Versions Compared

Key

- This line was added.

- This line was removed.

- Formatting was changed.

| Multiexcerpt | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

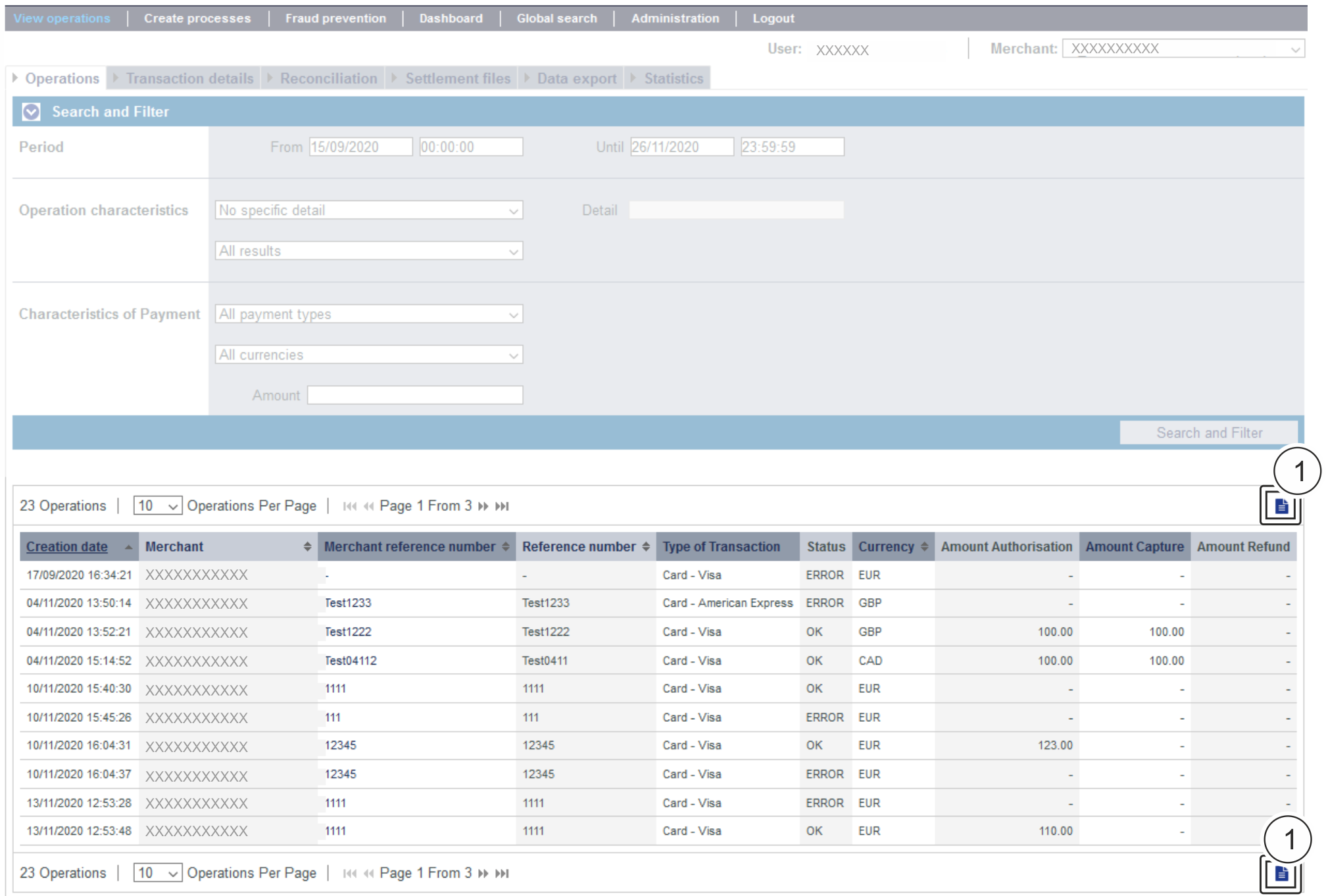

Opening the detailed view of an operationYou can open a detailed view for every operation in the search results. More information about the customer and operation data are shown to you in the detailed view. Moreover, you can add other actions to the operation in the detailed view, such as postings or credits. If an operation was processed using card, account or device data, you can disable these in the detailed view. If you wish to enable the card, account or device data again, you must remove the credit card from the negative list. Proceed as follows to open the detailed view of an operation:

→ The application verifies the values entered. If the values are invalid, a message showing the reason why will appear in red. If the values are valid, the search results will be shown.

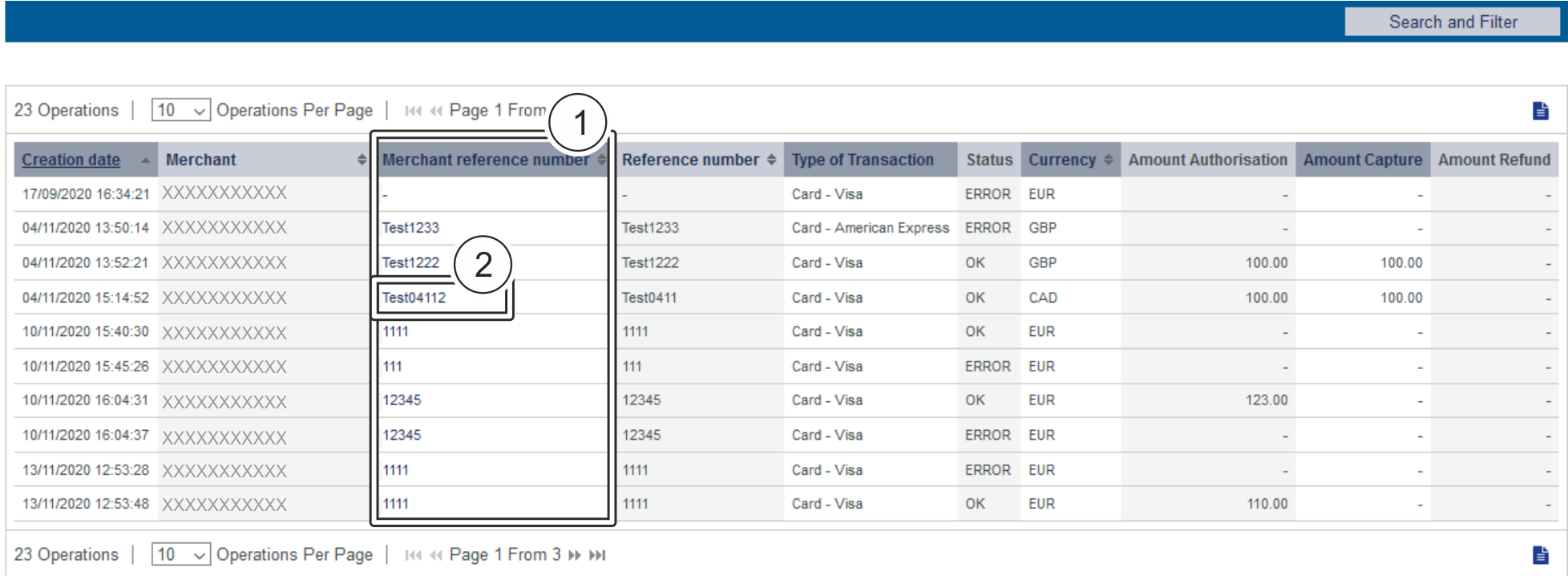

3. Click on the merchant reference number for the required operation in the "Merchant reference number" column. → The detailed view of the operation opens. The detailed view of the operation is divided into fields with the customer and operation data, along with data about postings. If you check the country of origin of the card for purposes of fraud prevention, you will also find the country of origin of the credit card here. Moreover, you can add other actions to the operation in the detailed view.

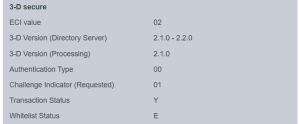

Details on 3-D Secure transactionsFor payments which are authenticated with 3-D Secure you may see details like this:

The values shown above depend on 3-D Secure version used for authentication and the card scheme. Here are some details: ECI valueThe ECI value stands for "Electronic Commerce Indicator" and detailed overview can be found here: ECI Codes EN 3-D Version (Directory Server)The Directory Server is managed by the card scheme (Mastercard, VISA, American Express, ...) where each credit card issuer isregistered and can be identified by the BIN (Bank Identication Number). The Directory Server "talks" to the Access Control Server which finally refers to the credit card issuer system. For 3-D Secure processing all parties (scheme, issuer and PSP

3-D Version (Processing)This is the 3-D Secure version which has been agreed by all parties finally for 3-D Secure authentication. It may happen that a specific issuer is not supporting 3-D Secure (Version 2.1.0, 2.2.0) by now and then automatically a fallback to Version 1.0 will happen. Authentication TypeCurrent supported values for "authentication type" are:

Challenge Indicator (Requested)

Transaction Status

Whitelist Status

|

| Multiexcerpt | ||||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| ||||||||||||||||||||||||||

Referenznummer und Händlervorgangsnummer eingebenDie Referenznummer und Händlervorgangsnummer dienen zur eindeutigen Identifikation des Vorgangs im

Die Referenznummer des Händlers dient als Auszahlungsreferenz, die in der entsprechenden EPA-Datei Ihrer Bank angegeben wird.

Die Händlervorgangsnummer wird vom

Ihre Warenkorbinformationen eingebenHier können Sie die Waren oder Dienstleistungen eingeben, die Ihr Kunde bei Ihnen bestellt hat.

|

| Multiexcerpt | ||

|---|---|---|

| ||

Activating the "Period" selection fieldWhen you click in the input fields for the date, a calendar opens in which you can select a date. When you click in the input fields for the time, you can define a time for the search. |

| Multiexcerpt | ||

|---|---|---|

| ||

Exporting search resultsYou can export the search results as an Excel file for further processing. Proceed as follows to export the search results:

→ The application verifies the values entered. If the values are invalid, a message showing the reason why will appear in red. If the values are valid, the search results will be shown.

3. Click on the "Export → The search results are issued as a CSV file ready to download. |

| Multiexcerpt | |||||

|---|---|---|---|---|---|

| |||||

|

On this page

| Table of Contents | ||

|---|---|---|

|