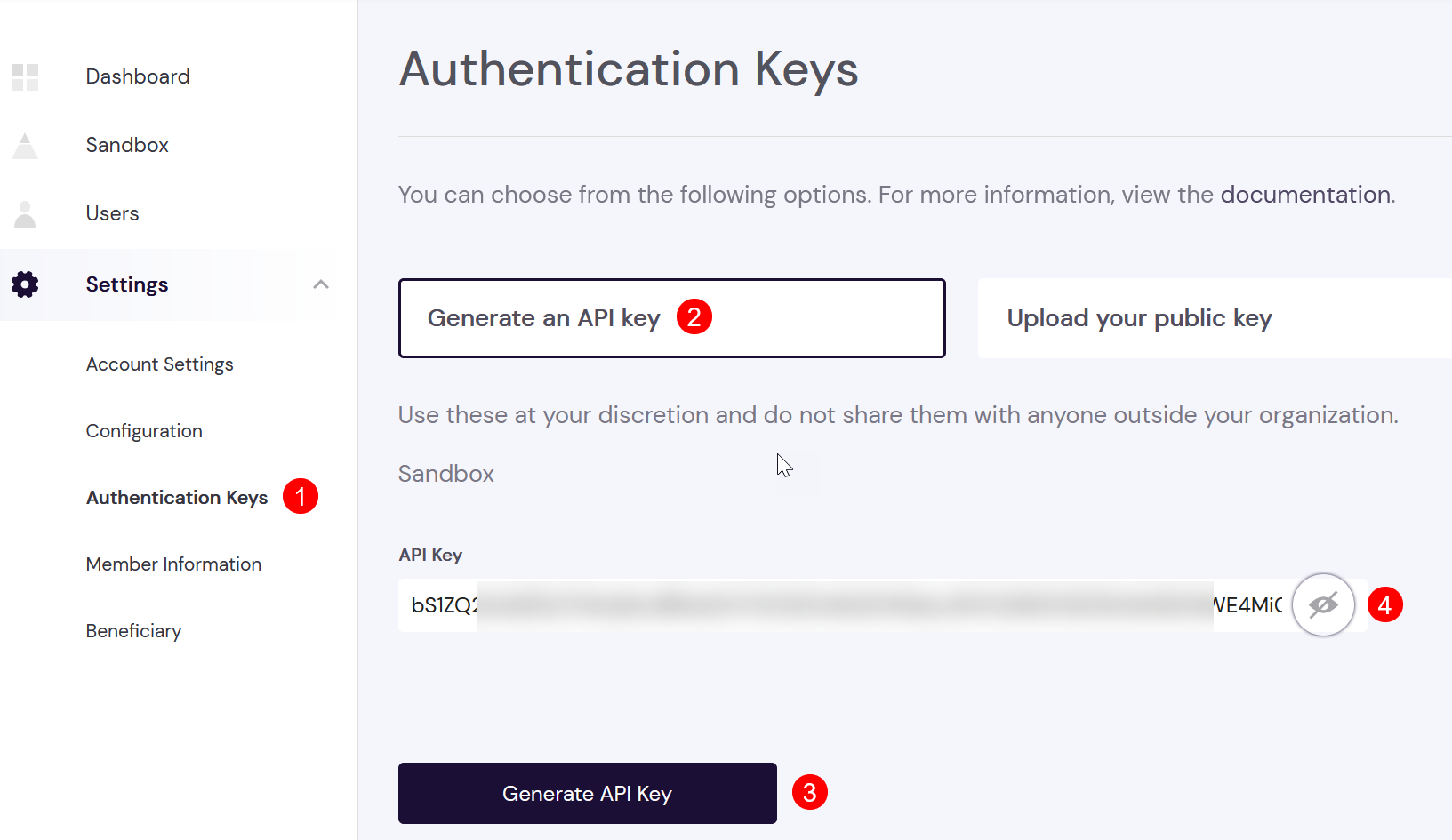

Settings → Authentication Keys

Please generate an API Key for your configuration and send it to | Multiexcerpt include |

|---|

| SpaceWithExcerpt | EN |

|---|

| MultiExcerptName | Helpdesk-Name |

|---|

| PageWithExcerpt | Wording |

|---|

|

:

| Multiexcerpt |

|---|

|

|

We also need your MemberID and other information which is shown in next section.

Settings → Member Information

The information shown here is also needed for setup in | Multiexcerpt include |

|---|

| SpaceWithExcerpt | EN |

|---|

| MultiExcerptName | Platform-Name |

|---|

| PageWithExcerpt | Wording |

|---|

|

:

| Multiexcerpt |

|---|

| MultiExcerptName | TokenKey2 |

|---|

|

|

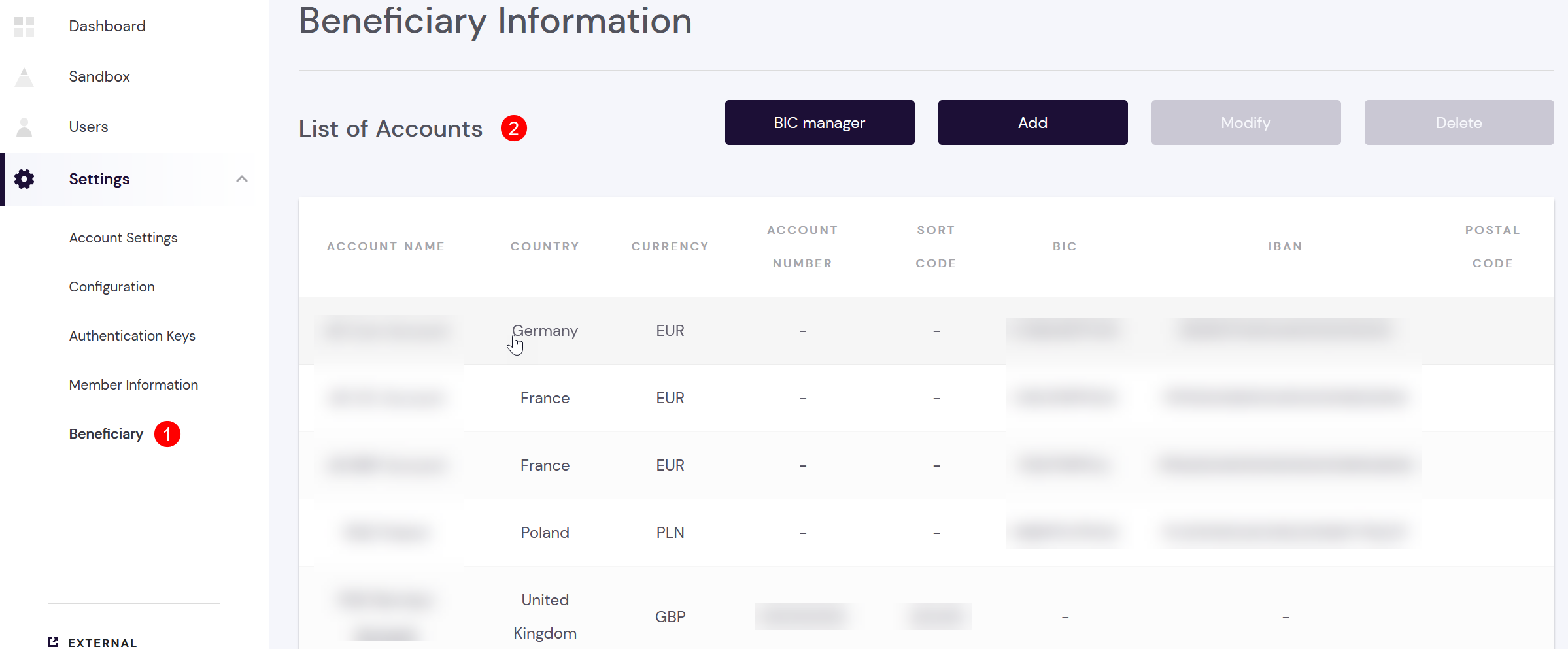

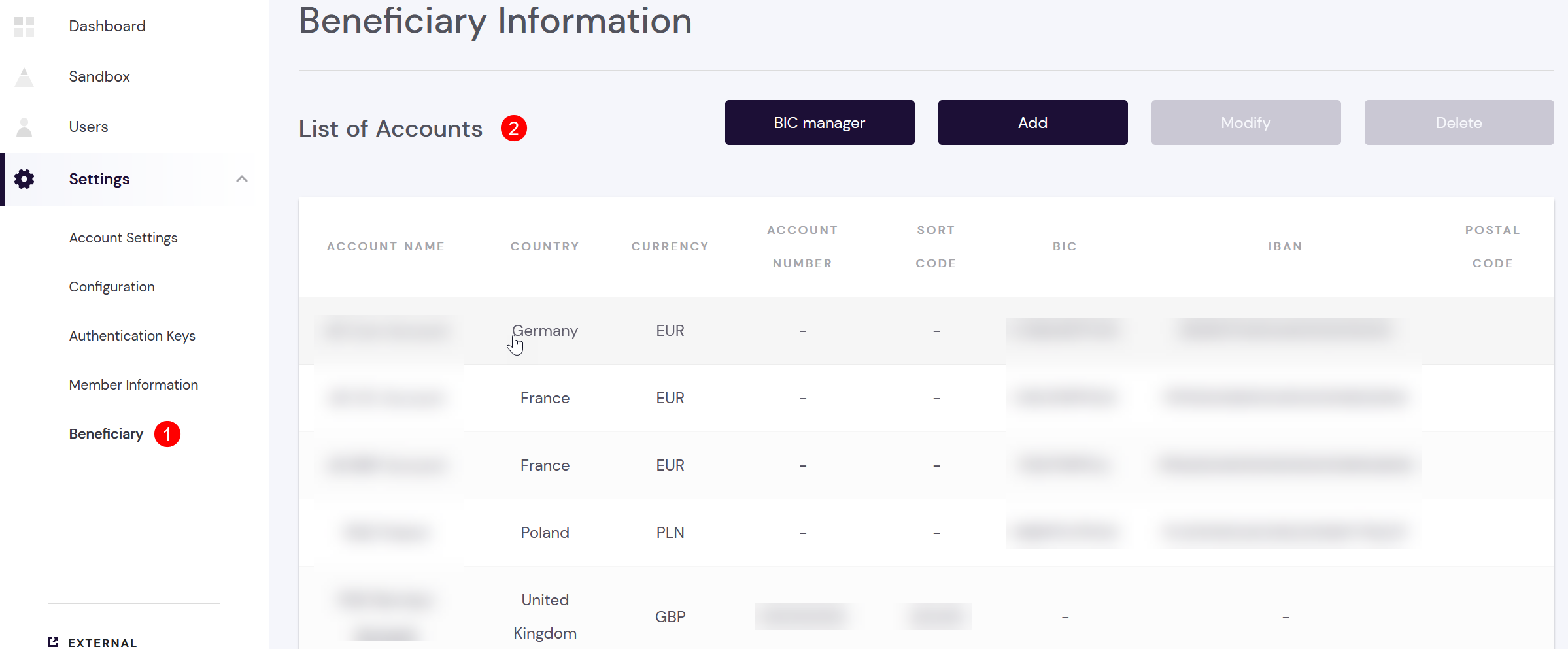

Settings → Beneficiary

Your merchant account may have multiple bank accounts configured. Each bank account can have an account name (assigned by you) and is defined

- either with IBAN/BIC (SEPA based)

- or with Account Number / Sort Code (FasterPayments / UK)

A sample setup may look like this:

| Multiexcerpt |

|---|

| MultiExcerptName | TokenBeneficiary |

|---|

|

|

Testing in Sandbox-mode

As long as your OpenBanking Setup is not setup in Production Mode you can test it in Sandbox Mode.

Therefore please use test data shown here: Test Instant Payment.