How will data transfer look like with 3-D Secure 2.x?

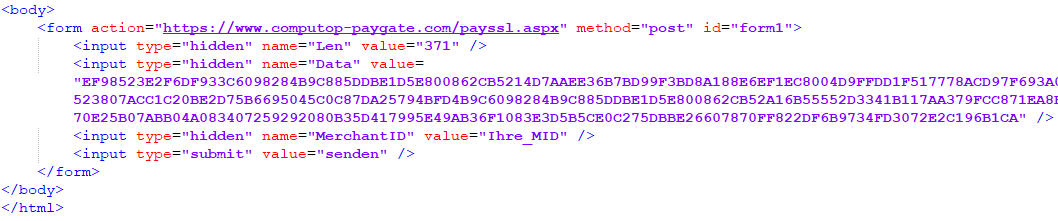

REQUEST: During the implementation of 3-D Secure 2.0 and the necessary delivery of larger amounts of data, we recommend you to call our forms via Form-POST Method. Please note that the option iFrame is still available. Background are possible browser restrictions, which can lead to the fact that the sent data string is cut off.

Example:Multiexcerpt MultiExcerptName payssl-request

RESPONSE:

Please also note a change to the final redirect to the URLSuccess | URLFailure.

This will be excecuted as a body POST in the case of a 3-D Secure 2.0 transactions. Therefore, you should be able to receive both a GET and a POST response on the URLSuccess | URLFailure.

How can I choose between 3-D Secure 1.0 or 2.0?

IMPORTANT: To be able to use and test 3-D Secure 1.0 or 3-D Secure 2.0, we have to configure 3-D Secure on our

on your behalf. Please contactMultiexcerpt include SpaceWithExcerpt EN MultiExcerptName Platform-Kurz PageWithExcerpt Wording

if you have not yet started this process.Multiexcerpt include SpaceWithExcerpt EN MultiExcerptName Helpdesk-Name PageWithExcerpt Wording By default, each payment is made following the 3-D Secure 1.0 process.

If you want to follow the 3-D Secure procedure 2.0, please use the request parameter MsgVer=2.0. This applies to tests as well as in production at a later stage.

Parameter: MsgVer

Value: 2.0

Use of JSON objects becomes mandatory

Please note that a mandatory extension of existing parameters comes with the implementation of 3-D Secure 2.0 . For this reason,

expects and returns relevant additional data as JSON Object.Multiexcerpt include SpaceWithExcerpt EN MultiExcerptName Platform-Name PageWithExcerpt Wording

The JSON Object must be Base64 encoded and regularly transmitted with all other parameters in the encrypted Blowfish data to

.Multiexcerpt include SpaceWithExcerpt EN MultiExcerptName Platform-Name PageWithExcerpt Wording Please pass JSON Objects with values only. Empty or zero-filled objects/parameters lead to a rejection.

JSON Example request - encrypted data

BASEURL=

Multiexcerpt include SpaceWithExcerpt EN MultiExcerptName BaseURL PageWithExcerpt Wording

| Multiexcerpt | ||||

|---|---|---|---|---|

| ||||

{{BASEURL}}payssl.aspx?MerchantID=Generic3DSTest&len=1800&data=CDC44E5A9D2C8A559CEDF1CCA97C9FBD3D90E046BFBF96F06ADA9A00FB0BC3494317E8D924FF44729671B93348B477F880541ACFF12C8E3A868CD55FEA95219C245CF7F4716FCF3462167A8B63D11424FA7BD30891504F8465C56805975115EB71C0A04E5D7466D771495035749FFF94D3087529F578DEF518003EA1422F6DE7B7DFD78A0DD695550623A42BF41A422EC219012318FE26D2B757F12BDFE046EA4CB8D35079ABAB6859691FEE1B03483471495035749FFF94D3087529F578DEF518003EA1422F6DE7D4E20259A484D23A9EFC7F4ADB209DD67D8EDE5BD2AC0CB2682D7CF26A6624A54BCF4E93219ADD89ABA6214820D4BAA5A9A184DD7F8AF3E2BE98C5B63113276B023B92DA5AADCCD7387B71B6651A0E7E4E42F8790122386AA9A184DD7F8AF3E23CFEC0086B59B6A9D98EB96DFDA496D97D85706A4A810056FE48AB878EFC1E976DB7504D402F4B96778B45ADE1DF3E217EFFBA566359677AB73F514F1E75F11DBE3E15983BA530E7D5B13A87D1A2ED19A9A184DD7F8AF3E21D32D652A71B2A49A58F3A30256097DA11388C26E7CBEB12E65B31C485C94DE8179CEACDE9237EF4C426A05E594E28069E10B19AE173D25A93A546845C5D78C44112031D6D5DE9B4ABA6214820D4BAA5A9A184DD7F8AF3E260C35EC59CD2FAA2435CD631BFC801AA7C72A1BAE39879C0BF733EDC45DD99F3A9A184DD7F8AF3E2DDA25A6458507ACE3B3CAAC3A4B293A9C6177F7F00EBFB6924050D9DF661DE8EC204863D819ABF9564498E9F2D72BEFF2E040214C4961D8737821BA1F638BE05FB01E1B382733FC42D6B04AB80D66218C75E691B9475C5F6CF13AD357057BC6B5864EE113DF2272EF6572101D5E45CB634F3E941FA7B3EA7E636EAEF751C67C82F8E8D9B618E69826221B2A42D7F694D9E10B19AE173D25A6EB48BD63BFFE0FAFC78722BD9FFA39623B5D40494B96D2A9E10B19AE173D25A188DA61C8E3401850C400A3144C3547808A0C82C7B8E9863D017852B02FBFE6D62983EBC372B1A8108D832C13F92E88535C213D0FDA1B1A5C426A05E594E28069E10B19AE173D25A92AD74641E23F21D1D66F1B352AFCCD408B1727FACC2405AA9A184DD7F8AF3E29B3106F31EE7D473A854D99576FDD5620141A96DEF638FCE4362F90866AED8044E42F8790122386AA9A184DD7F8AF3E20F6BF2E070199426696A900FEEBC7848B6F72D445F2CB9F0ED160CC32B1A3C40C426A05E594E28069E10B19AE173D25A201E55FC81E8F7CD78FFD98E342897C11AB2BE505B3E8421C63E936DCCF29058C31D72A3697DA2C89EFC7F4ADB209DD67D8EDE5BD2AC0CB2682D7CF26A6624A54BCF4E93219ADD89ABA6214820D4BAA5A9A184DD7F8AF3E2BE98C5B63113276B023B92DA5AADCCD7387B71B6651A0E7E4E42F8790122386AA9A184DD7F8AF3E23CFEC0086B59B6A9D98EB96DFDA496D93F669AB8A34E11706F7B3F762241F749A9A184DD7F8AF3E286587E20CD9A354709F67B1501183CFC5D6FD3FD6E23B0D4FA9746B8925D4A4FA9A184DD7F8AF3E21D32D652A71B2A49A58F3A30256097DA11388C26E7CBEB120758D07B77A47DB34E359C7AE383D69BC426A05E594E28069E10B19AE173D25A93A546845C5D78C44112031D6D5DE9B4ABA6214820D4BAA5A9A184DD7F8AF3E260C35EC59CD2FAA2435CD631BFC801AA7C72A1BAE39879C0BF733EDC45DD99F3A9A184DD7F8AF3E2DDA25A6458507ACE3B3CAAC3A4B293A9C6177F7F00EBFB6924050D9DF661DE8EC204863D819ABF9564498E9F2D72BEFF2E040214C4961D8737821BA1F638BE05FB01E1B382733FC46AA58C2847221D78069144B06DE3755A6C88EADD3B3FCCD6F6572101D5E45CB634F3E941FA7B3EA7B08783F57D9AD1BAB2071FAB9B93B3C13FF102AD44B6A493B5C341FB37BF525B0A0E4F490BE1D46A4C5B8F691A2020868119A0AEB9E9BCD4F9D783FEA316723E17976FBB4909040AE279D66AF13B8441582CB00BB30835AB6401E5CDDF295F533AEE31D2677314D288F2C15BFB16837EF4A779C1E39E4AA1CEE13FABDB2B89D9A7A89ED81EC005BCD416330CFCE5CF716A316FDF29A9CFF3F25490656C800BCA582CB00BB30835ABABD19D247E68289A52F1387D978126C967F9BBB890618AF5A0E5136C7DC2892D2460687217D2779B5836D3F1FFAE8F3B582CB00BB30835ABEE02C59E0AAF8C913339B61F9DDFB7DAC4FF2460869E4876C5DFD5D39E79330D427654226D9E37E72D7A4C332F59563DF70B3A840877E2B1BF739A2347A73347F7DA9F100EEBC189ADE92F98BE65BCBE29FE1A3DFE89E44EEEBF9C902BBAA7C2F68CBC48C724B889A53EA148988B56CC52D52743C045F57844F6607DDEA75FE613EAC80E2C02BCEA89B71E52E64D7538DC9B82EB2740B82C698F43B6A62D770935233D5F10E593D0519511BAAD615B0035D7524B097C29BA39EBEBEDB93425EB7824B9CCDB1397E716993ED326500615B4B1853A59F760A0E06373BDFE1CC6695A93B15851F56428&template=ct_responsive_ch&language=en |

JSON Example request - request parameter before encryption

| Multiexcerpt | |||||

|---|---|---|---|---|---|

| |||||

|

Key Parameter / Object

If you do not use your own template, we a new template for the first tests for you. All you have to do is add "Template=ct_responsive_ch" to the encrypted data and the cardholderName entered by the customer will automatically be adopted by

for the 3-D 2.0 process. For the planned / upcoming 3DS-2.0 rollout,Multiexcerpt include SpaceWithExcerpt EN MultiExcerptName Partner-Name PageWithExcerpt Wording

will adapt the standard templates accordingly and make them available to you.Multiexcerpt include SpaceWithExcerpt EN MultiExcerptName Partner-Name PageWithExcerpt Wording If you use your own merchant template and the cardholder query is not yet integrated in it, you need to integrate the cardholderName yourself.

Example XSL file:

| Code Block | ||

|---|---|---|

| ||

<!-- Cardholdername --> <div class="row ccholder"> <span class="label"> <xsl:value-of select="paygate/language/strCCHolder"/> </span> <div class="input"> <input type="text" value="" id="creditCardHolder" name="creditCardHolder"> <xsl:attribute name="value"><xsl:value-of select="paygate/creditCardHolder"/></xsl:attribute> </input> </div> </div> |

- Example XML file:

| Code Block | ||

|---|---|---|

| ||

For each language used: <strCCHolder>Cardholdername</strCCHolder> |

For PaySSL.aspx | PayNow.aspx, the cardholderName is a key value pair.

For Direct.aspx, the cardholderName is a JSON Parameter of the JSON-Objects "Card".

JSON Object – browserInfo

For PaySSL.aspx

captures the browser data on your behalf and there is no need for you to take any action.Multiexcerpt include SpaceWithExcerpt EN MultiExcerptName Partner-Name PageWithExcerpt Wording For a server-to-server connection via Direct.aspx or the use of PayNow.aspx, the individual additional queries must be implemented in the shop.

JSON Object – accountInfo

The more data you transfer to us, the higher the probability that smooth payment processing (frictionless mode) will take effect.

You should therefore check which data you already have and evaluate internally which data you would like to transfer.

JSON Object – customerInfo (billToCustomer | shipToCustomer)

Please note that the transfer of address data is mandatory for 3-D Secure 2.0.

IMPORTANT: If the delivery address is not identical to the billing address, both addresses must be transferred! In the case of digital goods, the billing address is sufficient.

JSON Object – merchantRiskIndicator

We strongly recommend to pass the merchantRiskIndicator (shipping method).

The shipping type is transferred in the JSON object merchantRiskIndicator in the JSON parameter shippingAddressIndicator.

This can have a positive effect on smooth payment processing (frictionless mode).

Use cases for transaction flagging

Scenario 01 – Credit Card One-Time Payment

You offer your customers payment by credit card

Each payment is a one-time payment, and therefore always a newly initiated payment

You do not use a pseudo card number to store and reuse the card data

Credentials on File (CoF)

You must use 3-D Secure

No further adjustments are necessary

Scenario 02 – Credit Card Subscriptions

You offer your customers payment by credit card

Customers enter into a subscription with you that ALWAYS maintains the same amount and payment interval

You use the pseudo card number to store and reuse the card data

IMPORTANT: The following initial payment is subject to the liability shift for you as a merchant. In the case of the subsequent payment, however, this expires, so that there is no liability shift.

Credentials on File (CoF) – Initial Subscription Payment

Applies to PaySSL.aspx + PayNow.aspx

3-D Secure is mandatory

Necessary adjustments:

Example:

JSON object credentialOnFile with JSON parameter recurring (3 keys included)

JSON object credentialOnFile with JSON parameter initialPayment and the value "true"

Example Initial Subscription Payment:

| Code Block | ||

|---|---|---|

| ||

{

"type": {

"recurring": {

"recurringFrequency": 30,

"recurringStartDate": "2019-09-14",

"recurringExpiryDate": "2020-09-14"

}

},

"initialPayment": true

} |

| Code Block | ||||

|---|---|---|---|---|

| ||||

{

"type": {

"recurring": {

"recurringFrequency": 30,

"recurringStartDate": "2019-09-14",

"recurringExpiryDate": "2020-09-14"

}

},

"initialPayment": true,

"useCase": "flexibleAmount"

} |

Credentials on File (CoF) – Subsequent Subscription Payment

Applies to Direct.aspx

3-D Secure is NOT mandatory

Necessary adjustments:

Example:

Please always send the schemereferenceID from the initial payment so that the downstream systems can link the two transactions accordingly.

JSON object credentialOnFile with JSON parameter recurring (3 keys included)

JSON object credentialOnFile with JSON parameter initialPayment and value "false"

Example Subsequent Subscription Payment:

| Code Block | ||

|---|---|---|

| ||

{

"type": {

"recurring": {

"recurringFrequency": 30,

"recurringStartDate": "2019-09-14",

"recurringExpiryDate": "2020-09-14"

}

},

"initialPayment": false

} |

| Code Block | ||||

|---|---|---|---|---|

| ||||

{

"type": {

"recurring": {

"recurringFrequency": 30,

"recurringStartDate": "2019-09-14",

"recurringExpiryDate": "2020-09-14"

}

},

"initialPayment": false,

"useCase": "flexibleAmount"

} |

Scenario 03 – Credit Card Recurring Payment / Down Payment / Final Payment

You offer your customers payment by credit card

Customers shop repeatedly in your shop using the same credit card data

You use the pseudo card number to store and reuse the card data

IMPORTANT: The following initial payment is subject to the liability shift for you as a merchant. In the case of the subsequent payment, however, this expires, so that there is no liability shift.

Credentials on File (CoF) - Initial Recurring Payment

Applies to PaySSL.aspx + PayNow.aspx

3-D Secure is mandatory

Necessary adjustments:

Example:

JSON object credentialOnFile with JSON parameter unscheduled and the value "CIT"

JSON object credentialOnFile with JSON parameter initialPayment and the value "true"

Example Initial Recurring Payment:

| Code Block | ||

|---|---|---|

| ||

{

"type": {

"unscheduled": "CIT"

},

"initialPayment": true

} |

Credentials on File (CoF) - Subsequent Recurring Payment

Applies to Direct.aspx

3-D Secure is NOT mandatory

Necessary adjustments:

Example:

Please always send the schemereferenceID from the initial payment so that the downstream systems can link the two transactions accordingly

JSON object credentialOnFile with JSON parameter unscheduled and the value "MIT"

JSON object credentialOnFile with JSON parameter initialPayment and value "false"

Example Subsequent Recurring Payment:

| Code Block | ||

|---|---|---|

| ||

{

"type": {

"unscheduled": "MIT"

},

"initialPayment": false

} |

Scenario 04 – Credit Card Account Verification

You offer your customers payment by credit card

In this scenario, you only want to validate the customer's credit card

You use the pseudo card number to store and reuse the card data

IMPORTANT: Currently and in the future, schemes/card brands want to prevent merchants from carrying out card data validations with a minimum amount (e.g. 1 cent authorization). Therefore,

offers you the corresponding "ZeroValueAuthentication". This is controlled by passing the additional parameter "AccVerify" in the encrypted data – see the example below for details.Multiexcerpt include SpaceWithExcerpt EN MultiExcerptName Platform-Name PageWithExcerpt Wording

Please make sure that your credit card acquirer supports this function for you.

Credentials on File (CoF) - Validation Request

Applies to PaySSL.aspx + PayNow.aspx

3-D Secure is mandatory

Necessary adjustments:

Example:

Please send the parameter AccVerify=Yes in the encrypted data (for further details please refer to our programming manual)

JSON object credentialOnFile with JSON parameter unscheduled and the value "CIT"

JSON object credentialOnFile with JSON parameter initialPayment and the value "true"

Example Account Verification:

| Code Block | ||

|---|---|---|

| ||

{

"type": {

"unscheduled": "CIT"

},

"initialPayment": true

} |

Scenario 05 – Credit Card Token Storage / Form Prefill – PayNow interface

| Info |

|---|

The processes described below are subject to the liability shift for you as a merchant. |

You offer your customers payment by credit card

Customers buy in your shop and you store the credit card data in the form of the pseudo card number

A: When the customer returns, you prefill the credit card form with the saved data. In the case of CIT with initial=false, flagging is used if the merchant prefills the pseudo card number to the customer using a template prefill option.

B: When the customer returns, you prefill the credit card form with the saved data. If the customer deletes the existing card number and stores a new one or, if necessary, adds another card, then the flagging for CIT must be used again (initial=true), if the customer also wants this card to be preassigned.

Credentials on File (CoF) – Initial Payment for Token Storage

Applies to PayNow.aspx

3-D Secure is mandatory

Necessary adjustments:

Example:

- JSON object credentialOnFile with JSON parameter unscheduled and the value "CIT".

JSON object credentialOnFile with JSON parameter initialPayment and the value "true"

Example Initial Payment for Token Storage:

| Code Block | ||

|---|---|---|

| ||

{

"type": {

"unscheduled": "CIT"

},

"initialPayment": true

} |

Credentials on File (CoF) – Subsequent Payment for Token Storage

Applies to PayNow.aspx

3-D Secure is mandatory

Necessary adjustments:

Example:

- JSON object credentialOnFile with JSON parameter unscheduled and the value "CIT"

JSON object credentialOnFile with JSON parameter initialPayment and value "false"

- Please always send the schemereferenceID from the initial payment (COF-CIT-TRUE) so that the downstream systems can link the two transactions accordingly

Example subsequent payment für Token Storage:

| Code Block | ||

|---|---|---|

| ||

{

"type": {

"unscheduled": "CIT"

},

"initialPayment": false

} |

Szenario 05 – Credit Card Token Storage / Form Prefill – PaySSL interface (merchant template)

The obligatory control of the initial and recurring payments is managed by

| Multiexcerpt include | ||||||

|---|---|---|---|---|---|---|

|

| Multiexcerpt include | ||||||

|---|---|---|---|---|---|---|

|

Please note the following requirements in relation to merchant specific or

| Multiexcerpt include | ||||||

|---|---|---|---|---|---|---|

|

Applies to PaySSL.aspx

3-D Secure is mandatory

- The shift in liability is subject to the liability shift for you as a merchant

Necessary adjustments:

- Please integrate a prefill checkbox using the code snippet provided below

- Please activate (comment in) the code contained in the XSL file for preassigning the pseudo card number

- To preassign the pseudo card number in the template you must transfer unencrypted data, e.g. "PCNrBrand=VISA&Background=VISA&PCNR=xxxxxxxxxxxxx123&PCNrMonth=09&PCNrYear=2025". For the display to the customer we recommend that only the last three digits match the pseudo card number and thus also the customer's real card number.

- In order to process the card data at

you must transfer the valid pseudo card number as request parameter "CCNr" in the encrypted part.Multiexcerpt include SpaceWithExcerpt EN MultiExcerptName Platform-Kurz PageWithExcerpt Wording - If the customer decides to save the card data the parameter "prefill=on" is sent to

. This indicator is reported back to your shop in the response message. You can see whether the customer has agreed to the prefill by the return parameter "prefill=on".Multiexcerpt include SpaceWithExcerpt EN MultiExcerptName Platform-Kurz PageWithExcerpt Wording

| Code Block | ||||

|---|---|---|---|---|

| ||||

// Adds a Change-Event to the checkbox called 'cbPrefill'

$("#cbPrefill").change(function() {

if ($("#cbPrefill").is(':checked'))

{ // If the checkbox was activated, the value of hiddenfield with name 'prefill' is set to 'on' $("input[type='hidden'][name='prefill']").val('on'); }

else

{ // If the checkbox was deactivated, the value of hiddenfield with name 'prefill' is deleted again $("input[type='hidden'][name='prefill']").val(''); }

});

// In case of retries (If form gets called a second time due to errors),

// the last status will be set

if ($("input[type='hidden'][name='prefill']").val() == 'on') {

$("#cbPrefill").attr('checked', true);

} |

| Code Block | ||||

|---|---|---|---|---|

| ||||

<!-- Hiddenfield, which tells Paygate that prefill function should get activated --> <!-- value="on" means that Paygate will return 'prefill=on' in the response to merchant --> <!-- value="" means that Paygate will not return 'prefill=on' in the response to merchant --> <input type="hidden" name="prefill"><xsl:attribute name="value"><xsl:value-of select="paygate/prefill"/></xsl:attribute></input> <!-- Checkbox to (de)activate prefill function --> <div id="div_cbPrefill" class="div_cbPrefill"> <input type="checkbox" name="cbPrefill" id="cbPrefill"></input> <span><xsl:value-of select="paygate/language/strCCSaveData" disable-output-escaping="yes"/></span> <div class="row"></div> </div> |

Scenario 06 – Credit Card Recurring Payment incl. Liability Shift (e.g. Travel business)

IMPORTANT: The following scenario only applies to PCI-certified systems

There are several scenarios for the travel industry that allow recurring payments to also be subject to liability shift

Example:

Customer books a hotel room via a booking platform, enters his card data and executes 3-D Secure 2.0. This is processed via a separate PSP. This transaction only serves to validate the card data -ZeroValueAuthentication-.

This results in an Authenticate Status = CAVV, which the central booking platform then reports to the hotel operator (and any other service providers such as rental car agencies, insurance agencies, etc.). The hotel operator makes a NON-3DS 2.0 payment via

, but including the CAVV and any other data. The second transaction also contains the corresponding liability shift.Multiexcerpt include SpaceWithExcerpt EN MultiExcerptName Platform-Name PageWithExcerpt Wording

The basis for this to work and for the liability shift to take place is the passing on of the Authenticate Status (CAVV). This is determined via a so-called "External 3DS Authentication". Two steps are necessary:

The external merchant system that initiated the first payment (AccVerify/ZeroValueAuthentication) stores the authentication status

Subsequently, a recurring payment can be made via

. In this case, the merchant must include the JSON object threeDSData in the JSON data as well as the original card data of the initial authenticate (Card-JSON). The card data must therefore be transferred in its original form from the booking platform to all relevant service providers / agencies in compliance with PCI.Multiexcerpt include SpaceWithExcerpt EN MultiExcerptName Platform-Name PageWithExcerpt Wording

For this purpose a separate section explains the necessary steps.

All necessary technical information can be found in the Multi-party Ecommerce / Agent Model section.

Scenario 07 – Credit Card MoTo (MailOrder / TelephoneOrder) via PaySSL, Direct or PayNow

You offer your customers payment by credit card, which is collected by telephone.

The credit card data is entered in a separate call centre application which triggers a payment via

using PaySSL.aspx, Direct.aspx or Paynow.aspx.Multiexcerpt include SpaceWithExcerpt EN MultiExcerptName Platform-Name PageWithExcerpt Wording You use the pseudo card number to store and reuse the card data

IMPORTANT: MoTo payments are not subject to the liability shift as 3-D Secure is not possible. (Out of Scope)

Credentials on File (CoF) - Initial MoTo Payment

Applies to PaySSL.aspx, PayNow.aspx und Direct.aspx

3-D Secure is not possible (Out of Scope)

Necessary adjustments:

Example:

JSON object credentialOnFile with JSON parameter unscheduled and the value "MIT"

JSON object credentialOnFile with JSON parameter initialPayment and the value "true"

Example Initial MoTo Payment:

| Code Block | ||

|---|---|---|

| ||

{

"type": {

"unscheduled": "MIT"

},

"initialPayment": true,

"useCase": "ucof"

} |

Credentials on File (CoF) - Subsequent MoTo Payment

Applies to automated payment initiation via Direct.aspx

3-D Secure is not possible (Out of Scope)

Necessary adjustments:

Example:

Please always send the schemereferenceID from the initial payment so that the downstream systems can link the two transactions accordingly

JSON object credentialOnFile with JSON parameter unscheduled and the value "MIT"

JSON object credentialOnFile with JSON parameter initialPayment and value "false"

Example Subsequent MoTo Payment:

| Code Block | ||

|---|---|---|

| ||

{

"type": {

"unscheduled": "MIT"

},

"initialPayment": false,

"useCase": "ucof"

} |

Scenario 08 – Credit Card MoTo (MailOrder / TelephoneOrder) via Virtual Terminal

You offer your customers payment by credit card, which is collected by telephone.

The credit card data is entered via Virtual Terminal.

IMPORTANT: MoTo payments are not subject to the liability shift as 3-D Secure is not possible. (Out of Scope)

Credentials on File (CoF)

By using the Virtual Terminal no further adjustments are necessary.

Scenario 09 – Batch Processing

The requirement of the card brands to mark recurring transactions correctly is already an older requirement; we provided information on this in January 2019. In the course of the PSD2-SCA implementation, this will become fully mandatory so that recurring transactions can be clearly identified and the downstream systems can recognize why 3-D Secure was not processed in these cases. Since in those cases no end customer actively participates in the payment process, as consequence, the implementation is mandatory for all merchants.

Below you will find our descriptions & details, i.e. in the first step the initial payment from the store has to be marked as CredentialOnFile and based on that the recurring batch transactions will follow.

***initial shop transaction or AccountVerification:

On our application page the correct initial flagging (CredentialOnFile) is described for different use cases and the following chapter + scenario will apply to you.

Chapter: 2. use cases for transaction identification

Scenario 03 - Credit Card Recurring Payment / Deposit Payment / Final Payment

***Recurring batch submission

Since the schemeReferenceID was generated from the initial store request and reported back, that initial value must be used for all subsequent batch submissions + RTF=M (M=Merchant Initiated Transaction) needs to be included & specified.

Card+processing+EN

Chapter: Batch usage of the interface

affected batch format / action:

CC,Sale,<Amount>,<Currency>,<TransID>,(<RefNr>),<CCBrand>,<CCNr|PCNr>,<CCExpiry>,<OrderDesc>,<textfeld1>,<textfeld2>,<RTF>,<cardholder>,<transactionID>,<schemeReferenceID>

CC,Authorize,<Amount>,<Currency>,<TransID>,(<RefNr>),<CCBrand>,<CCNr|PCNr>,<CCExpiry>,<OrderDesc>,<textfeld1>,<textfeld2>,<RTF>,<cardholder>,<transactionID>,<schemeReferenceID>

In the batch request there exists the "transactionID" on the one hand and in addition the "schemeReferenceID" as well , please use for the transfer only the transactionIDand we recommend that you take field schemeReferenceID.

Examples - ‒ Batch Versions 1.2 ‒ schemeReferenceID field delivery:

CC,Sale,<Amount>,<Currency>,<TransID>,(<RefNr>),<CCBrand>,<CCNr|PCNr>,<CCExpiry>,<OrderDesc>,<textfeld1>,<textfeld2>,<RTF>,<cardholder>,<1234567890>

The Acquirer Scheme Identifier must be transferred in batch format by using the TransactionID / schemeReferenceID, i.e. you will receive the schemeReferenceID (in the case of a 3DS-1.0 fallback transaction as TransactionID) / TransactionID for the initial 3DS-2.X transaction. This value must then be included in the batch format so that all recurring payments are correctly identified. The field cardHolder must be present but can also be submitted as an empty field and using schemeReferenceID the TransactionID field also empty.

Example:

CC,Sale,999,EUR,987456321,123456789,<VISA>,<0123456789123456>,<052029>,<mein Warenkorb>,,,M,,,<1234567890>

***Token/PCN Mandate - SchemeReferenceID

You can try to submit payments without using a schemeReferenceID, but we cannot prevent card transactions to be declined.

In case of a rejection, we recommend to execute a separate transaction as Card Check (AccVerify=YES) transaction via our ...PaySSL.aspx, i.e. the customer receives a payment link which he can use to process an initial 3DS-2.X transaction and the schemeReferenceID is then reported back and can be included in the process of recurring payments again.

Scenario 10 – Extended Transaction Management (ETM)

- When using the

ETM,Multiexcerpt include SpaceWithExcerpt EN MultiExcerptName Partner-Name PageWithExcerpt Wording

takes care of the correct flagging of transactions for you.Multiexcerpt include SpaceWithExcerpt EN MultiExcerptName Platform-Name PageWithExcerpt Wording

Test 3-D Secure 2.0

Take the opportunity to test 3-D Secure 2.0 now!

While not all downstream systems currently offer 3-D Secure for testing, you can perform a test simulation within

| Multiexcerpt include | ||||||

|---|---|---|---|---|---|---|

|

Please proceed as follows for testing:

Activate 3-D Secure 2.0 for your

MerchantID. If you are unsure whether it has already been activated, please contactMultiexcerpt include SpaceWithExcerpt EN MultiExcerptName Partner-Name PageWithExcerpt Wording Multiexcerpt include SpaceWithExcerpt EN MultiExcerptName Helpdesk-Name PageWithExcerpt Wording In the encrypted data request, use the default parameter OrderDesc with the value "Test:0000". This will give you a correspondingly successful authorization after successful authentication.

IMPORTANT: In simulation mode, the schemereferenceID of the initial payment is not returned because this ID is generated by the downstream systems. These systems are not involved in the Simulation.Perform 3-D Secure Authentication

Please ONLY use the available Testcards (expiration date always in the future + CVV/CVC may contain any value)

Depending on the desired scenario (e.g. Browser 3-D Secure 2.0 challenge, frictionless browser authentication, etc.), please use the appropriate One-Time Passwords