| Table of Contents |

|---|

The

| Multiexcerpt include | ||||||

|---|---|---|---|---|---|---|

|

About this manual

This manual describes the programming and the scope of services of the

Merchant Interface and is aimed at users of Multiexcerpt include SpaceWithExcerpt EN MultiExcerptName Platform-Kurz PageWithExcerpt Wording

| Multiexcerpt include | ||||||

|---|---|---|---|---|---|---|

|

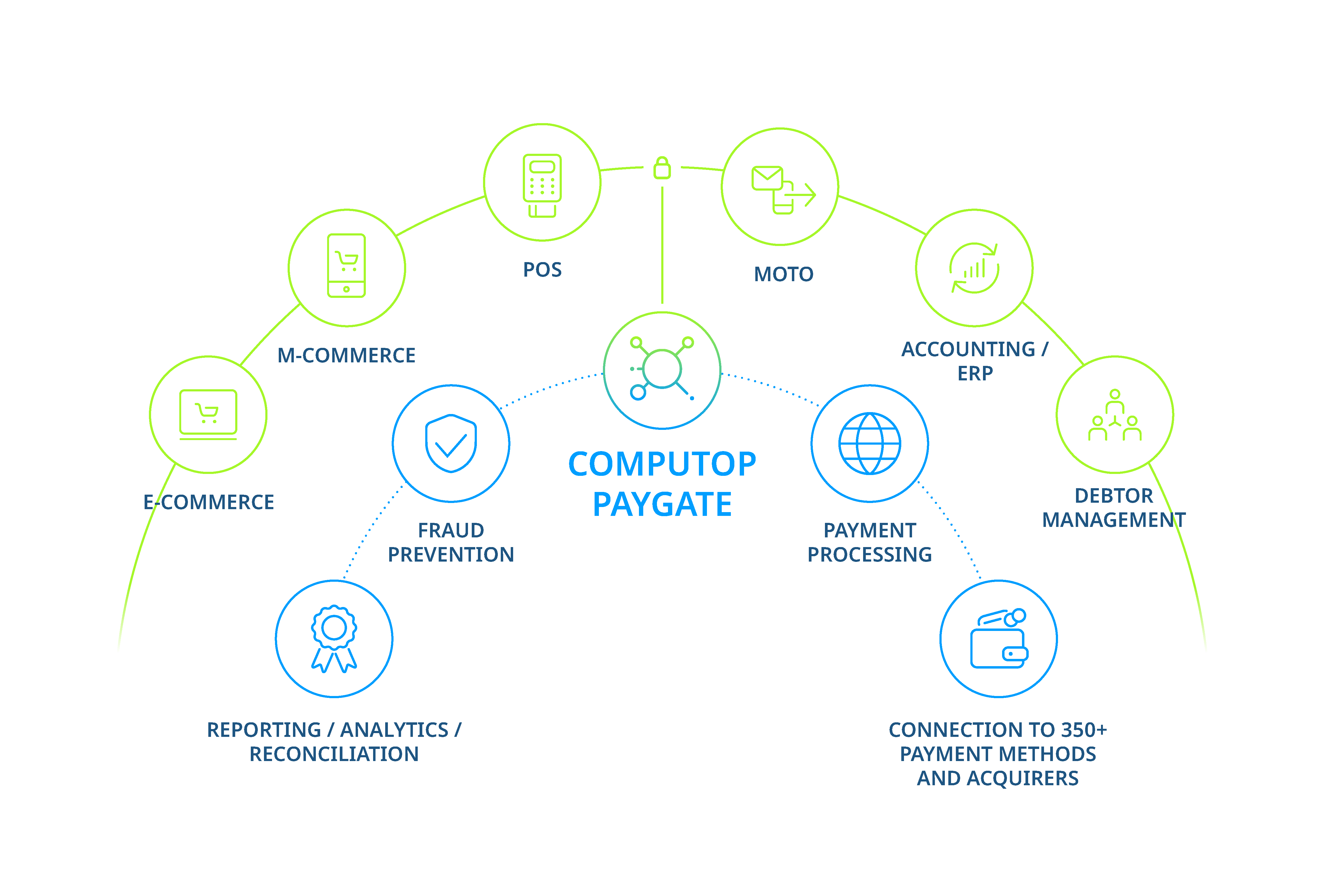

is a payment gateway for the secure processing of transactions via the Internet, Mail Order and POSMultiexcerpt include SpaceWithExcerpt EN MultiExcerptName Platform-Name PageWithExcerpt Wording

This chapter The

| Multiexcerpt include | ||||||

|---|---|---|---|---|---|---|

|

| Multiexcerpt include | ||||||

|---|---|---|---|---|---|---|

|

| Multiexcerpt include | ||||||

|---|---|---|---|---|---|---|

|

| Multiexcerpt include | ||||||

|---|---|---|---|---|---|---|

|

About the Multiexcerpt include SpaceWithExcerpt EN MultiExcerptName Platform-Kurz PageWithExcerpt Wording

| SpaceWithExcerpt | EN |

|---|---|

| MultiExcerptName | Platform-Kurz |

| PageWithExcerpt | Wording |

offers several interfaces for the submission of payment tasks. The Merchant Interface described in this document serves to connect Internet shops and enterprise resource planning systems. The Multiexcerpt include SpaceWithExcerpt EN MultiExcerptName Platform-Name PageWithExcerpt Wording

Merchant Interface accepts payment orders, encrypts the data and carries out payment transactions. Multiexcerpt include SpaceWithExcerpt EN MultiExcerptName Platform-Kurz PageWithExcerpt Wording

interfaces for Internet shops, enterprise resource planning systems, call centres and transaction managementMultiexcerpt include SpaceWithExcerpt EN MultiExcerptName Platform-Kurz PageWithExcerpt Wording

Merchant Interface

This manual describes the programming of the Merchant Interface.

also allows the submission of batch files. These are CSV files containing several payment orders which are transmitted to the Multiexcerpt include SpaceWithExcerpt EN MultiExcerptName Platform-Kurz PageWithExcerpt Wording

. Multiexcerpt include SpaceWithExcerpt EN MultiExcerptName Platform-Kurz PageWithExcerpt Wording

permits both manual as well as automated (FTP) transfer of batch files. You can find details of the batch process in the Manual of Batch manager.Multiexcerpt include SpaceWithExcerpt EN MultiExcerptName Platform-Kurz PageWithExcerpt Wording

Please note that not all interfaces are available for every payment method. For details, please refer to the descriptions of the respective payment type or contact

.Multiexcerpt include SpaceWithExcerpt EN MultiExcerptName Sales-Name PageWithExcerpt Wording

Hosted Payment Page

The Hosted Payment Page is a checkout that contains only the step of selecting the payment method. It is a HTML form with responsive design that is displayed properly on all devices.

In the case of payments via Hosted Payment Page, the shop redirects its customers to the

HTML form where they selects their payment method. After confirming the selection depending on the payment method Multiexcerpt include SpaceWithExcerpt EN MultiExcerptName Platform-Kurz PageWithExcerpt Wording

forwards the customer to a Multiexcerpt include SpaceWithExcerpt EN MultiExcerptName Platform-Kurz PageWithExcerpt Wording

HTML form or to a form from an external service provider and notifies the shop after completion about the payment result.Multiexcerpt include SpaceWithExcerpt EN MultiExcerptName Platform-Kurz PageWithExcerpt Wording

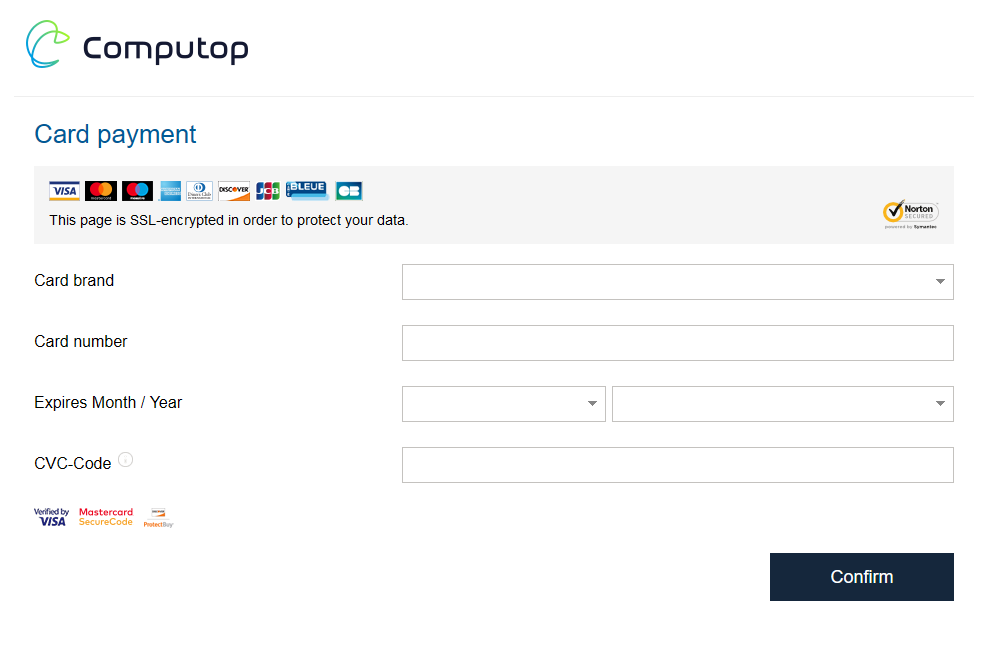

Credit Card Form (paySSL)

When requesting card payments via

hosted forms the complexity of 3-D Secure is completely removed from the merchant implementation.Multiexcerpt include SpaceWithExcerpt EN MultiExcerptName Partner-Name PageWithExcerpt Wording

Silent Order Post (PayNow)

Silent order post is a transmission method where form data is sent from a merchant website directly to a third party server. This is usually achieved using the form action attribute, which specifies the URL where the data is to be sent.

This approach is very similar to

hosted payment forms and leaves the merchant in full control of the checkout experience as all website elements are delivered from the merchant’s server.Multiexcerpt include SpaceWithExcerpt EN MultiExcerptName Partner-Name PageWithExcerpt Wording

Server-to-Server Intragration

Our server-to-server solution allows you to exchange all transaction-related data directly between your server and

. Here, the merchant itself takes care of authentication via a separate interface.Multiexcerpt include SpaceWithExcerpt EN MultiExcerptName Platform-Kurz PageWithExcerpt Wording

Batch Manager

Batch Manager lets you transmit payment transactions in the form of files. In this process you assemble transaction data such as the credit card number, amount and currency in a batch file which is transmitted to

. Multiexcerpt include SpaceWithExcerpt EN MultiExcerptName Platform-Name PageWithExcerpt Wording

then makes the authorization or payment and saves the transaction status in the batch file. After processing, the merchant can access the batch file with the details on the transaction status via download.Multiexcerpt include SpaceWithExcerpt EN MultiExcerptName Platform-Kurz PageWithExcerpt Wording

Multiexcerpt include SpaceWithExcerpt EN MultiExcerptName Backoffice-Name PageWithExcerpt Wording

| SpaceWithExcerpt | EN |

|---|---|

| MultiExcerptName | Backoffice-Name |

| PageWithExcerpt | Wording |

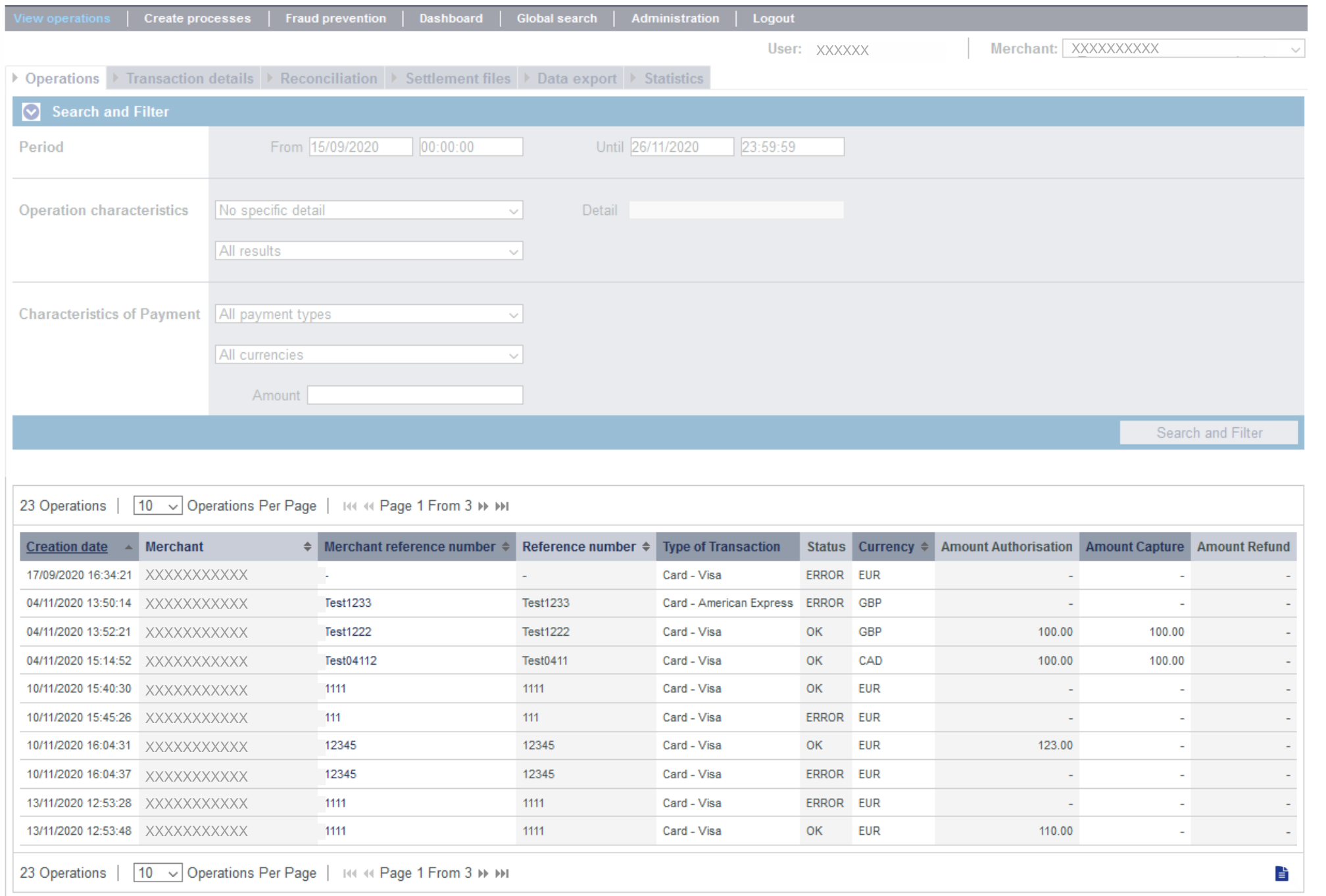

enables the merchant to manage transactions online. This is a web application with password protection and TLS encryption, which lists all transactions and also permits, for example, credits.Multiexcerpt include SpaceWithExcerpt EN MultiExcerptName Backoffice-Name PageWithExcerpt Wording

allows you to view all your payment processes (purchases) with the associated payment transactions (individual process steps of a process, e.g. (pre-) authorization, capture, refund, etc.). You can also create new payment processes and add payment transactions to existing payments. You also have access to graphical dashboards and can export your payment data. The application carries out a dynamic analysis directly on your transaction database so that you can always see the latest processing status. You can also set measures for fraud prevention and carry out manual postings or credit memos.Multiexcerpt include SpaceWithExcerpt EN MultiExcerptName Backoffice-Name PageWithExcerpt Wording

Operations overview in Multiexcerpt include SpaceWithExcerpt EN MultiExcerptName Backoffice-Name PageWithExcerpt Wording

The optional dashboard of the application offers you the possibility of clearly displaying all processes with the associated payment transactions in the form of tables and diagrams.

Transactions Overview in the Dashboard of Multiexcerpt include SpaceWithExcerpt EN MultiExcerptName Backoffice-Name PageWithExcerpt Wording

You can find details about

in the Multiexcerpt include SpaceWithExcerpt EN MultiExcerptName Backoffice-Name PageWithExcerpt Wording

User Manual document.Multiexcerpt include SpaceWithExcerpt EN MultiExcerptName Backoffice-Name PageWithExcerpt Wording

Virtual POS Terminal / MOTO

The

virtual POS Terminal is designed for the processing of MOTO (Mail Order, Telephone Order) transactions. The POS Terminal is a clever alternative to the physical terminal and lets you process direct debits and credit card payments. You can find details about POS Terminal in the User Manual.Multiexcerpt include SpaceWithExcerpt EN MultiExcerptName Platform-Kurz PageWithExcerpt Wording

Test Mode

supports testing of your implementation before going live. Three different operating modes are supported:Multiexcerpt include SpaceWithExcerpt EN MultiExcerptName Platform-Name PageWithExcerpt Wording

In the live / productive operation mode all payments are forwarded live to the connected service provider (e.g. acquirer, bank, scheme, downstream service provider). These payment transactions are carried out in real life.

In the test system (Downstream) mode, payment transactions are forwarded to a downstream test system. This is not available for all payment methods and is noted in the corresponding payment method documentation.

As well as the simulation mode: In this mode all payment processes within

are simulated. This mode is available for all payment types. Multiexcerpt include SpaceWithExcerpt EN MultiExcerptName Platform-Name PageWithExcerpt Wording This mode is always available - even if the payment method has been activated for "live".

Response Codes

uses numerical response codes which provide information about the transaction status. To determine success or error of a transaction more precisely, please analyse the response parameter Code. For a detailed breakdown of these codes, please see the Response Codes.Multiexcerpt include SpaceWithExcerpt EN MultiExcerptName Platform-Kurz PageWithExcerpt Wording

Scope of services of

| Multiexcerpt include | ||||||

|---|---|---|---|---|---|---|

|

Overview of supported payment methods

The role of

is to receive and process payment requests and provide additional functions such as fraud prevention and protection of minors. Multiexcerpt include SpaceWithExcerpt EN MultiExcerptName Platform-Kurz PageWithExcerpt Wording

has several interfaces for receiving transactions: A Merchant Interface for the shop-connection, a Batch Interface for payment orders in batch files and the POS Terminal for processing payments for telephone- and fax-orders. Multiexcerpt include SpaceWithExcerpt EN MultiExcerptName Platform-Kurz PageWithExcerpt Wording

offers several payment methods and additional functions for payment processing: Multiexcerpt include SpaceWithExcerpt EN MultiExcerptName Platform-Kurz PageWithExcerpt Wording

Credit cards |

| ||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

The

| |||||||||||||||||

Visa Secure and Mastercard ID Check secure your payment claim by a password if a customer disputes the payment later. American Express with SafeKey and Diners Club / Discover with ProtectBuy also uses the 3D-Secure technology, which means that the card holder must additionally confirm his identity with a password. | |||||||||||||||||

| Payments with the Brazilian credit cards Hipercard, Elo and Aura can be processed via the

| ||||||||||||||||

In China the

| |||||||||||||||||

| Be2bill is specially optimized for the “Cartes Bancaires” credit cards which is widely used in France. | |||||||||||||||||

| KoreaCC | KoreaCC is a payment method which enables Korean merchants (based in South Korea) to offer domestic customers (with Korean credit cards) a credit card payment method. | ||||||||||||||||

| Cofidis | |||||||||||||||||

| 1euro.com | |||||||||||||||||

| Cetelem | |||||||||||||||||

| Facilypay |

Debit cards |

| ||||||||

|---|---|---|---|---|---|---|---|---|---|

Maestro is the international debit card standard and offers merchants a payment guarantee for E-Payment. The German girocard (EC card) is one such card. It is coupled to the giro account which is charged immediately. Maestro is seldom used in eCommerce. | |||||||||

| |||||||||

The combined credit- and debit card Dankort gives access to 3.5 million card holders on the Danish market. | |||||||||

| |||||||||

Around 6 million Belgians have a Bancontact/Mr Cash card.

| |||||||||

|

Wallet systems |

| ||||||||

|---|---|---|---|---|---|---|---|---|---|

| |||||||||

The new AmazonPay interface allows millions of Amazon customers to complete their purchases with using their Amazon account without leaving the web page of the visited online shop. | |||||||||

Skrill allows customers to pay and to send and receive money without having to disclose bank or card details. In 2014 Skrill had over 36 million users and 156,000 merchants worldwide. | |||||||||

Alipay is China’s leading online payment system. With the aid of the E-Wallet customers and merchants can make or receive payments. Alipay has over 800 million registered users and in 2014 it processed over 100 million online payments per day. | |||||||||

Klarna Checkout simplifies the checkout process for all terminals. The customer only needs to supply email address and post code during the payment process. Klarna takes care of the credit check and assumes the risk in the case of non-payment. Following completion of the purchase, which by default is a purchase on account, payment can alternatively be made by credit card, direct debit or direct transfer. | |||||||||

paydirekt allows online purchases to be paid simply and directly from your giro account. Merchants benefit from this alternative to existing online payment processes which correspond to the stringent requirements of the German credit sector. | |||||||||

| Apple Pay is a digital wallet for storing payment details, providing an easy and secure way to pay in iOS applications, websites running on Safari browser and contactless POS terminals. In applications and on websites, users can quickly and securely provide their payment, shipping, and contact information to check out with just one touch using Apple’s Touch ID. Apple Pay’s simplicity increases conversion rates and new user adoption that come with it. | |||||||||

| Google Pay is the fast, simple way to pay on sites, in apps and in stores using the cards saved to your Google Account. It protects your payment info with multiple layers of security and makes it easy to send money, store tickets or cash in on rewards – all from one convenient place. | |||||||||

| BitPay is an e-wallet for Bitcoins. It allows users to store and pay in Bitcoins. Merchants that integrate BitPay are able to accept payment in Bitcoins. Customers can convert Bitcoins into USD, at no charge. | |||||||||

| Asiapay has 3 platforms: PesoPay for payment in Philippines, SiamPay for payment in Thailand and PayDollar for payment in all the other countries. The platform can be configured in MAT. | |||||||||

| WeChat is a free, cross-platform and instant messaging application developed by Tencent. It was first released in January 2011 and was one of the largest standalone messaging apps by monthly active users. As of May 2016, WeChat has over a billion created accounts, 700 million active users; with more than 70 million outside of China (as of December 2015). In 2016, WeChat reached 864 million active users. | |||||||||

| ChinaPay | ChinaPay is the online payment service of China UnionPay (CUP). The company offers both banking, broker and payment services as well as offline purchases on account and POS terminals. ChinaPay is the third largest online payment services provider in China. | ||||||||

| With MobilePay the customer pays by entering his mobile phone number on the website. This payment solution simplifies the payment procedure because the customer's card is stored in the app, making it unnecessary to input the card number. More than 3 million Danes already use this payment type, with which simple P2P payments are also possible. | |||||||||

| The swedish payment method Swish is one of the most popular payment methods in Sweden. More than half of the population uses the app on their cell phones. Originally Swish was a joint venture project of the most popular swedish banks as a pure P2P-payment method. Since 2017 it is also available for E-Commerce and POS. If you want to pay, you can either do it via scan of a QR-code or the submission of your mobile or swish number. | |||||||||

| Zimpler is a FinTech company focused on excelling the mobile payment experience. Zimpler is developed with the purpose of simplifying mobile payments online, while giving users control over their spending. | |||||||||

| Bluecode is the first pan-European mobile payment solution that enables cashless payments via Android smartphone, iPhone and Apple Watch combined with value-added services in a single technology platform. | |||||||||

| Visa Click to Pay is Visa’s online checkout experience built on the latest ecommerce industry specifications – EMV Secure Remote Commerce. To make a purchase, no longer entering of 16-digit primary account numbers, look up passwords or fill out long forms are required. | |||||||||

Pay easily and absolutely secure with the TWINT E-Wallet solution using the leading payment app in Switzerland. All you need to do is to scan a QR code and verify your identify using your smartphone. |

Online bank transfers |

| ||||||||||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

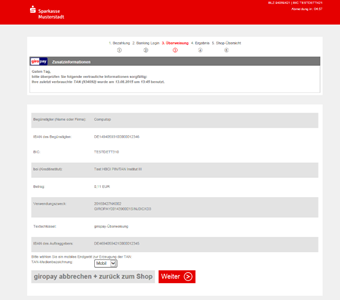

giropay is an online bank transfer with PIN and TAN that provides you with access to nearly 40 million online banking users in Germany in Austria. Additionally to the full 100% payment guarantee the use of giropay is relatively low priced. | |||||||||||||||||||||||||||||||||

The international online bank transfer with PIN/TAN from SOFORT AG is now available in 11 countries. As part of the Klarna Group SOFORT offers the integration of payment in the webshop, so that a customer is forwarded to his/her bank and can make the transfer with input of PIN and TAN. | |||||||||||||||||||||||||||||||||

In Austria the online bank transfer with EPS is very widespread in E-commerce and thus an interesting addition to the payment mix. | |||||||||||||||||||||||||||||||||

Bank transfers with iDEAL are a guarantor of success in the Netherlands: About 100.000 webshops and organizations offers iDEAL. About 50 % of all e-commerce payments are processed with iDEAL, monthly there are about 13 million transactions. | |||||||||||||||||||||||||||||||||

PostFinance is an online banking payment method in Switzerland and is the market leader in Swiss payment transactions with a market share of around 60%. With PostFinance merchants can reach over 3.5 million potential customers. | |||||||||||||||||||||||||||||||||

Przelewy24 is an online banking method for Poland. It uses online bank authentication for account postings in real-time. Przelewy24 is available to 95% of all Polish online banking customers. | |||||||||||||||||||||||||||||||||

POLi is a secure and trusted online banking service for Australia and New Zealand. | |||||||||||||||||||||||||||||||||

TrustPay is a real-time bank transfer which is available in Central and Eastern Europe. Customers can purchase goods and services by logging onto their online bank account on checkout and entering both their password and a specific ID which is assigned to them via email. More than 200 million customers can be reached in this way. | |||||||||||||||||||||||||||||||||

SafetyPay is the world’s leading real-time online bank transfer with access to over 250 million banking customers in Europe, the USA, Canada and Latin America, with immediate payment guarantee, fast disbursement and simple refunding. That means no chargebacks, no risk of fraud, no payment default. It supports mobile, telephone/mail order, E-Invoices and offers sales promotions. | |||||||||||||||||||||||||||||||||

The Trustly online bank transfer is convenient for the customer and secure for the merchant. The payment method allows buyers in 6 countries (Finland, Sweden, Denmark, Estonia, Poland and Spain) to contact accounts in one of 57 banks. There are therefore more than 67 million potential customers. | |||||||||||||||||||||||||||||||||

In China the

| |||||||||||||||||||||||||||||||||

| Every fifth online payment in Brazil is a bank transfer. The

| ||||||||||||||||||||||||||||||||

PayU offers payment solutions in many countries. Online transfers in Poland and the Czech Republic are easily integrated via

| |||||||||||||||||||||||||||||||||

| CIMB Clicks is an online bank transfer payment method for CIMB bank customers. The customer selects CIMB for payment and logs into their online banking environment. They review the pre-populated payment details, authorise payment and then simply wait for the purchase to arrive. | |||||||||||||||||||||||||||||||||

| Dragonpay is a Filipino cash based and online bank-transfer payment method. Customers can choose between online transfer with their bank account and cash payment at a branch store or retailer. | |||||||||||||||||||||||||||||||||

| eNETS is an online bank transfer payment method. At checkout, the customer picks eNETS, selects the name of their bank and logs into their online banking environment. They review the pre-populated payment details, authorise payment and then simply wait for the purchase to arrive. | |||||||||||||||||||||||||||||||||

| Finland OBT is a real time online transfer system from Finland. With this method customers select their own trusted online bank and log in. After payment authorisation the merchant receives a confirmation of the payment via Finland OBT. | |||||||||||||||||||||||||||||||||

| Maybank2U is the bank transfer payment method of Maybank (Malayan Banking Berhad). Maybank2U is one of a number of bank transfer payment methods that PPRO has bundled together for its customers on one integration. Bank customers log into their online banking environment. They review the payment details and authorise payment for the funds to be credited directly to the payee’s account. | |||||||||||||||||||||||||||||||||

| Multibanco is a payment method from Portugal in which the customer can choose between online transfer and cash payment. In the first variant the customer can give details for Multibanco and the merchant receives confirmation of the payment. Alternatively the customer can pay by cash at a bank or a cash machine. The merchant receives a payment guarantee from the system. | |||||||||||||||||||||||||||||||||

| MyBank is a real time online transfer system which is currently offered in Greecce, Italy and Spain. Within MyBank the customer chooses their own trusted online bank and carries out the transfer from there. After authorisation of the payment the merchant receives confirmation of the payment and a payment guarantee from MyBank. | |||||||||||||||||||||||||||||||||

| MyClear FPX allows real-time debiting of a customer’s bank account for online purchases, recurring payments, P2P payments and e-billing. With MyClear FPX, the customer chooses the desired payment method, selects their bank and logs into their online banking environment. They review the pre-populated payment details, authorise payment and then simply wait for the purchase to arrive. | |||||||||||||||||||||||||||||||||

| RHB Now is a real-time online bank-transfer payment method. At checkout, the customer selects the name of their bank and logs into their online banking environment. They review the pre-populated payment details, authorise payment and then simply wait for the purchase to arrive. | |||||||||||||||||||||||||||||||||

| Blik is a mobile payment methode supported by Polish banks via their mobile banking apps. It enables the immediate transfer of funds to a recipient’s mobile phone number. Users can also make payments online and instore. | |||||||||||||||||||||||||||||||||

| Instanea ? (BNP only) |

Cash-in, Prepaid & Co. |

| ||||||||

|---|---|---|---|---|---|---|---|---|---|

With Barzahlen online purchases in Germany at over 3,400 branches of retail partners such as real,-, dm, Telekom and mobilcom debitel can be paid in cash. The additional customer potential encompasses about a quarter of the Internet users who do not yet purchase online. Neither credit cards, online banking nor prepaid cards are required. | |||||||||

paysafecard is a prepaid card which is a widespread micropayment method for gaming, gambling and adult-content and available within

| |||||||||

More than 30% of online payments in Brazil are made using the Boleto Bancário cash-in solution. With a payment form customers can pay in cash in supermarkets, post office branches or at one of over 48,000 bank terminals. | |||||||||

The three Cofidis customer cards Carte 4 Etoiles, Carte helline and Carte helline 4 Etoiles can also be integrated via the

| |||||||||

The IKANO Shopping Card helps to strengthen customer loyalty and offers greater financial freedom. With no risk: The IKANO BANK offers a 100% payment guarantee and day-certain payment. | |||||||||

Payment in advance offers high certainty and occupies a special position in online trade.

| |||||||||

| 7-Eleven is a cash payment method. After selecting goods or services, consumers reach the merchant’s checkout site. The consumer selects 7-Eleven. The merchant site then generates the billing details as a print-optimised document. The customer can pay at a participating store. Once the payment has been received, the merchant ships the purchase. |

Invoice and hire purchase | |||||||||

|---|---|---|---|---|---|---|---|---|---|

You can also use Klarna’s purchase on account and purchase by instalment via

| |||||||||

| |||||||||

Paymorrow supports invoice purchasing and secured SEPA direct debits in Germany. Merchants benefit from comprehensive protection against payment defaults because Paymorrow also handles debtor management and debt collection. | |||||||||

With the products Purchase on invoice and Hire purchase merchants get tailored solutions for the region D-A-CH. Paysafe Pay Later especially features a fast and guaranteed payout as well as a comprehensive support for the B2B and B2C business. | |||||||||

| AfterPay offers purchase on account after delivery. Buyers can pay for articles in four simple instalments, without having to provide any additional information during the ordering process. There is no risk of fraud or payment default for the merchant. After a credit check, AfterPay assumes the entire end customer payment default risk for each transaction. | |||||||||

Consors Finanz is a brand of international BNP Paribas Group and belongs to the leading consumer-finance-providers in Germany. Company's focus is consumer lending as well as sales financing within retail sector and online commerce. The new eFinancing application allows customers to enter online credit agreements faster and easier, because the application process was optimized for maximum user-friendliness. Financing plans between 6 and 40 month can be mapped through the credit line of a Consors Finanz Mastercard. With a button the customer possibly can select from longer credit periods. Then the installment plan will be processed by an installment credit. | |||||||||

| EasyCredit is a provider of hire purchase and purchase on invoice in Germany. After the customer is forwarded to easyCredit they undertake the calculation of all possible installments. | |||||||||

Risk Management | Address checks and credit rating | ||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

Address and credit rating data from arvato infoscore offers top quality assessments with more than 40 million negative traits associated with 7.8 million people and 450,000 companies. | |||||||||||||||||

With Accertify’s Fraud Management solution, online merchants benefit from real-time decisioning through a sophisticated yet efficient fraud scoring engine that can screen transactions in milliseconds and turn large volumes of disparate data into actionable intelligence that reduces fraud. | |||||||||||||||||

| ACI ReD Shield risk |

| ||||||||||||||||

| |||||||||||||||||

Boniversum supports merchants with credit ratings for consumers. The data from the credit agency help to evaluate non-payment risks and to adapt the methods of payment according to the credit prognosis. | |||||||||||||||||

CRIF (formerly Deltavista) provides information on about | CRIF provides information on more than 80 million individuals, 6 million companies, and 10 million payment, register, and address records from Germany, Austria and Switzerland. | ||||||||||||||||

Schufa address and credit rating data contains 66 million points of data concerning individuals and 462 million other information points, derived mainly through cooperation with banks | . |

Debtor management |

| ||||||||

|---|---|---|---|---|---|---|---|---|---|

The

|

Additional functions |

| ||||||||

|---|---|---|---|---|---|---|---|---|---|

ETM: Extended transaction management | For long delivery times and partial captures ETM extends the reservation of the authorized amount | ||||||||

Capture On Demand | Automated capture with specified time delay | ||||||||

MOTO SSL terminal | Web-based call centre application for processing payments for telephone- and fax orders | ||||||||

| Download of transactions and sales data for Excel analyses, if necessary incl. EPA information |

Batch handling |

|

|---|---|

Batch file transfer incl. UDK if necessary | Transaction submission via batch file and transfer of reference number to the acquirer's balance notification |

EPA download & comparison | Collection of EPA file and batch provision for merchant, if necessary with format conversion for SAP or the like |

PCI solutions |

| ||||||||

|---|---|---|---|---|---|---|---|---|---|

PCI Pseudo card number (PCN) | The PCN is a fully-functioning substitute for credit card numbers. The merchant can save and use the PCN without PCI-certification to avoid the repeated input of card data within the shop. | ||||||||

Corporate PayPage | The Corporate PayPage enables merchants to use the

| ||||||||

User administration | Personal access rights for every user of

|

Multiexcerpt include SpaceWithExcerpt EN MultiExcerptName Platform-Kurz PageWithExcerpt Wording

fraud prevention

| SpaceWithExcerpt | EN |

|---|---|

| MultiExcerptName | Platform-Kurz |

| PageWithExcerpt | Wording |

supports different processes for fraud prevention. These include inquiries with credit agencies in the monitoring of the card's country of origin and payment guarantees for credit cards. Multiexcerpt include SpaceWithExcerpt EN MultiExcerptName Platform-Kurz PageWithExcerpt Wording

Function | Description | ||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

Verification of the country of origin of the IP | A main part of fraud attempts comes from abroad.

| ||||||||||||||||||||||||

Verification of the card's country of origin | 75% of all attempted frauds take place with foreign credit cards.

| ||||||||||||||||||||||||

Seller protection in the case of PayPal | PayPal offers seller protection via a delivery address comparison. Either the shop notifies the delivery address or the customer uses PayPal Express-Purchase and selects a delivery address lodged with PayPal.

| ||||||||||||||||||||||||

giropay Pin/TAN query | The giropay online transfer based on the PIN/TAN online-banking process: The customer logs in with a PIN (Personal Identification Number) and then uses a new TAN (TransAction Number) for each payment. | ||||||||||||||||||||||||

Block list check and sales limits | To reduce your direct debit-risk

| ||||||||||||||||||||||||

Address checks and credit ratings | Address check and credit ratings with all established credit agencies, e.g. arvato Infoscore, Bürgel, Creditreform, Universum Group, Schufa. | ||||||||||||||||||||||||

American Express address verification |

| ||||||||||||||||||||||||

Visa Secure, Mastercard ID Check, American Express SafeKey & Diners Club / Discover ProtectBuy | If you use Visa Secure, Mastercard ID Check, Dinsers Club / Discover ProtectBuy and American Express SafeKey you benefit from a secure payment claim, should the customer dispute the payment. The so-called liability shift transmits the default risk to the card-issuing bank. | ||||||||||||||||||||||||

Visa Secure / ID Check / SafeKey Authentication Hosting | If you only wish to verify the identity of the card holder without immediately activating a credit card payment,

| ||||||||||||||||||||||||

Variable amounts for Visa Secure / ID Check / SafeKey | It is sometimes not clear when the credit card data is input how much the subsequent payment will be. In this case

|

services for fraud preventionMultiexcerpt include SpaceWithExcerpt EN MultiExcerptName Platform-Kurz PageWithExcerpt Wording

Services for credit and debit cards

You can submit credit card payments and debit card payments either online via the Merchant Interface as a batch file or via the SSL-Terminal. The following table describes the services of

for these payment methods: Multiexcerpt include SpaceWithExcerpt EN MultiExcerptName Platform-Kurz PageWithExcerpt Wording

Function | Description | ||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

Individual layout for payment pages | Anyone saving or transmitting credit card data must undergo extensive security authorisation, called PCI DSS Certification. You can avoid much of this by the use of

| ||||||||||||||||||||||||

Authorisations | Verification of creditworthiness and validity of the credit cards and reservation of the amount on the customer's card account. | ||||||||||||||||||||||||

Authorisation renewal | An authorisation lowers the card limit of the customer and reserves the sale for your company. The authorisation is valid however for onlyup to 7 days. To maintain your payment claim,

| ||||||||||||||||||||||||

Partial authorisation for partial deliveries | Complaints may be made if a customer obtains a partial shipment but must pay in full.

| ||||||||||||||||||||||||

Captures | Capture is the second step after the authorisation which debits the reserved amount from the customer's card account. You can choose between manual or automated capture. | ||||||||||||||||||||||||

Capture On Demand | With Capture On Demand you can temporarily delay the automatic capture, for example in order to delay debiting of the money until after delivery. You can define a default delay and individual delays for each transaction, for example capture in 72 hours. | ||||||||||||||||||||||||

Credits |

| ||||||||||||||||||||||||

Reversals | In

| ||||||||||||||||||||||||

Authentication Hosting | If you only wish to verify the identity of the card holder without immediately activating a credit card payment,

| ||||||||||||||||||||||||

Fraud prevention | 75% of all attempted frauds take place with foreign credit cards.

| ||||||||||||||||||||||||

Batch transmission | Along with online-processing,

| ||||||||||||||||||||||||

Pseudo card number (PCNR) | Anyone who saves or forwards credit card numbers has to undergo extensive security authorisation in accordance with PCI DSS. You can avoid this by using

|

services for credit card paymentsMultiexcerpt include SpaceWithExcerpt EN MultiExcerptName Platform-Kurz PageWithExcerpt Wording

Services for transfers and direct debits

You can submit electronic direct debits either online via the Merchant Interface, as a batch file or via the SSL-Terminal. The following table describes

services for electronic direct debits: Multiexcerpt include SpaceWithExcerpt EN MultiExcerptName Platform-Kurz PageWithExcerpt Wording

Function | Description | ||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

PayPal, ELV, giropay | PayPal administers 15 million customer accounts in Germany. In the case of PayPal the user can pay via direct debit, giropay or credit card. Irrespectively of how the customer pays with PayPal, the Merchant benefits from PayPal seller protection. | ||||||||||||||||

giropay online transfer | giropay is a payment standard of German banks like Sparkasse (savings banks), Postbank and Volks- und Raiffeisenbanken, wherein the customer is connected directly with its banks' online-banking. Customers usually log-in with a PIN, receive a pre-completed payment transmit form and need only confirm with a TAN. If you use giropay via

| ||||||||||||||||

iDEAL online transfer for the Netherlands | iDEAL is a payment standard of the Dutch banks where the customer is connected directly to its banks' online-banking. Its operating principle is similar to giropay (see above) but the payment guarantee is unlimited. | ||||||||||||||||

Block list check | To reduce your direct debit-risk

| ||||||||||||||||

Captures |

| ||||||||||||||||

Austrian accounts | If you have a company account in Austria

| ||||||||||||||||

Capture On Demand | With Capture On Demand you can temporarily delay the automatic capture, for example in order to delay debiting of the money until after delivery. You can define a default delay and individual delays for each transaction, for example capture in 72 hours. | ||||||||||||||||

Reversals | It is not possible to refund direct debits, however, you can reverse the capture until your direct debits have been transmitted to the banks for that day. The reversal must take place on the same day. | ||||||||||||||||

Batch transmission | Along with online-processing,

|

services for electronic direct debitsMultiexcerpt include SpaceWithExcerpt EN MultiExcerptName Platform-Kurz PageWithExcerpt Wording

Payment methods available

This chapter gives a short introduction to the operating principle of the payment methods offered by

. The descriptions do not concentrate on the technology but on technical aspects from the perspective of merchants and customers.Multiexcerpt include SpaceWithExcerpt EN MultiExcerptName Platform-Kurz PageWithExcerpt Wording

Credit card payments with TLS

The credit card is a widely used international payment tool on the Internet. Transport Layer Security (TLS) is successor of Secure Socket Layer (SSL) and an asymmetric encryption method in the Internet which protects credit card data against tapping and manipulation, during transfer for example. In the case of credit card payments with TLS the card holder enters the credit card data in a form which is encrypted with TLS.

Entry form with TLS-encryption for credit card data

For safety reasons an SSL certificate is required for TLS-encryption.

Transaction procedure with TLS-credit card payments

In the case of TLS-payments the customer chooses the Credit card payment method at the Internet checkout. The customer is then requested on an TLS-encrypted page to input the credit card number and expiry date. The

receives the credit card data and then processes the payment.Multiexcerpt include SpaceWithExcerpt EN MultiExcerptName Platform-Kurz PageWithExcerpt Wording

Credit card payment with TLS checks the credit limit of the customers but offers no protection against fraud using stolen card data. Please note therefore the security processes Visa Secure, Mastercard ID Check and American Express SafeKey in the following chapter.

In the case of American Express payments

can protect against fraud by comparing the order address with the address stored at American Express: Multiexcerpt include SpaceWithExcerpt EN MultiExcerptName Platform-Name PageWithExcerpt Wording

carries out an address comparison with American Express to ensure that the customer is the correct card holder. If the street number or postcode does not correspond with the American Express data Multiexcerpt include SpaceWithExcerpt EN MultiExcerptName Platform-Name PageWithExcerpt Wording

will either refuse the payment or send you an alert by e-mail.Multiexcerpt include SpaceWithExcerpt EN MultiExcerptName Platform-Kurz PageWithExcerpt Wording

Credit cards with Visa Secure, Mastercard ID Check and American Express SafeKey

Mastercard ID Check (UCAF), Visa Secure (VbV) and American Express SafeKey are authentication methods which verify the identity of the card holder before making the payment. The name 3-D Secure used by technicians describes only the protocol. The correct brand names are Visa Secure, Mastercard ID Check and American Express SafeKey.

Merchants benefit from authentication with Verified by Visa, MasterCard SecureCode or American Express SafeKey because the card associations enact a liability shift: If you use Visa Secure, Mastercard ID Check or American Express SafeKey you benefit from a secure payment claim, the liability shift transmits the default risk to the card-issuing bank in case of a successful customer authorisation, should the customer dispute the payment. You obtain in effect a payment guarantee in case the customer asserts that it has not implemented the credit card payment itself.

From a technical perspective Visa Secure, Mastercard ID Check and American Express SafeKey are not payment methods but an authentication process which precedes the payment: Once the credit card data has been entered,

checks the identity of the card holder and does not process the payment until after the authentication.Multiexcerpt include SpaceWithExcerpt EN MultiExcerptName Platform-Kurz PageWithExcerpt Wording

Transaction procedure with Visa Secure, ID Check or SafeKey

The customer selects the Credit card payment method in the Internet shop and enters the card number and expiry date.

receives the card number and checks, via a connection to Visa, MasterCard or American Express, whether this credit card is registered for Visa Secure, ID Checl or SafeKey. Then extensive card data is sent to the card-issuing bank to verify the identity of the cardholder (3DS 2.1 / 3DS 2.2). The cardholder must identify himself to his bank. There are different procedures for this (SMS, TAN, APP). If the cardholder's identity has been verified by the card-issuing bank, the transaction is given a mark that indicates that the authentication was carried out with 3DS 2.x.Multiexcerpt include SpaceWithExcerpt EN MultiExcerptName Platform-Kurz PageWithExcerpt Wording

The subsequent authorization contains the 3DS 2.1 identifier so that the acquirer and the card-issuing bank can carry out the authorization with the identifier.

ELV Score: Direct debit with block list check

can combine SEPA direct debits in Germany and Austria with a block list check which offers high security at low cost: Multiexcerpt include SpaceWithExcerpt EN MultiExcerptName Platform-Kurz PageWithExcerpt Wording

firstly checks whether the Customer's account number is black listed by major retailers. Secondly you can prevent fraud by setting sales limits per day, week or month which an account connection may not exceed.Multiexcerpt include SpaceWithExcerpt EN MultiExcerptName Platform-Kurz PageWithExcerpt Wording

Since there are substantially more accounts than credit cards, many Internet purchases are paid for by direct debit. The direct debit process is unsafe for merchants without a block list check: in the case of SEPA direct debits there is no authorisation because it is not possible to carry out a credit rating on the account of the customer. There are frequently return debit notes due to lack of funds in accounts.

The block list check links the benefits of the direct debit with the security of a block list check and individual sales limits.

can now draw a direct debit not only from German but also from Austrian or Netherland customer accounts. The precondition for this is a company account in Austria or the Netherlands.Multiexcerpt include SpaceWithExcerpt EN MultiExcerptName Platform-Kurz PageWithExcerpt Wording

Transaction procedure of a direct debit payment on the Internet

In order to pay with a direct debit, the customer selects the Direct debit payment method at the Internet checkout and enters his account details on an Internet page. This Internet page is TLS encrypted to protect the account data during the transmission against tapping and manipulation. After the input

checks if the IBAN is plausibly, whether the account is blocked and whether the sales limit for this account has been reached. After successful verification, Multiexcerpt include SpaceWithExcerpt EN MultiExcerptName Platform-Kurz PageWithExcerpt Wording

draws direct debits from the customer's bank.Multiexcerpt include SpaceWithExcerpt EN MultiExcerptName Platform-Kurz PageWithExcerpt Wording

International direct debit payments via PPRO International Direct Debit (IDD)

Electronic direct debits over

are possible in UK, the Netherlands, Austria and Spain for all accounts of appropriate banks, but offer no block list checks. For customers the payment by entering their banking details is convenient and secure, because the 8 weeks period for chargebacks applies here too. The merchant gets a real-time payment, but bears the risk of possible chargebacks.Multiexcerpt include SpaceWithExcerpt EN MultiExcerptName Platform-Kurz PageWithExcerpt Wording

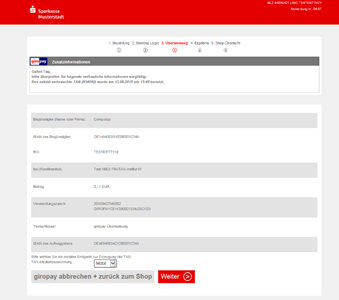

Money transfer with giropay, eps, iDEAL and DIRECTebanking

supports online transfers with giropay in Germany, with iDEAL in the Netherlands, with eps in Austria and DIRECTebanking in Germany, England, Austria, Switzerland and the Netherlands. A number of surveys of Internet users verify that transfer is a popular and accepted method of payment. Multiexcerpt include SpaceWithExcerpt EN MultiExcerptName Platform-Name PageWithExcerpt Wording

therefore supports this convenient, secure payment procedure. The customer potential for online merchants increases to around 20 million online-banking customers with the use of online transfers.Multiexcerpt include SpaceWithExcerpt EN MultiExcerptName Platform-Name PageWithExcerpt Wording

giropay is a standard which was founded by the German banks Sparkasse, Postbank, Volks- und Raiffeisen Banken. The giropay online transfer has a number of advantages for merchants. Firstly giropay provides the vendor with a guarantee for payments of up to 10,000 euros; secondly the transfer is a prepayment which minimises the payment term. Last but not least the customer is using the familiar and trusted online banking of its own credit institution, just the same as with online banking.

giropay links customers directly to their banks

Dutch banks established the iDEAL money transfer standard, which works in a similar fashion to giropay in Germany. Approximately 70% of all e-commerce payments in the Netherlands are processed with iDEAL. Therefore offering iDEAL is a vital success factor for e-commerce business in the Netherlands.

In Austria

supports online money transfer with the Austrian Electronic Payment Standard (EPS) which is a well established system in Austria and offering a payment guarantee to the merchant.Multiexcerpt include SpaceWithExcerpt EN MultiExcerptName Platform-Name PageWithExcerpt Wording

supports SOFORT transfer of SOFORT AG in many countries in Europe. Currently supported countries can be found on the webpage https://www.sofort.com/ger-DE/verkaeufer/su/e-payment-europaweit-mit-sofort-xxl/. SOFORT Banking is a method of bank transfers and is based on online banking. The customer selects SOFORT Banking as payment method for their online purchase and then will be forwarded to the secured payment form. The bank transfer data will be transferred automatically and the customer only has to select his or her bank and enter their usual login details for online banking. The consumer then releases the bank transfer by means of an approval code. All data is send encrypted to the online banking account. The online merchant receives a real-time confirmation of the executed bank transfer. The merchant can execute and dispatch the order immediately delivering goods/services faster. There is no waiting time until the dispatch of the goods like it would be for example in the case of prepayment via bank transfer.Multiexcerpt include SpaceWithExcerpt EN MultiExcerptName Platform-Name PageWithExcerpt Wording

Example of an online transfer procedure with giropay

In the first step the customer chooses the giropay payment method at the checkout of the online shop and selects its credit institution. The customer is then connected directly to its Sparkasse/bank and logs on as normal using a PIN. A pre-completed transfer form then appears. The customer need only enter their TAN to confirm the payment.

In the Netherlands the procedure of an iDEAL online transfer is similar but there is an unlimited payment guarantee.

Entry of giropay TAN into the transfer form

Entry of giropay TAN into the transfer form

As usual with online banking, the data disclosed in the online transfer is encrypted with TLS (Transport Layer Security) to prevent manipulation.

Payment type | URL |

|---|---|

giropay | |

eps / STUZZA | |

DIRECTebanking | |

Rabo iDEAL (English) | |

iDEAL-Portal (Dutch) |

Internet addresses with information about online money transfers

International online transfers

supports various online transfers in different countries via the acquirer PPRO. Merchants benefit from the payment guarantee, the immediate execution by advance payment and the large reachable customer base. On the other hand, customers use the familiar environment of their online banking and thus also gain confidence in the online shop. This lowers the number of cancelled orders and increases the conversion rate.Multiexcerpt include SpaceWithExcerpt EN MultiExcerptName Platform-Kurz PageWithExcerpt Wording

Przelewy24 in Poland

Przelewy 24 is supported by 18 large banks and reaches 95 % of the polish customers in online banking. The system has no transaction limit and directs customers via its online banking environment directly to the payment processing.

PostFinance Yellowpay in Switzerland

The PostFinance-Bank’s Yellowpay online transfer operates without a transaction limit, but with a payment guarantee for the merchant and reaches about one million customers with online accounts in Switzerland.

POLi in Australia and New Zealand

Over POLi you can reach 90 % of the customers in Australia and New Zealand – after all, that’s 33 million online banking customers. There is a transaction limit of 9,999 AUD.

TrustPay in Eastern Europe

TrustPay provides a real-time online transfer system in Central and Eastern Europe under the supervision of the National Bank of Slovakia. Numerous banks and the respective currencies of the participating states – Slovakia, Czech Republic, Türkey, Hungary, Estonia, Latvia, Lithuania, Croatia as well as Slovenia – are supported.

SafetyPay in Brazil, Costa Rica, Germany, Colombia, Mexico, Nicaragua, the Netherlands, Austria, Panama, Peru, Spain

SafetyPay, whose head office is in Florida, offers an international system for online bank transfers, with which the customers pay for international purchases in their own currency using their familiar online banking system. Merchants reach about 250 million potential bank customers in this way.

Trustly in Scandinavia, Poland and Spain

Founded in 2008 Trustly is a technology enterprise from Sweden, which enables secure and convenient payments via online banking for the customers. Trustly offers Collecting as well as an automated credit via API and reconciliation files for all supported acquirers (all 21 main banks in Sweden, Denmark and Finland). Trustly is FSA regulated.

AmazonPay

With AmazonPay you offer your customers the level of comfort which they are used to with Amazon: Simply select delivery address from the address book, define payment method and confirm the order. Done.

AmazonPay is available in Germany, Great Britain and the USA. Amazon.de alone has around 16.7 million customer accounts. Amazon customers know the ordering procedure and trust it. This trust and the familiar procedures can improve the conversion rate of your shop. Last but not least, AmazonPay offers a payment guarantee.

AmazonPay starts with the Amazon login in a popup window. The individual widgets then permit the selection of the addresses and methods of payment saved by the customer at Amazon. Amazon makes these details available to the

, which then handles the payment procedures. Due to the integration of Amazon, the customer is informed about the payment and the dispatch of the articles by email, as he is used to from Amazon.Multiexcerpt include SpaceWithExcerpt EN MultiExcerptName Platform-Name PageWithExcerpt Wording

PayPal Express Checkout

lets merchants process PayPal payments. It lets you receive payments from 230 million PayPal-customers worldwide. 15 million Internet users own a PayPal customer account in Germany alone.Multiexcerpt include SpaceWithExcerpt EN MultiExcerptName Platform-Name PageWithExcerpt Wording

PayPal offers its users several payment methods

PayPal was a subsidiary of eBay and is widespread amongst eBay users worldwide. The old PayPal-standard solution however has required manual processing for reasons bound up with the history of eBay.

offers fully-automated payment processing with PayPal Express Checkout for mass mail-order business. Thanks to its automation in Multiexcerpt include SpaceWithExcerpt EN MultiExcerptName Platform-Name PageWithExcerpt Wording

, PayPal Express Checkout is also suitable for processing larger transaction quantities, for example in the mail-order business. The manual processing of e-mails and payment processes which is normal for the PayPal-standard solution are a thing of the past.Multiexcerpt include SpaceWithExcerpt EN MultiExcerptName Platform-Kurz PageWithExcerpt Wording

Customers in more than 100 markets

PayPal is particularly useful for customer purchases abroad since

supports all currencies and markets offered by PayPal. In many countries PayPal offers customers typical payment methods for their country. A German customer can thus have the option to pay with PayPal by credit card, direct debit or with giropay-transmit. Customers abroad can often use typical payment methods such as prepaid cards in Italy or debit cards in the UK. Integrating PayPal into your shop therefore provides your customers with several payment methods at once.Multiexcerpt include SpaceWithExcerpt EN MultiExcerptName Platform-Name PageWithExcerpt Wording

Seller protection and address verification

also provides you with the PayPal risk management. With address verification and PayPal seller protection PayPal relieves the merchant of the risk of payment failures in the case of direct debit payments, German credit card payments and unjustified customer complaints.Multiexcerpt include SpaceWithExcerpt EN MultiExcerptName Platform-Name PageWithExcerpt Wording

PayPal Express Checkout Fewer order cancellations

Long order processes increase the rate of cancellations.

offers the PayPal Express Checkout to shorten the order process: your customers do not need to enter any address data but rather click on Checkout with PayPal in the shopping cart area, log on and select the invoice- and delivery address retained by PayPal. Multiexcerpt include SpaceWithExcerpt EN MultiExcerptName Platform-Name PageWithExcerpt Wording

then sends the delivery address as a result parameter back to your shop.Multiexcerpt include SpaceWithExcerpt EN MultiExcerptName Platform-Name PageWithExcerpt Wording

PayPal Express Checkout button

If the customer selects Continue to Checkout instead of PayPal Express Checkout in the shopping cart area, PayPal is displayed again as a payment method on the payment page. Selecting PayPal lets your customer log into PayPal to confirm the payment. In this case it is important that the delivery address is transmitted to ensure that the PayPal seller protection is activated.

Process optimisation for PayPal payments

Along with standard processing,

supports more complex supply processes with PayPal. As with credit cards you can also reserve an amount for PayPal payments which you can then capture via the usual interfaces. In this way you do not charge your customers until the goods have been shipped. Multiexcerpt include SpaceWithExcerpt EN MultiExcerptName Platform-Kurz PageWithExcerpt Wording

supports all transaction types as required for optimal completion of your processes. We are happy to provide you with consultation (if necessary with our colleagues from PayPal).Multiexcerpt include SpaceWithExcerpt EN MultiExcerptName Platform-Name PageWithExcerpt Wording

Wallet system: Skrill (Moneybookers)

Skrill from Moneybookers has around 21 million, mostly younger, account holders from the gaming sector, ranks alongside PayPal as one of the world’s largest wallet systems for online payments. Skrill is available in 200 countries with 41 currencies and offers merchants a payment guarantee without chargebacks as well as the possibility to process credits (refunds).

Payment type | URL |

|---|---|

Skrill |

Web page with information about Skrill

Guaranteed payments on invoice

With payment by invoice you can reduce the number of uncompleted orders in your online shop by up to 81%. This increases your turnover and your sales. Therefore

allows purchase on account in numerous European countries with payment guarantee.Multiexcerpt include SpaceWithExcerpt EN MultiExcerptName Platform-Name PageWithExcerpt Wording

offers you as a merchant the greatest possible flexibility in that you can freely choose the best system of invoice purchases for your particular business. The following providers all give a guarantee of payment although their processing, price and geographical reach differ:Multiexcerpt include SpaceWithExcerpt EN MultiExcerptName Partner-Name PageWithExcerpt Wording

Provider logos for guaranteed invoice purchase

Full service from Klarna and Ratepay

With Klarna and Ratepay you profit as a merchant from a full invoice and hire purchase service. All you have to do is pass on all the invoice data during the order to the service provider, who then takes over the complete billing and debtor management. That than takes over the complete billing and debtor management. Your customers gain financial flexibility with Klarna, since they can choose between invoice purchase and hire purchase. Furthermore Ratepay offers classical hire purchase and SEPA direct debit.

Klarna already offers invoice purchase and hire purchase in many European countries.

Payment type | URL |

|---|---|

Klarna | |

Ratepay | |

| afterpay | www.afterpay.de |

Internet addresses of Klarna, Rateay and afterpay

Guaranteed hire purchase

Rate payment within the online shop motivates your customers to order high value baskets. This also increases your turnover. Therefore

offers guaranteed hire purchase within many European countries.Multiexcerpt include SpaceWithExcerpt EN MultiExcerptName Platform-Name PageWithExcerpt Wording

As a

customer, several systems are available to you for purchase by instalment with payment guarantee: With Klarna, Ratepay and afterpay, online approval for the purchase by instalment is given in a matter of seconds during the order process. A PostIdent-process is not necessary. Klarna, Ratepay and afterpay transfer the invoice amount rapidly to the merchant and bear the non-payment risk themselves.Multiexcerpt include SpaceWithExcerpt EN MultiExcerptName Platform-Kurz PageWithExcerpt Wording

Provider logos for guaranteed hire purchase

As merchant you benefit from rapidly available liquidity. With Klarna, Ratepay and afterpay your customers increase financial flexibility, as they can define the instalment amount themselves.

Debit payments in England and Denmark

Debit cards are more widespread in Europe than credit cards. Direct debit, bank- and savings banks cards (formerly ec-Cards) are extremely popular in Germany. Our European neighbours also prefer to use debit cards.

therefore supports Maestro in England and the Dankort in Denmark.Multiexcerpt include SpaceWithExcerpt EN MultiExcerptName Platform-Name PageWithExcerpt Wording

With 23 million card holders, Maestro offers huge customer potential in the UK.

Notice: In the UK Maestro replaces the old Switch/Solo-Cards. It works there without SecureCode but does require an address verification. Outside the UK Maestro functions worldwide only with SecureCode (see also next chapter).

Logos of the debit cards in France, England and Denmark

In Denmark you can reach around 3.5 million card holders with the Dankort-solution. The significance of Dankort is also demonstrated by the fact that the Danes make 535 million payment transactions annually using the Dankort.

Maestro worldwide and in UK

250 million people in Europe own a Maestro card. Maestro offers a potential of 570 million customers worldwide. In the UK Maestro replaced the former Switch-Cards and therefore works a little differently to the rest of the world:

offers Maestro with address verification for the UK and Maestro SecureCode worldwide.Multiexcerpt include SpaceWithExcerpt EN MultiExcerptName Platform-Kurz PageWithExcerpt Wording

Notice: Maestro with SecureCode does not function in the UK for all cards!

The customer potential of 570 million Maestro card owners worldwide is very attractive for merchants with customers abroad. Since 2006, 250 million card holders in Europe, for example the British and the Austrians, have been able to use their Maestro card on the Internet. However while the Austrians must first apply for a SecureCode password to use their Maestro card online, 23 million British people can now use their Maestro on the Internet without a SecureCode.

Logo from Maestro

All current payment solutions for Maestro to date however only work with SecureCode, which the 23 million British card holders do not have. Therefore

has equipped its Multiexcerpt include SpaceWithExcerpt EN MultiExcerptName Partner-Name PageWithExcerpt Wording

payment platform with two Maestro solutions: Multiexcerpt include SpaceWithExcerpt EN MultiExcerptName Platform-Kurz PageWithExcerpt Wording

supports the worldwide standard of Maestro SecureCode but also processes Maestro with British cards without SecureCode. In the UK SecureCode is used with integrated address verification. You can therefore reach all Maestro customers with Multiexcerpt include SpaceWithExcerpt EN MultiExcerptName Platform-Kurz PageWithExcerpt Wording

, including the 23 million English Maestro card holders. Multiexcerpt include SpaceWithExcerpt EN MultiExcerptName Platform-Name PageWithExcerpt Wording

Along with worldwide distribution, Maestro has several benefits for business: firstly the discount costs are generally lower than with credit cards and secondly you benefit from shorter payment terms. Business also benefits from a secured payment claim in the Maestro SecureCode. Maestro therefore has much to recommend it, particularly for merchants with customers abroad.

paysafecard and Barzahlen

supports prepaid payments with paysafecard. On the one hand these are prepaid cards that your customers buy in shops in order to subsequently shop online. Since this is a prepaid means of payment, these systems are free from chargebacks. In addition it offers merchants a payment guarantee.Multiexcerpt include SpaceWithExcerpt EN MultiExcerptName Platform-Name PageWithExcerpt Wording

Logos from paysafecard and Barzahlen

Paysafecard is widespread in the gaming, gambling and adult content sectors. You can tap into additional target groups with this prepaid system:

- customers who do not want to disclose personal data such as bank account or credit card number

- young people who are denied access to classic payment systems such as credit cards

- customers who do not obtain a credit card from their bank

- as well as customers who prefer to pay with paysafecard

The prepaid system is international: the paysafecard Group operates in more than 40 countries in Europe as well as in North and Latin America and processes around 20 million prepaid payments annually.

Barzahlen is aimed at all customers in Germany who are unwilling to enter their sensitive data online, and those who do not use credit cards or online banking. An alternative to cash on delivery, Barzahlen is quicker and less expensive. Customers pay the amount to an associated retailer, on the basis of a payment form; the retailer transmits a payment confirmation in real time to the online shop so that the goods can be dispatched quickly.

Payment type | URL |

|---|---|

paysafecard | |

Barzahlen |

Web links to paysafecard and Barzahlen

Address-checks and credit rating

Popular with customers, risky for the merchant: Payment methods such as direct debit or purchase on account involve a high level of default risk.

Paycontrol is an automated credit rating working in conjunction with all standard credit agencies, combines flexibility and payment security for online business.Multiexcerpt include SpaceWithExcerpt EN MultiExcerptName Partner-Name PageWithExcerpt Wording

SecurePay is integrated directly into the

online payment platform. This saves time-consuming and laborious manual enquiries to credit agencies on the part of the merchant. SecurePay lets you access information automatically from arvato infoscore, Boniversum, CRIF and Schufa without linking your shop system to individual credit agency interfaces.Multiexcerpt include SpaceWithExcerpt EN MultiExcerptName Platform-Name PageWithExcerpt Wording

Logos from providers of address checks and credit ratings

As it is integrated into the interface between the online shop and

, if a customer gets a negative credit rating the merchant can react quickly and automatically and offer the customer, for instance, only payment methods with a payment guarantee at the checkout. SecurePay thus protects the merchant from payment defaults as far as possible without foregoing sales.Multiexcerpt include SpaceWithExcerpt EN MultiExcerptName Platform-Name PageWithExcerpt Wording

The use of SecurePay gives online merchants many more options in addition to credit card acceptance while minimising the risk, enabling them to compile individual payment options including electronic direct debits and even purchase on account for their customers. The pre-transaction credit rating means maximum possible payment security for the merchant with a substantially greater and therefore more customer-friendly package of payment methods.